Hester Peirce Challenges SEC: Many NFTs, Including Revenue-Sharing Models, Avoid Securities Classification

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hester Peirce Challenges SEC: Many NFTs, Including Revenue-Sharing Models, Avoid Securities Classification

Crypto regulation is once again in the spotlight as Commissioner Hester Peirce of the Securities and Exchange Commission (SEC) publicly challenges the agency's approach to Non-Fungible Tokens (NFTs). Her recent statements suggest that the SEC's broad interpretation of securities laws may be overly restrictive and stifle innovation in the burgeoning NFT market. Specifically, Peirce argues that many NFTs, particularly those incorporating revenue-sharing models, do not meet the Howey Test criteria for securities classification.

This bold challenge throws down the gauntlet, reigniting the debate surrounding the SEC's regulatory power over digital assets and its potential impact on the future of the NFT ecosystem.

The Howey Test and NFT Classification: A Point of Contention

The SEC typically uses the Howey Test to determine whether an asset qualifies as a security. This test considers four factors:

- An investment of money: Investing capital in the NFT.

- In a common enterprise: Participation in a shared project or venture.

- With a reasonable expectation of profits: Anticipation of financial gains from the NFT's performance or related activities.

- Derived from the efforts of others: Reliance on the efforts of the NFT creators or developers for profit.

Peirce contends that many NFTs fail to meet these criteria, particularly the "reasonable expectation of profits" and "derived from the efforts of others" elements. She argues that many NFTs are simply digital collectibles, purchased for their artistic merit or utility, and not primarily as investments expecting significant financial returns. Furthermore, the holder often has little to no reliance on the creator for future profits.

Revenue-Sharing NFTs: A Grey Area?

The debate intensifies when considering NFTs with integrated revenue-sharing models. These NFTs often promise a share of future profits generated by the project they represent. While the SEC may argue this fits the "expectation of profits" criteria, Peirce counters that this revenue is often incidental to the core value proposition of the NFT itself. She posits that the focus should be on the primary purpose and function of the NFT, not solely on the possibility of secondary income streams.

"The SEC's approach risks stifling innovation in the NFT space," Peirce stated in a recent public address. She emphasizes the need for a more nuanced regulatory framework that distinguishes between NFTs designed purely as speculative investments and those primarily valued for their artistic or utility functions.

Implications for the NFT Market and Future Regulation

Peirce's challenge has significant implications for the future of NFT regulation. A more flexible and less restrictive approach could unlock greater innovation and broader adoption of NFTs across various industries. Conversely, a continued strict interpretation could hinder the growth of the market and potentially drive innovation overseas.

The ongoing debate highlights the complexities of regulating the rapidly evolving digital asset landscape. It underscores the need for clear, consistent, and adaptable regulatory frameworks that protect investors while fostering innovation. The SEC's response to Peirce's challenge will be closely watched by investors, developers, and regulators alike, shaping the future trajectory of NFT regulation and the wider crypto market.

Keywords: Hester Peirce, SEC, NFTs, Non-Fungible Tokens, Crypto Regulation, Howey Test, Securities Classification, Revenue-Sharing NFTs, Digital Assets, Crypto Market, NFT Regulation, Innovation, Investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hester Peirce Challenges SEC: Many NFTs, Including Revenue-Sharing Models, Avoid Securities Classification. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Google Gemini Volvo To Debut Revolutionary Ai Car Technology

May 23, 2025

Google Gemini Volvo To Debut Revolutionary Ai Car Technology

May 23, 2025 -

Flood Warnings Issued Memorial Day Weekend Weather Impacts South

May 23, 2025

Flood Warnings Issued Memorial Day Weekend Weather Impacts South

May 23, 2025 -

Live Game Edmonton Oilers Vs Dallas Stars Play By Play And Statistics

May 23, 2025

Live Game Edmonton Oilers Vs Dallas Stars Play By Play And Statistics

May 23, 2025 -

The 11 Best Knicks Ever A Definitive Ranking From Ewing To Brunson

May 23, 2025

The 11 Best Knicks Ever A Definitive Ranking From Ewing To Brunson

May 23, 2025 -

7 000 Stipend Approved For Hanover Board Members Details Inside

May 23, 2025

7 000 Stipend Approved For Hanover Board Members Details Inside

May 23, 2025

Latest Posts

-

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025 -

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025 -

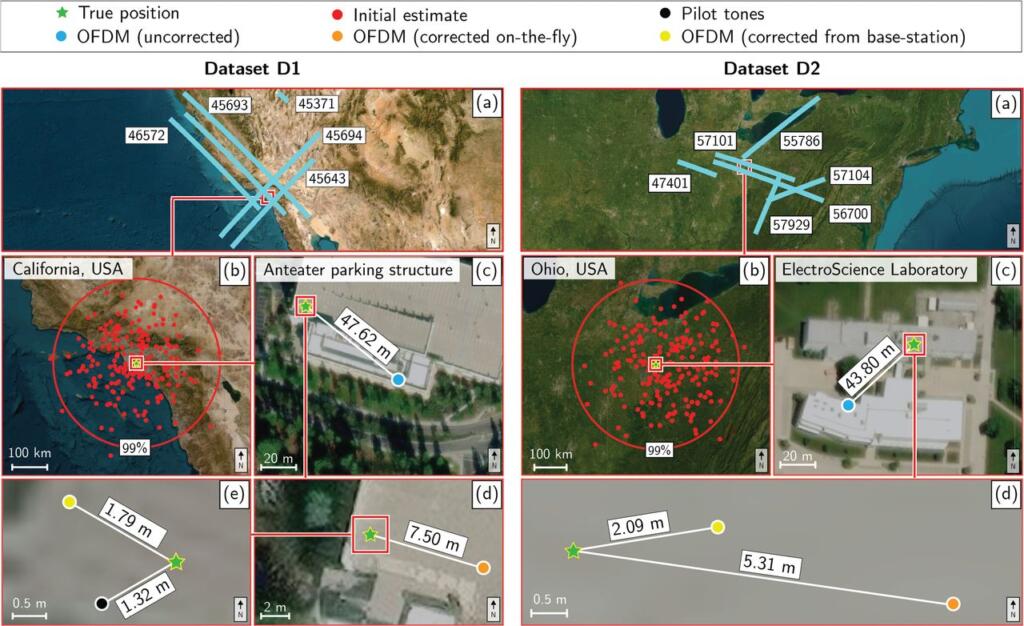

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025 -

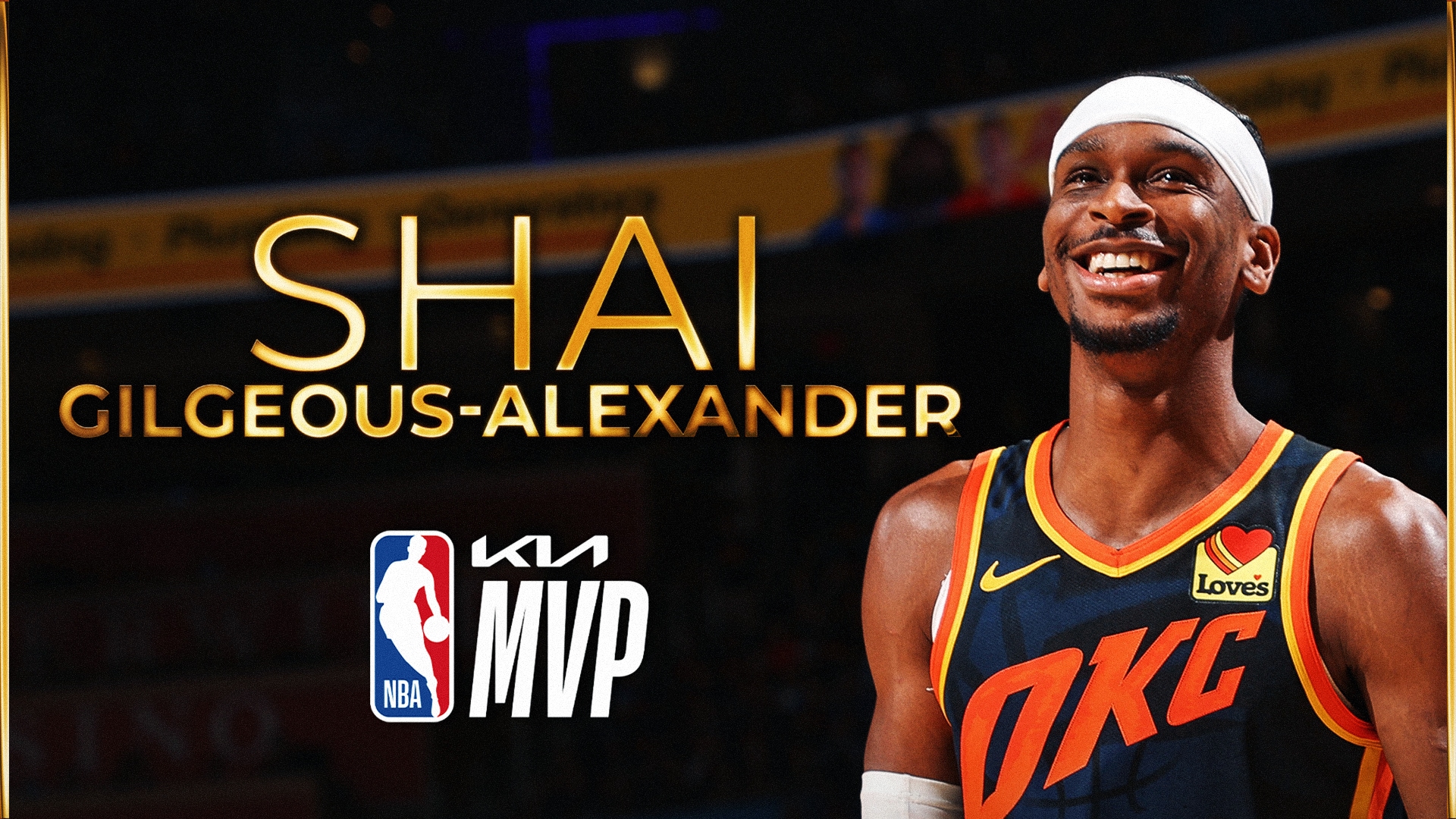

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025 -

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025