Honda Motor Co., Ltd. Reports Disastrous Earnings: 76% Profit Collapse

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Honda Motor Co., Ltd. Reports Disastrous Earnings: 76% Profit Collapse Sends Shockwaves Through Auto Industry

Honda Motor Co., Ltd., a global automotive giant, announced a devastating 76% plunge in operating profit for the first quarter of fiscal year 2024, sending shockwaves throughout the automotive industry. The stark figures reveal a struggling company grappling with a perfect storm of challenges, raising concerns about the future of the Japanese automaker. This significant downturn underscores the intensifying pressures faced by automakers globally, navigating supply chain disruptions, soaring raw material costs, and shifting consumer demand.

A Deep Dive into Honda's Dismal Q1 Results:

The reported operating profit of ¥64.9 billion ($449 million) represents a dramatic fall from the ¥271.6 billion ($1.88 billion) recorded during the same period last year. This represents a considerable blow to Honda's financial health and significantly underperformed analysts' expectations. The company attributed the significant decline primarily to:

-

Supply Chain Bottlenecks: Ongoing global supply chain disruptions, particularly the persistent semiconductor shortage, continued to hamper production, limiting Honda's ability to meet the robust demand for its vehicles. This production shortfall directly impacted sales and revenue.

-

Rising Raw Material Costs: The substantial increase in the cost of raw materials, including steel, aluminum, and electronic components, severely squeezed profit margins. Honda, like many other automakers, struggled to pass these increased costs onto consumers without negatively impacting sales volume.

-

Increased Research and Development Expenses: Investments in electric vehicle (EV) technology and other future mobility solutions contributed to higher research and development expenditures, further impacting profitability in the short term. While crucial for long-term competitiveness, these investments are currently straining the company's bottom line.

-

Weakening Yen: The weakening Japanese Yen against other major currencies also negatively impacted Honda's overseas earnings, reducing the value of profits generated in foreign markets.

Honda's Response and Outlook:

Honda acknowledged the severity of the situation and outlined several strategies to mitigate the challenges and restore profitability. These include:

-

Enhanced Supply Chain Management: The company is actively working to diversify its supply chain and strengthen relationships with key suppliers to reduce its vulnerability to future disruptions.

-

Cost Optimization Measures: Honda is implementing various cost-cutting initiatives across its operations to improve efficiency and reduce expenses without compromising product quality.

-

Accelerated EV Development: Honda is accelerating its development and launch of electric vehicles to capitalize on the growing demand for environmentally friendly vehicles and maintain its competitiveness in the evolving automotive landscape.

Industry Implications and Investor Sentiment:

Honda's dismal earnings report has raised concerns about the broader automotive industry's ability to navigate the current economic headwinds. Investors reacted negatively to the news, with Honda's stock price experiencing a significant drop. The situation highlights the need for automakers to adapt quickly to the changing market dynamics and invest strategically in future technologies to maintain profitability and competitiveness.

The Road Ahead for Honda:

The coming quarters will be crucial for Honda's recovery. The success of its strategic initiatives to address supply chain challenges, optimize costs, and accelerate EV development will ultimately determine whether it can overcome this significant setback and return to profitability. The automotive landscape remains highly competitive, and Honda will need to execute its strategy flawlessly to regain its position as a leading global automaker. The company's ability to innovate and adapt will be key to its future success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Honda Motor Co., Ltd. Reports Disastrous Earnings: 76% Profit Collapse. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Clinical Data Weight Loss Injection Proves More Effective Than Alternatives

May 14, 2025

Clinical Data Weight Loss Injection Proves More Effective Than Alternatives

May 14, 2025 -

Italian Open Draper Vs Moutet Live Score And Updates

May 14, 2025

Italian Open Draper Vs Moutet Live Score And Updates

May 14, 2025 -

Trump Begins Second Term With Saudi Arabia Visit Key Foreign Policy Implications

May 14, 2025

Trump Begins Second Term With Saudi Arabia Visit Key Foreign Policy Implications

May 14, 2025 -

Nissans Restructuring Plan Impact Of 11 000 Job Cuts And Seven Factory Closings

May 14, 2025

Nissans Restructuring Plan Impact Of 11 000 Job Cuts And Seven Factory Closings

May 14, 2025 -

This Weight Loss Injection Sheds More Kilos A New Studys Findings

May 14, 2025

This Weight Loss Injection Sheds More Kilos A New Studys Findings

May 14, 2025

Latest Posts

-

Did Twilio Suffer A Data Breach Company Responds To Alleged Steam 2 Fa Compromise

May 14, 2025

Did Twilio Suffer A Data Breach Company Responds To Alleged Steam 2 Fa Compromise

May 14, 2025 -

Meta Faces Ftc Antitrust Scrutiny The Future Of Whats App And Instagram Ownership

May 14, 2025

Meta Faces Ftc Antitrust Scrutiny The Future Of Whats App And Instagram Ownership

May 14, 2025 -

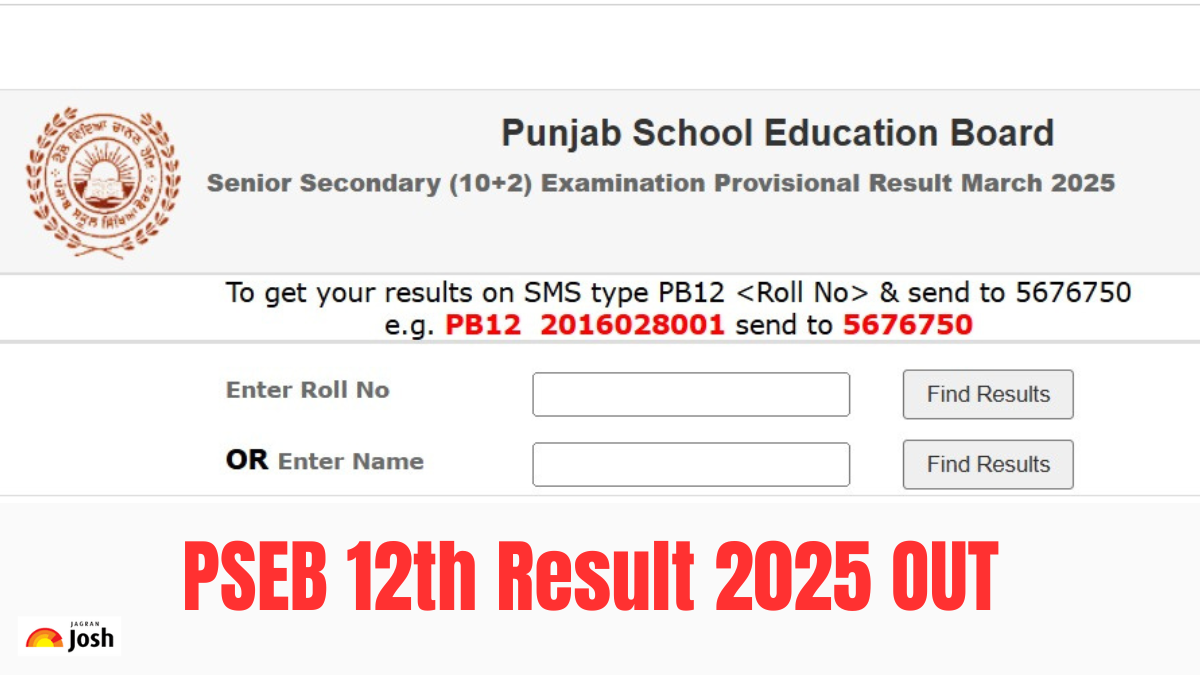

Punjab Board 12th Result 2025 Live Updates Pseb Ac In

May 14, 2025

Punjab Board 12th Result 2025 Live Updates Pseb Ac In

May 14, 2025 -

Direct Rogue One Links And Key Character Reveals In Andor Season 2 Finale

May 14, 2025

Direct Rogue One Links And Key Character Reveals In Andor Season 2 Finale

May 14, 2025 -

Update Bindi Irwin Unable To Attend Steve Irwin Gala After Medical Emergency

May 14, 2025

Update Bindi Irwin Unable To Attend Steve Irwin Gala After Medical Emergency

May 14, 2025