HMSTR Stock Alert: Oversold Conditions Raise Questions For Hamster Kombat Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HMSTR Stock Alert: Oversold Conditions Raise Questions for Hamster Kombat Investors

Hamster Kombat's parent company, HMSTR, is experiencing a significant dip, leaving investors wondering what the future holds. The recent market downturn has pushed HMSTR stock into oversold territory, sparking concerns and prompting a flurry of activity among traders and analysts. This situation presents both risk and potential reward for those invested in the quirky, yet surprisingly popular, Hamster Kombat franchise.

The gaming market is notoriously volatile, and HMSTR, despite its initial success, is not immune to the fluctuations. The recent oversold condition, indicated by various technical indicators, suggests the stock price may be undervalued. However, this doesn't automatically translate into a guaranteed rebound. Several factors need careful consideration before investors make any rash decisions.

What Does "Oversold" Mean for HMSTR Stock?

When a stock is deemed "oversold," it means its price has fallen rapidly and significantly below its intrinsic value, according to certain technical analyses. This often happens due to panic selling, driven by negative news or broader market trends. While it can signal a potential buying opportunity, it's crucial to remember that oversold conditions don't guarantee a price reversal. The stock could continue its downward trend.

Several indicators, including the Relative Strength Index (RSI) and the Stochastic Oscillator, are commonly used to determine whether a stock is oversold. Analysts are currently scrutinizing these indicators for HMSTR, attempting to predict the stock's future trajectory.

Factors Influencing HMSTR Stock Performance:

Several factors are contributing to the current uncertainty surrounding HMSTR stock:

- Increased Competition: The mobile gaming market is incredibly competitive. New releases and established players constantly vie for market share, putting pressure on HMSTR's Hamster Kombat franchise.

- Marketing Strategies: The effectiveness of HMSTR's marketing campaigns plays a significant role in driving user engagement and, subsequently, the stock price. A less successful marketing strategy could contribute to decreased player numbers and revenue.

- Game Updates and Content: Regular updates and new content are vital to maintaining player interest in Hamster Kombat. A lack of engaging updates could lead to player attrition and impact revenue.

- Overall Market Sentiment: Broader market trends and investor sentiment towards the tech sector also heavily influence HMSTR's performance. A general market downturn will invariably impact even successful companies.

Should Hamster Kombat Investors Be Worried?

The current situation presents a complex scenario for HMSTR investors. While the oversold condition presents a potential opportunity, it's vital to proceed cautiously. Investors should:

- Conduct Thorough Due Diligence: Before making any investment decisions, thoroughly research HMSTR's financials, future plans, and competitive landscape.

- Diversify Your Portfolio: Never put all your eggs in one basket. Diversifying your investment portfolio can help mitigate risk.

- Consult a Financial Advisor: Seeking advice from a qualified financial advisor can provide valuable insights and guidance based on your individual financial situation.

The future of HMSTR stock remains uncertain. While the oversold condition offers a glimmer of hope for a price rebound, several factors could influence its trajectory. Careful consideration, thorough research, and sound financial planning are crucial for investors navigating this volatile period. Stay informed and monitor the situation closely for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HMSTR Stock Alert: Oversold Conditions Raise Questions For Hamster Kombat Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

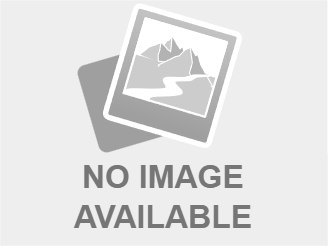

Tumor Niche Taurine And Leukaemogenesis A Glycolysis Connection

May 17, 2025

Tumor Niche Taurine And Leukaemogenesis A Glycolysis Connection

May 17, 2025 -

Singapore Ge 2025 High Voter Turnout At 92 83 Overseas Votes Reflect National Trends

May 17, 2025

Singapore Ge 2025 High Voter Turnout At 92 83 Overseas Votes Reflect National Trends

May 17, 2025 -

La Inversion De Buffett En Apple Se Reduce Venta De Acciones Y Explicacion Del 13 Menos

May 17, 2025

La Inversion De Buffett En Apple Se Reduce Venta De Acciones Y Explicacion Del 13 Menos

May 17, 2025 -

Official The Diplomat Returns For Season 4 Season 3 Imminent

May 17, 2025

Official The Diplomat Returns For Season 4 Season 3 Imminent

May 17, 2025 -

Bradford Citys First Signing Powering Up For League One

May 17, 2025

Bradford Citys First Signing Powering Up For League One

May 17, 2025