Hong Kong Stocks Plunge: Biggest Drop Since 1997 Amid US-China Tariff Fears

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hong Kong Stocks Plunge: Biggest Drop Since 1997 Amid US-China Tariff Fears

Hong Kong's stock market experienced its sharpest decline since the Asian financial crisis of 1997, plummeting on fears of escalating US-China trade tensions. The Hang Seng Index, a key benchmark for the Hong Kong Stock Exchange, suffered a dramatic fall, triggering widespread concern among investors and fueling anxieties about global economic stability. This unprecedented drop underscores the deep interconnectedness of the global economy and the significant impact of geopolitical events on financial markets.

A Day of Reckoning for Hong Kong Investors

The market's freefall was largely attributed to renewed anxieties surrounding the escalating US-China trade war. The announcement of increased tariffs by the US administration sent shockwaves through the global financial system, with Hong Kong, heavily intertwined with the Chinese economy, bearing the brunt of the impact. The Hang Seng Index shed over 4%, its largest single-day percentage drop in over two decades, wiping billions of dollars off the market capitalization.

Understanding the Underlying Factors

Several factors contributed to this dramatic plunge:

- Increased US Tariffs: The imposition of new tariffs on Chinese goods significantly dampened investor sentiment. This move is seen as further escalating the trade conflict, increasing uncertainty and hindering economic growth in both countries.

- Weakening Chinese Yuan: The Chinese Yuan's decline against the US dollar further exacerbated the situation. A weaker Yuan makes Chinese exports more expensive, potentially impacting global trade and further slowing economic growth.

- Global Economic Uncertainty: The ongoing trade war has created a climate of uncertainty, discouraging investment and prompting investors to seek safer havens for their assets. This flight to safety contributed significantly to the sell-off in Hong Kong.

- Hong Kong's Unique Vulnerability: Hong Kong's economy is deeply integrated with mainland China, making it particularly susceptible to shifts in the US-China relationship. The city's status as a major financial hub means it feels the impact of global economic volatility acutely.

What This Means for the Future

The sharp decline in Hong Kong's stock market raises serious concerns about the broader global economy. The prolonged trade war between the US and China continues to cast a long shadow, creating significant uncertainty and disrupting global supply chains. The impact extends beyond Hong Kong, affecting investor confidence worldwide and potentially hindering economic growth. Analysts are closely monitoring the situation, trying to gauge the extent and duration of the market downturn.

Looking Ahead: Navigating Uncertainty

The future remains uncertain. The outcome of the US-China trade negotiations will significantly influence the trajectory of Hong Kong's stock market and the broader global economy. Investors are urged to exercise caution and carefully consider their investment strategies in light of the prevailing uncertainty. Experts suggest diversification and a long-term investment approach as ways to mitigate risk in this volatile environment. The situation demands close monitoring and a proactive approach to risk management. The coming weeks and months will be crucial in determining the long-term impact of this significant market downturn. The Hong Kong Stock Exchange, and indeed global markets, are bracing for further volatility as the trade war continues to unfold.

Keywords: Hong Kong Stock Market, Hang Seng Index, US-China Trade War, Tariffs, Asian Financial Crisis, Global Economy, Market Volatility, Investment, Economic Uncertainty, China Economy, Hong Kong Economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hong Kong Stocks Plunge: Biggest Drop Since 1997 Amid US-China Tariff Fears. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is United Health Groups Unh Stock Success Justified By Its Financials

Apr 08, 2025

Is United Health Groups Unh Stock Success Justified By Its Financials

Apr 08, 2025 -

Global Stock Market Rout Chinas Counter Tariffs Exacerbate Trade War With Us

Apr 08, 2025

Global Stock Market Rout Chinas Counter Tariffs Exacerbate Trade War With Us

Apr 08, 2025 -

Londoners Flock To Kew Gardens To Smell The Corpse Flower

Apr 08, 2025

Londoners Flock To Kew Gardens To Smell The Corpse Flower

Apr 08, 2025 -

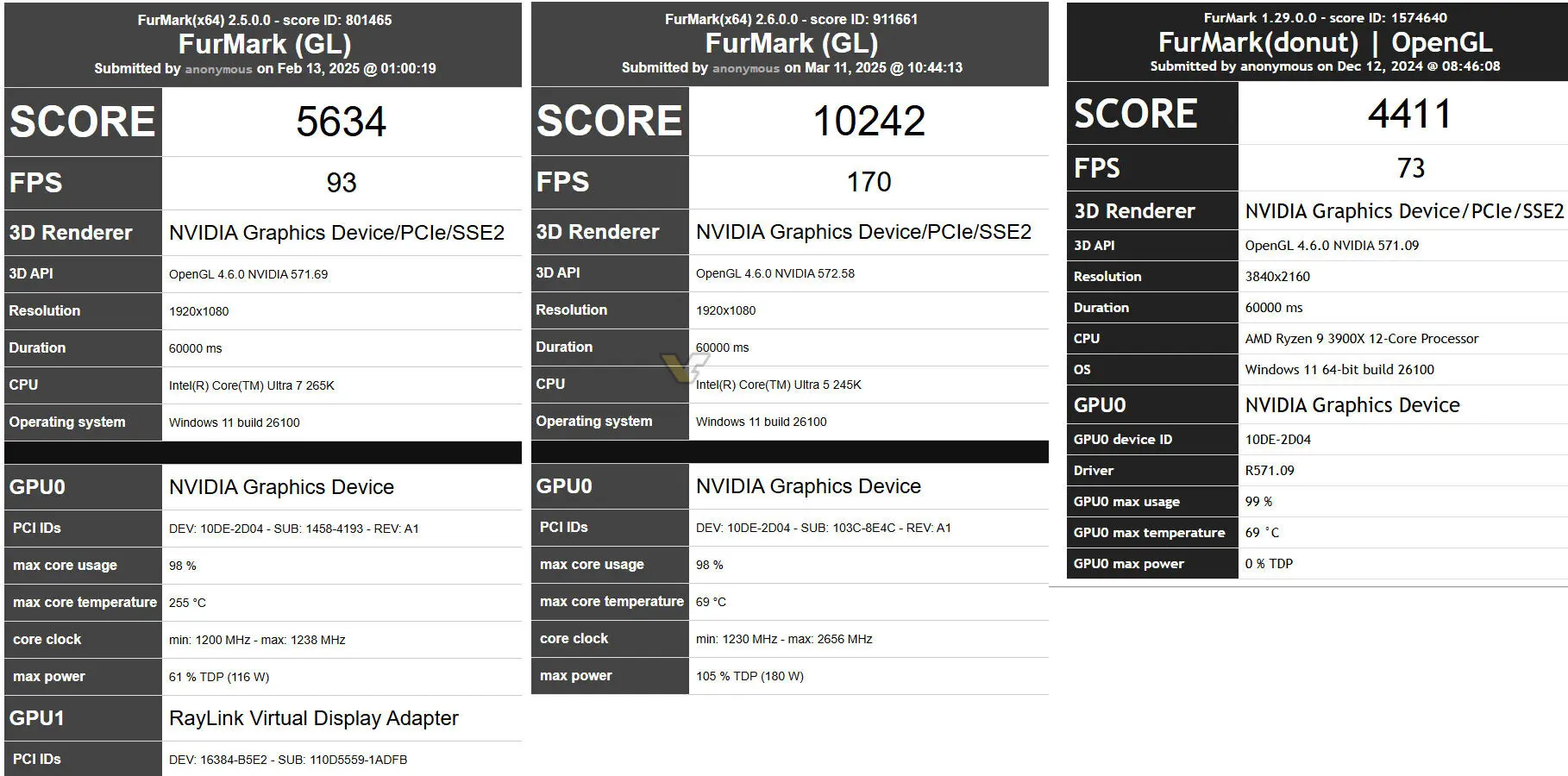

Fur Mark Database Leaks Rtx 5060 Ti Performance At 180 W Tdp Unveiled

Apr 08, 2025

Fur Mark Database Leaks Rtx 5060 Ti Performance At 180 W Tdp Unveiled

Apr 08, 2025 -

1 Billion Eu Fine For X Musks Platform Under Fire For Disinformation

Apr 08, 2025

1 Billion Eu Fine For X Musks Platform Under Fire For Disinformation

Apr 08, 2025