Honda Earnings Miss: 76% Operating Profit Drop Shakes Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Honda Earnings Miss: 76% Operating Profit Drop Shakes Investors

Honda Motor Co. sent shockwaves through the financial markets today with its announcement of a staggering 76% plunge in operating profit for the April-June quarter. The disappointing results, significantly below analyst expectations, highlight the Japanese automaker's struggle to navigate a complex landscape of rising raw material costs, supply chain disruptions, and a weakening global economy. Investors reacted swiftly, with Honda's stock price experiencing a noticeable dip following the release of the financial report.

This dramatic downturn marks a significant setback for Honda, a company typically known for its robust financial performance and innovative vehicle technology. The considerable fall in operating profit underscores the gravity of the challenges currently facing the automotive industry worldwide.

A Deeper Dive into the Disappointing Figures:

Honda reported an operating profit of ¥64.8 billion (approximately $440 million USD) for the second quarter, a stark contrast to the ¥270.4 billion ($1.8 billion USD) profit recorded during the same period last year. This represents a 76% year-on-year decrease, significantly impacting investor confidence. The company attributed the decline primarily to:

- Soaring Raw Material Costs: The escalating prices of crucial components like steel, aluminum, and semiconductors have severely impacted Honda's production costs, squeezing profit margins. This is a common issue affecting many automakers globally.

- Persistent Supply Chain Bottlenecks: Ongoing disruptions to the global supply chain continue to hamper Honda's production capacity, limiting its ability to meet market demand and maximize revenue. The semiconductor shortage, in particular, remains a persistent challenge.

- Weakening Global Demand: Economic uncertainty in key markets, including China and Europe, has led to a decrease in consumer demand for automobiles, further impacting Honda's sales figures and overall profitability.

What's Next for Honda?

In response to the disappointing results, Honda has announced plans to implement cost-cutting measures and streamline its operations to improve efficiency. The company is also focusing on accelerating its transition towards electric vehicles (EVs) and other alternative energy technologies, aiming to adapt to the evolving automotive landscape. These strategic shifts are intended to bolster its long-term competitiveness and profitability. However, the success of these strategies remains to be seen, and investors will be closely monitoring Honda's performance in the coming quarters.

Industry-Wide Implications:

Honda's significant earnings miss serves as a stark reminder of the considerable headwinds currently facing the global automotive industry. The challenges of rising inflation, supply chain vulnerabilities, and shifting consumer preferences are impacting automakers of all sizes and across various regions. This underscores the need for greater resilience and adaptability within the sector.

Investor Sentiment and Future Outlook:

The market reaction to Honda's earnings report reflects the concerns among investors about the company's short-term prospects. While the long-term outlook for Honda remains relatively positive given its strong brand reputation and commitment to innovation, the immediate future appears uncertain. Analysts will be closely scrutinizing Honda's upcoming financial reports and strategic initiatives to assess the effectiveness of its cost-cutting measures and its progress in the EV market. The company's ability to navigate these challenges will be crucial in regaining investor confidence and restoring its profitability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Honda Earnings Miss: 76% Operating Profit Drop Shakes Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Diddy Cassie And Exotic Dancer A Claim Of Paid Sex And Urination

May 13, 2025

Diddy Cassie And Exotic Dancer A Claim Of Paid Sex And Urination

May 13, 2025 -

Relations Bilaterales Rencontre Entre Le Ministre Marocain Des Habous Et Le Ministre Saoudien

May 13, 2025

Relations Bilaterales Rencontre Entre Le Ministre Marocain Des Habous Et Le Ministre Saoudien

May 13, 2025 -

Claudia Karvan Tears And Tragedy The Story Behind The Emotional Outpouring

May 13, 2025

Claudia Karvan Tears And Tragedy The Story Behind The Emotional Outpouring

May 13, 2025 -

Shocking Allegations Against Diddy Prosecutors Outline Pattern Of Coerced Participation

May 13, 2025

Shocking Allegations Against Diddy Prosecutors Outline Pattern Of Coerced Participation

May 13, 2025 -

Sigue El Partido Alcaraz Khachanov Octavos De Final De Roma En Directo

May 13, 2025

Sigue El Partido Alcaraz Khachanov Octavos De Final De Roma En Directo

May 13, 2025

Latest Posts

-

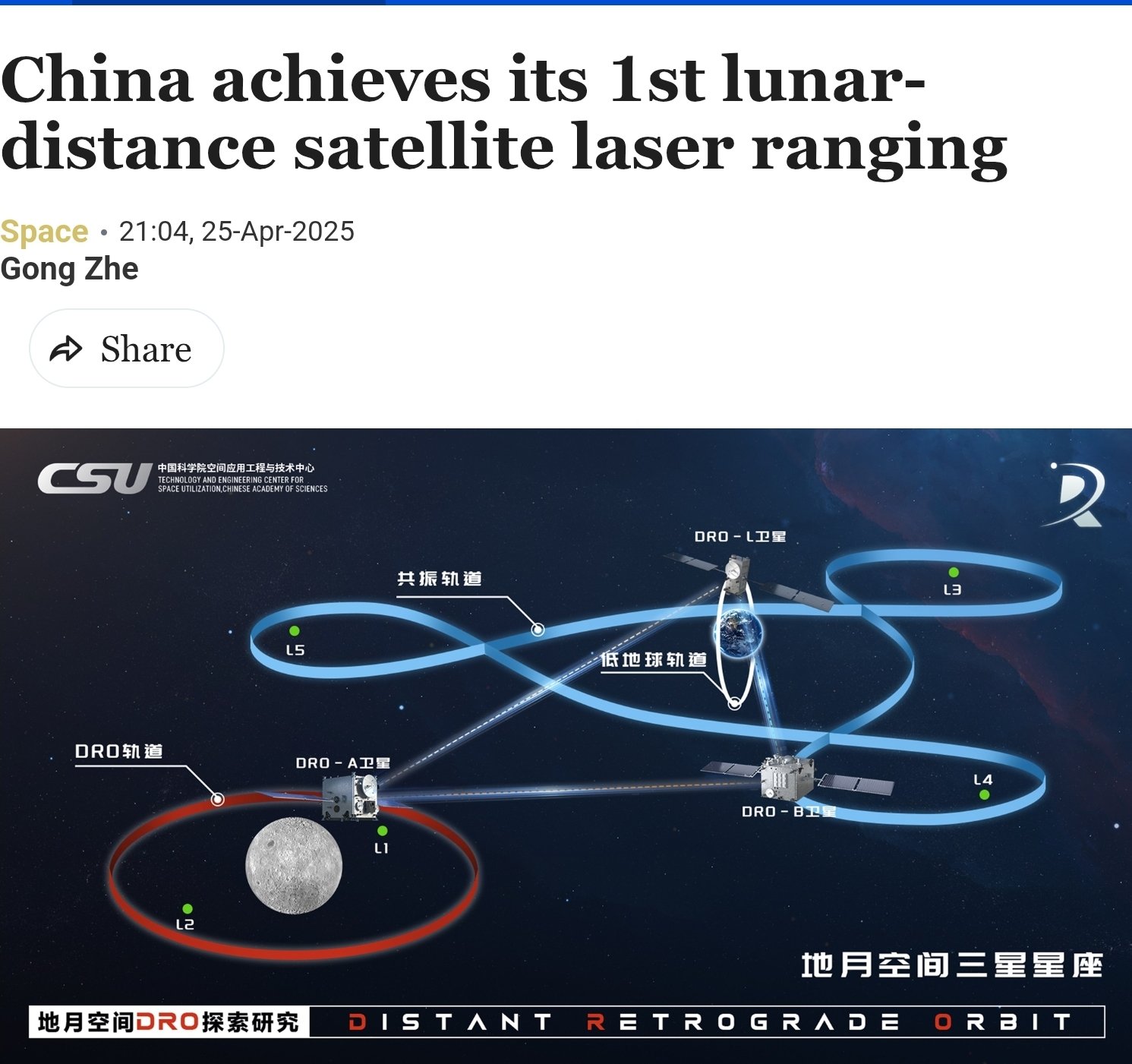

Chinas Satellite Laser Ranging Reaching The Moons Orbit

May 14, 2025

Chinas Satellite Laser Ranging Reaching The Moons Orbit

May 14, 2025 -

Resume Du Match Lnh Hurricanes 5 Capitals 2

May 14, 2025

Resume Du Match Lnh Hurricanes 5 Capitals 2

May 14, 2025 -

Samsung Galaxy S25 Edge Early Design And Pricing Insights From A Recent Leak

May 14, 2025

Samsung Galaxy S25 Edge Early Design And Pricing Insights From A Recent Leak

May 14, 2025 -

Honda Profit Cratering 76 Operating Profit Drop Sends Shockwaves

May 14, 2025

Honda Profit Cratering 76 Operating Profit Drop Sends Shockwaves

May 14, 2025 -

Facebook Bitcoin Scam Multi Stage Malware Targets Users Protect Yourself Now

May 14, 2025

Facebook Bitcoin Scam Multi Stage Malware Targets Users Protect Yourself Now

May 14, 2025