Hedera (HBAR) Price Action: Uptrend Slowdown And Potential Retracement Warning

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hedera (HBAR) Price Action: Uptrend Slowdown and Potential Retracement Warning

Hedera Hashgraph (HBAR), the enterprise-grade public ledger, has seen a notable slowdown in its recent uptrend, prompting concerns about a potential price retracement. While the long-term outlook for HBAR remains positive for many analysts, understanding the current market dynamics is crucial for investors. This article delves into the factors contributing to this slowdown and explores the potential scenarios for HBAR's price action in the coming weeks.

HBAR's Recent Performance: A Shifting Landscape

After a period of significant growth, HBAR's price has plateaued, exhibiting signs of consolidation. The previous bullish momentum, fueled by positive developments such as increased enterprise adoption and partnerships, seems to have temporarily stalled. This slowdown isn't necessarily a bearish signal, but it warrants careful observation. Technical indicators are showing signs of weakening bullish pressure, suggesting a potential period of correction could be on the horizon.

Factors Contributing to the Slowdown

Several factors could be contributing to the current HBAR price slowdown:

- Overall Crypto Market Sentiment: The broader cryptocurrency market's recent volatility and uncertainty have impacted even strong performers like HBAR. A general market downturn often leads to profit-taking across the board, regardless of individual project fundamentals.

- Profit-Taking: After a substantial price increase, many investors may be choosing to secure profits, leading to selling pressure and a price correction.

- Lack of Major Catalysts: The absence of significant new partnerships, product launches, or regulatory developments could be contributing to the price stagnation. While Hedera continues to build its ecosystem, the absence of major news events can impact short-term price action.

- Technical Resistance: HBAR's price may be facing resistance at a key technical level, preventing further upward movement until this hurdle is overcome. Chart analysis is crucial for identifying these resistance levels.

Potential Retracement: What to Expect

A retracement, in this context, refers to a temporary price decline after a period of upward movement. While a retracement is not inherently negative, it can be unsettling for investors. The extent of any potential retracement is difficult to predict, but understanding the following is vital:

- Support Levels: Identifying key support levels on the HBAR chart can help determine potential price floors during a retracement. These levels represent areas where buying pressure might outweigh selling pressure.

- Volume Analysis: Monitoring trading volume alongside price action provides valuable insights. Decreasing volume during a price decline can signal weakening selling pressure, potentially indicating the end of a retracement.

- Fundamental Analysis: Focusing on Hedera's long-term fundamentals, such as its technology, adoption rate, and partnerships, remains crucial. Strong fundamentals often provide a cushion against temporary price fluctuations.

Navigating the Uncertainty: Strategies for Investors

For investors holding HBAR, a potential retracement presents both challenges and opportunities:

- Dollar-Cost Averaging (DCA): Consider employing a DCA strategy to accumulate more HBAR during a potential dip, reducing the average cost basis.

- Risk Management: Implement appropriate risk management techniques, such as setting stop-loss orders, to protect your investment.

- Long-Term Perspective: Maintain a long-term perspective on HBAR's potential. The current slowdown shouldn't necessarily be interpreted as a sign of failure, but rather as a potential temporary setback within a broader positive trajectory.

Conclusion:

The recent slowdown in HBAR's uptrend is a development that requires careful monitoring. While a price retracement is possible, it's crucial to avoid panic selling and instead focus on understanding the underlying factors influencing the price action. By employing sound investment strategies and maintaining a long-term perspective, investors can navigate this period of uncertainty and potentially capitalize on future opportunities. Remember to conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hedera (HBAR) Price Action: Uptrend Slowdown And Potential Retracement Warning. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Estado Do Rs Em Crise Chuvas Causam 75 Mortes E Deixam Populacao Sem Agua E Luz

Apr 29, 2025

Estado Do Rs Em Crise Chuvas Causam 75 Mortes E Deixam Populacao Sem Agua E Luz

Apr 29, 2025 -

Next Gen Security Strike Ready Ai Platform Offers Advanced Threat Triage

Apr 29, 2025

Next Gen Security Strike Ready Ai Platform Offers Advanced Threat Triage

Apr 29, 2025 -

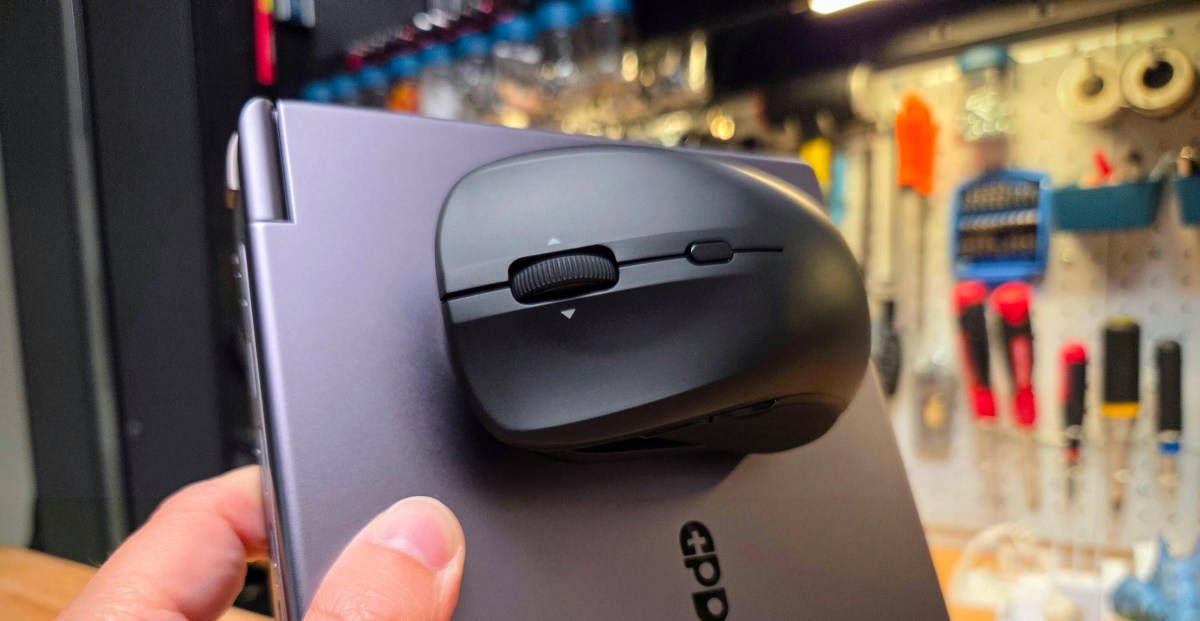

Hands On Review Magnetic Mouse With Integrated Usb C Charging Cable

Apr 29, 2025

Hands On Review Magnetic Mouse With Integrated Usb C Charging Cable

Apr 29, 2025 -

Criminal Ips Threat Intelligence Platform A Rsac 2025 Highlight

Apr 29, 2025

Criminal Ips Threat Intelligence Platform A Rsac 2025 Highlight

Apr 29, 2025 -

Gujarat Titans New Recruit Karim Janats Ipl Journey Begins

Apr 29, 2025

Gujarat Titans New Recruit Karim Janats Ipl Journey Begins

Apr 29, 2025

Latest Posts

-

Police Arrest Secondary School Student Following Teachers Penknife Injury

Apr 30, 2025

Police Arrest Secondary School Student Following Teachers Penknife Injury

Apr 30, 2025 -

Meta Faces Ftc Live Coverage Of The Instagram And Whats App Lawsuit

Apr 30, 2025

Meta Faces Ftc Live Coverage Of The Instagram And Whats App Lawsuit

Apr 30, 2025 -

Quetta Gladiators Vs Multan Sultans Gladiators Choose To Bowl First In Hbl Psl

Apr 30, 2025

Quetta Gladiators Vs Multan Sultans Gladiators Choose To Bowl First In Hbl Psl

Apr 30, 2025 -

Myles Lewis Skelly Arsenal Fans Reaction To His Goal Vs Man City A Shock

Apr 30, 2025

Myles Lewis Skelly Arsenal Fans Reaction To His Goal Vs Man City A Shock

Apr 30, 2025 -

Patient Privacy At Risk Thousands Of Health Records Potentially Compromised

Apr 30, 2025

Patient Privacy At Risk Thousands Of Health Records Potentially Compromised

Apr 30, 2025