GST Double Payments: RDU's Philemon Demands Tax Reduction Ahead Of GE2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

GST Double Payments: RDU's Philemon Demands Tax Reduction Ahead of GE2025

The issue of double GST payments is heating up in the lead-up to the 2025 General Elections (GE2025), with prominent political figure, Philemon, from the RDU (presumably a political party), demanding immediate tax reduction. The controversy has sparked widespread public debate, with citizens expressing frustration and anger over what they perceive as unfair taxation practices. This article delves into the specifics of the double payments, the RDU's proposed solutions, and the potential political ramifications.

<h3>Understanding the GST Double Payment Issue</h3>

Many citizens report paying Goods and Services Tax (GST) twice on various goods and services. This isn't necessarily a case of intentional double taxation by the government, but rather a complex issue arising from ambiguities within the current GST system. Some common examples cited include:

- Overlapping taxes: Businesses sometimes unknowingly apply GST on goods or services that have already had GST applied at a previous stage of the supply chain.

- Software glitches: Technical errors in billing and accounting software can lead to accidental double charges.

- Lack of clarity: The complexity of GST regulations can cause confusion for both businesses and consumers, resulting in inadvertent double payments.

This widespread problem is not only impacting household budgets but also negatively affecting businesses, hindering economic growth and potentially leading to decreased consumer spending.

<h3>RDU's Call for Tax Reduction and Reform</h3>

Philemon, a prominent member of the RDU, has taken a strong stance on the issue, demanding immediate action from the government. The RDU's official statement calls for:

- A significant reduction in GST rates: They argue this would alleviate the financial burden on citizens and stimulate economic activity.

- A comprehensive review and simplification of the GST system: The party advocates for clearer regulations and easier-to-understand guidelines to prevent future instances of double payments.

- Strengthened consumer protection measures: This includes establishing efficient channels for consumers to report and claim refunds for double payments.

- Increased transparency and accountability: The RDU is pushing for greater transparency in the government's handling of GST revenue and a more accountable system to prevent future occurrences.

Philemon's forceful demand for tax reduction is viewed by many analysts as a strategic move ahead of GE2025. Addressing this popular grievance could significantly boost the RDU's popularity and influence among voters.

<h3>Political Implications and Public Response</h3>

The double GST payment issue has become a significant political hot potato. The government has yet to issue a comprehensive response, although several ministers have acknowledged the problem and promised to investigate. The public response has been overwhelmingly negative, with many expressing their frustration through social media and various protests.

The upcoming GE2025 makes this issue even more critical. The RDU's proactive approach, with Philemon as a vocal advocate, has positioned them to capitalize on the widespread public dissatisfaction. Whether this will translate into electoral success remains to be seen, but the issue is undoubtedly shaping the political landscape. The government's response and the RDU's continued efforts to highlight this issue will be crucial in determining the outcome. The situation calls for a decisive and transparent approach from all parties involved to ensure fair taxation and restore public confidence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on GST Double Payments: RDU's Philemon Demands Tax Reduction Ahead Of GE2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Serie A Monday April 28th All The Key Games

Apr 28, 2025

Serie A Monday April 28th All The Key Games

Apr 28, 2025 -

Web3 Gaming Capitalizing On Nostalgia With Beloved Franchises

Apr 28, 2025

Web3 Gaming Capitalizing On Nostalgia With Beloved Franchises

Apr 28, 2025 -

Economia Brasileira Em Foco Copom Ipca Industria E Os Dados Da China

Apr 28, 2025

Economia Brasileira Em Foco Copom Ipca Industria E Os Dados Da China

Apr 28, 2025 -

Reused Megaliths The Possible Role Of Pre Existing Monuments In Stonehenge Construction

Apr 28, 2025

Reused Megaliths The Possible Role Of Pre Existing Monuments In Stonehenge Construction

Apr 28, 2025 -

Nothings Phone 2 A Modular Smartphone Redefining The Industry

Apr 28, 2025

Nothings Phone 2 A Modular Smartphone Redefining The Industry

Apr 28, 2025

Latest Posts

-

Former Ftc Commissioners Fight For Their Jobs Back

Apr 30, 2025

Former Ftc Commissioners Fight For Their Jobs Back

Apr 30, 2025 -

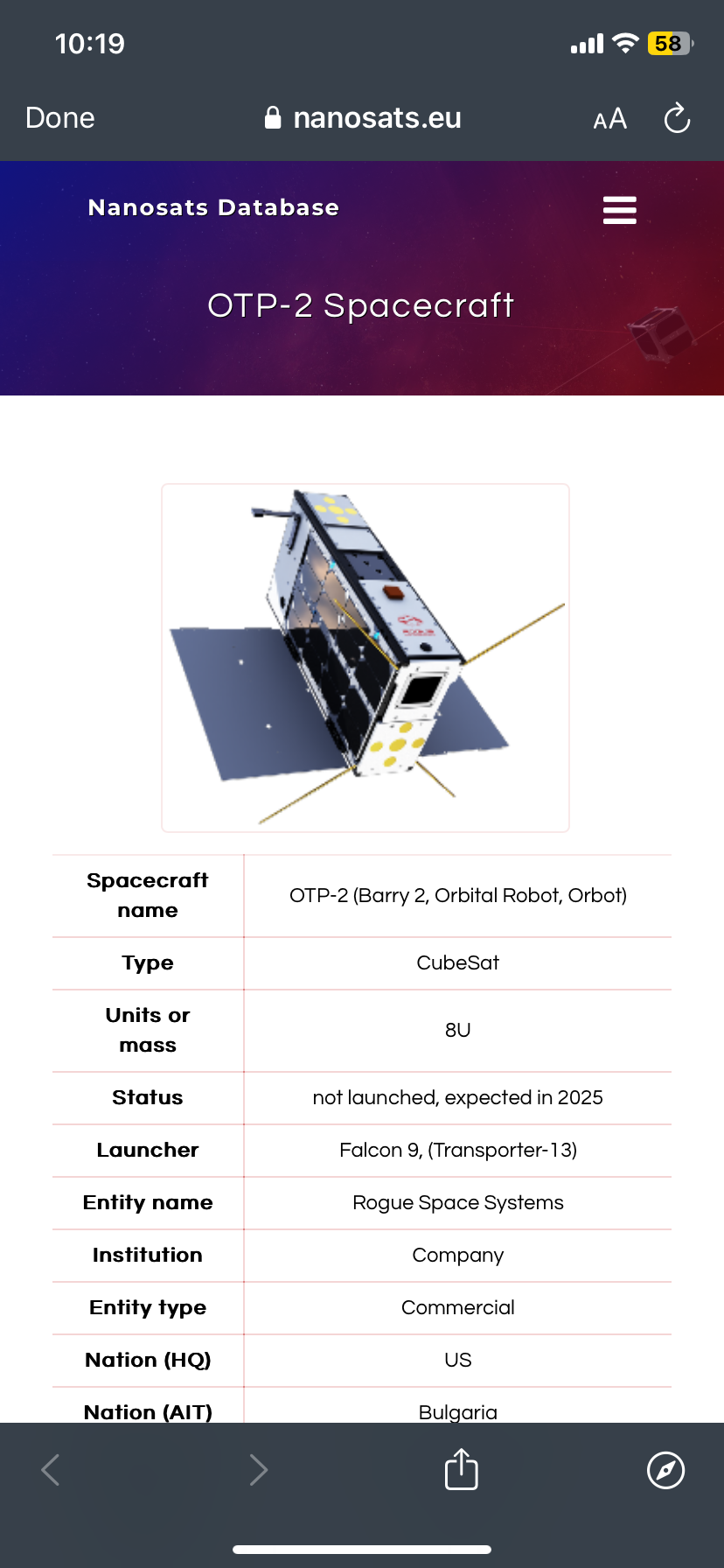

Two Propulsion System Experiments Detailed Otp 2 Project Update

Apr 30, 2025

Two Propulsion System Experiments Detailed Otp 2 Project Update

Apr 30, 2025 -

Foreign Parliament Decision Pending On Lutnicks Country Deal

Apr 30, 2025

Foreign Parliament Decision Pending On Lutnicks Country Deal

Apr 30, 2025 -

Epics Mobile Ambitions Success Or Failure A Critical Analysis

Apr 30, 2025

Epics Mobile Ambitions Success Or Failure A Critical Analysis

Apr 30, 2025 -

Madrid Open Results Sabalenka Through Rublev Eliminated Zverevs Photo Under Scrutiny

Apr 30, 2025

Madrid Open Results Sabalenka Through Rublev Eliminated Zverevs Photo Under Scrutiny

Apr 30, 2025