Hayes' Bitcoin Price Prediction: $1M In 3 Years Due To Fed Actions And Treasury Instability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hayes' Bitcoin Price Prediction: $1 Million in Three Years? Fed Actions and Treasury Instability Point to Crypto's Rise

The crypto world is buzzing after prominent trader and CEO of BitMEX, Arthur Hayes, issued a bold prediction: Bitcoin could hit $1 million in just three years. This audacious forecast isn't based on blind optimism, but rather on Hayes' analysis of current macroeconomic conditions, specifically focusing on the actions of the Federal Reserve and the perceived instability within the US Treasury system.

Hayes' prediction, outlined in a recent blog post, hinges on several key factors. He argues that the Federal Reserve's monetary policies, while intended to combat inflation, are actually fueling further economic uncertainty and eroding trust in fiat currencies. This, he believes, will drive investors towards alternative assets, like Bitcoin, as a safe haven.

The Fed's Tightrope Walk and Bitcoin's Safe Haven Status

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have undeniably impacted the global economy. While inflation has shown signs of cooling, the risk of a recession remains a significant concern. Hayes posits that this economic instability will cause investors to seek refuge in assets perceived as less susceptible to government manipulation. Bitcoin, with its decentralized nature and finite supply, fits this profile perfectly.

- Decentralization: Bitcoin operates independently of central banks and governments, making it an attractive option for those wary of fiat currency volatility.

- Finite Supply: The fixed supply of 21 million Bitcoin makes it a deflationary asset, contrasting sharply with the inflationary pressures seen in many fiat currencies.

- Safe Haven Asset: Historically, Bitcoin has shown resilience during times of economic uncertainty, attracting investors seeking to preserve their wealth.

Treasury Instability: A Catalyst for Bitcoin Adoption?

Hayes' prediction also considers potential instability within the US Treasury system. He suggests that the increasing national debt and ongoing political polarization could further erode confidence in the dollar, pushing investors towards more robust alternatives like Bitcoin. This view is gaining traction among some analysts who see Bitcoin as a hedge against potential financial turmoil.

Challenges and Counterarguments to the $1 Million Prediction

While Hayes' prediction is undeniably bold, it's not without its detractors. Critics point to the inherent volatility of the cryptocurrency market and the potential for regulatory crackdowns as significant hurdles to reaching such a high price point.

- Market Volatility: Bitcoin's price has historically been extremely volatile, experiencing both massive gains and significant drops.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions, which could negatively impact Bitcoin's price.

- Technological Advancements: The emergence of competing cryptocurrencies and technological advancements could also impact Bitcoin's dominance.

The Bottom Line: A Bold Prediction with Potential

Despite the challenges, Hayes' prediction highlights a growing sentiment among some investors: that Bitcoin could become a significant store of value in the face of increasing global economic uncertainty. Whether Bitcoin will truly reach $1 million in three years remains to be seen. However, his analysis underscores the crucial role macroeconomic factors play in shaping the future of cryptocurrency markets, making this prediction worthy of careful consideration. The ongoing developments in the financial world will undoubtedly impact the trajectory of Bitcoin's price, and investors should stay informed and monitor the situation closely. The next three years will be pivotal in determining whether Hayes' audacious forecast becomes a reality.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hayes' Bitcoin Price Prediction: $1M In 3 Years Due To Fed Actions And Treasury Instability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mistrial Declared Jury Fails To Reach Verdict In Ex Hockey Players Sexual Assault Trial

May 17, 2025

Mistrial Declared Jury Fails To Reach Verdict In Ex Hockey Players Sexual Assault Trial

May 17, 2025 -

Best Novig Promo Codes 2025 Maximize Your Savings With Alarm

May 17, 2025

Best Novig Promo Codes 2025 Maximize Your Savings With Alarm

May 17, 2025 -

Rud B253 Die Baender Des Kessels Podcast Mit Augsburg Fan Marco

May 17, 2025

Rud B253 Die Baender Des Kessels Podcast Mit Augsburg Fan Marco

May 17, 2025 -

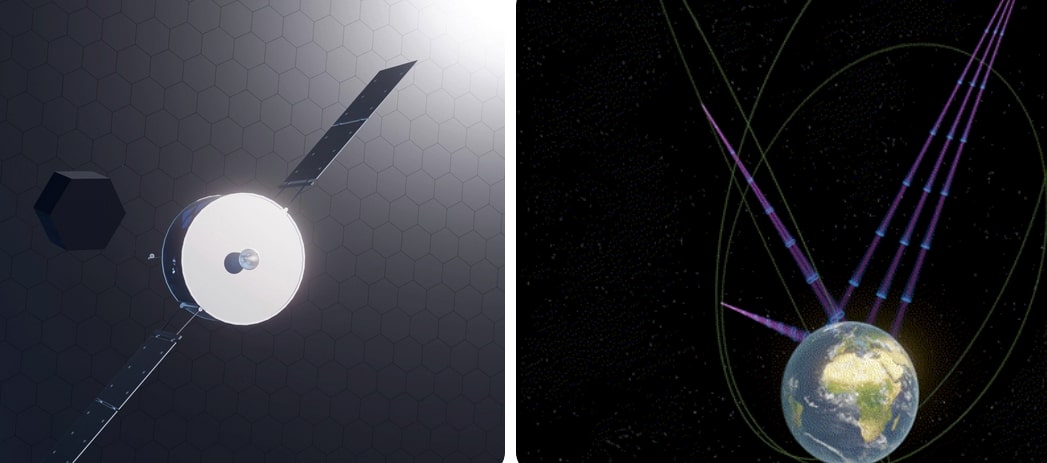

Space X Starship And The Future Of Space Solar Megawatts By 2030 Gigawatts By 2040

May 17, 2025

Space X Starship And The Future Of Space Solar Megawatts By 2030 Gigawatts By 2040

May 17, 2025 -

Gracie Abrams Arena Sized Sing Along Highlights Emotional Honesty

May 17, 2025

Gracie Abrams Arena Sized Sing Along Highlights Emotional Honesty

May 17, 2025