Hong Kong's Web3 Regulatory Framework: A Deep Dive Into Staking Rules And The Anticipated Stablecoin Law

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hong Kong's Web3 Regulatory Framework: Navigating the Complexities of Staking and the Looming Stablecoin Law

Hong Kong is rapidly emerging as a leading hub for Web3 innovation, but this ambition is inextricably linked to its developing regulatory framework. While the city aims to attract blockchain businesses and cryptocurrency investors, the specifics of its approach, particularly concerning staking and the anticipated stablecoin law, remain areas of keen interest and, for some, uncertainty. This deep dive explores the current state of Hong Kong's Web3 regulations, focusing on the intricacies of staking and the implications of the forthcoming stablecoin legislation.

Hong Kong's Web3 Stance: A Balancing Act

Hong Kong's government has expressed a clear intention to foster a thriving Web3 ecosystem. This strategy involves balancing innovation with robust regulatory oversight to mitigate risks associated with cryptocurrencies. The approach is a cautious yet progressive one, aiming to attract legitimate businesses while deterring illicit activities. This delicate balance is evident in the evolving rules surrounding staking and the anticipated legal framework for stablecoins.

Understanding Hong Kong's Staking Regulations

The current regulatory landscape doesn't explicitly define "staking" within its cryptocurrency guidelines. However, the Securities and Futures Ordinance (SFO) broadly covers activities that could be construed as offering securities. If a staking mechanism involves offering a return on investment linked to the performance of a digital asset, it could fall under the purview of the SFO, requiring licensing and compliance.

- Key Considerations for Staking Providers: Companies offering staking services in Hong Kong need to carefully assess whether their activities constitute the offering of regulated securities. Failure to comply could result in significant penalties.

- Implications for Users: While the regulations don't directly target individual users staking their crypto, understanding the regulatory status of the platform they use is crucial to mitigate potential risks. Choosing licensed and reputable providers is paramount.

Looking Ahead: Greater clarity on staking regulations is expected. The government is likely to provide further guidance to clarify the legal status of various staking models, promoting transparency and reducing ambiguity for both providers and users.

The Anticipated Stablecoin Law: A Pivotal Development

The upcoming stablecoin legislation is a significant development in Hong Kong's Web3 regulatory strategy. Details are still emerging, but the anticipated framework is expected to focus on:

- Licensing and Registration: Stablecoin issuers will likely need to obtain licenses or register with the relevant authorities. This will involve stringent requirements regarding capital adequacy, risk management, and transparency.

- Reserve Requirements: Similar to traditional banking regulations, the law may mandate that stablecoins maintain sufficient reserves to back their value. The type and composition of these reserves are yet to be fully defined.

- Auditing and Transparency: Regular audits and transparent disclosure of reserve holdings will likely be mandatory to ensure the stability and integrity of stablecoins operating within Hong Kong.

The Impact: The stablecoin law will significantly impact the use and adoption of stablecoins in Hong Kong. It will increase regulatory scrutiny, potentially leading to a more secure and trustworthy stablecoin ecosystem, while also potentially raising the barriers to entry for some issuers.

Conclusion: Hong Kong's Web3 Journey Continues

Hong Kong's regulatory approach to Web3 is dynamic and evolving. While the lack of explicit rules on staking currently necessitates a cautious approach, the anticipated stablecoin law indicates a commitment to a regulated yet innovative environment. Clearer guidelines and a well-defined regulatory framework will be essential for Hong Kong to realize its ambition of becoming a global leader in Web3. Continued monitoring of regulatory developments is crucial for all stakeholders navigating this exciting yet complex landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hong Kong's Web3 Regulatory Framework: A Deep Dive Into Staking Rules And The Anticipated Stablecoin Law. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Epic Games Fortnite Update 34 30 Server Outage And Maintenance Schedule

Apr 08, 2025

Epic Games Fortnite Update 34 30 Server Outage And Maintenance Schedule

Apr 08, 2025 -

Political Fallout Aoc Addresses Online Harassment Following Baseball Video Incident

Apr 08, 2025

Political Fallout Aoc Addresses Online Harassment Following Baseball Video Incident

Apr 08, 2025 -

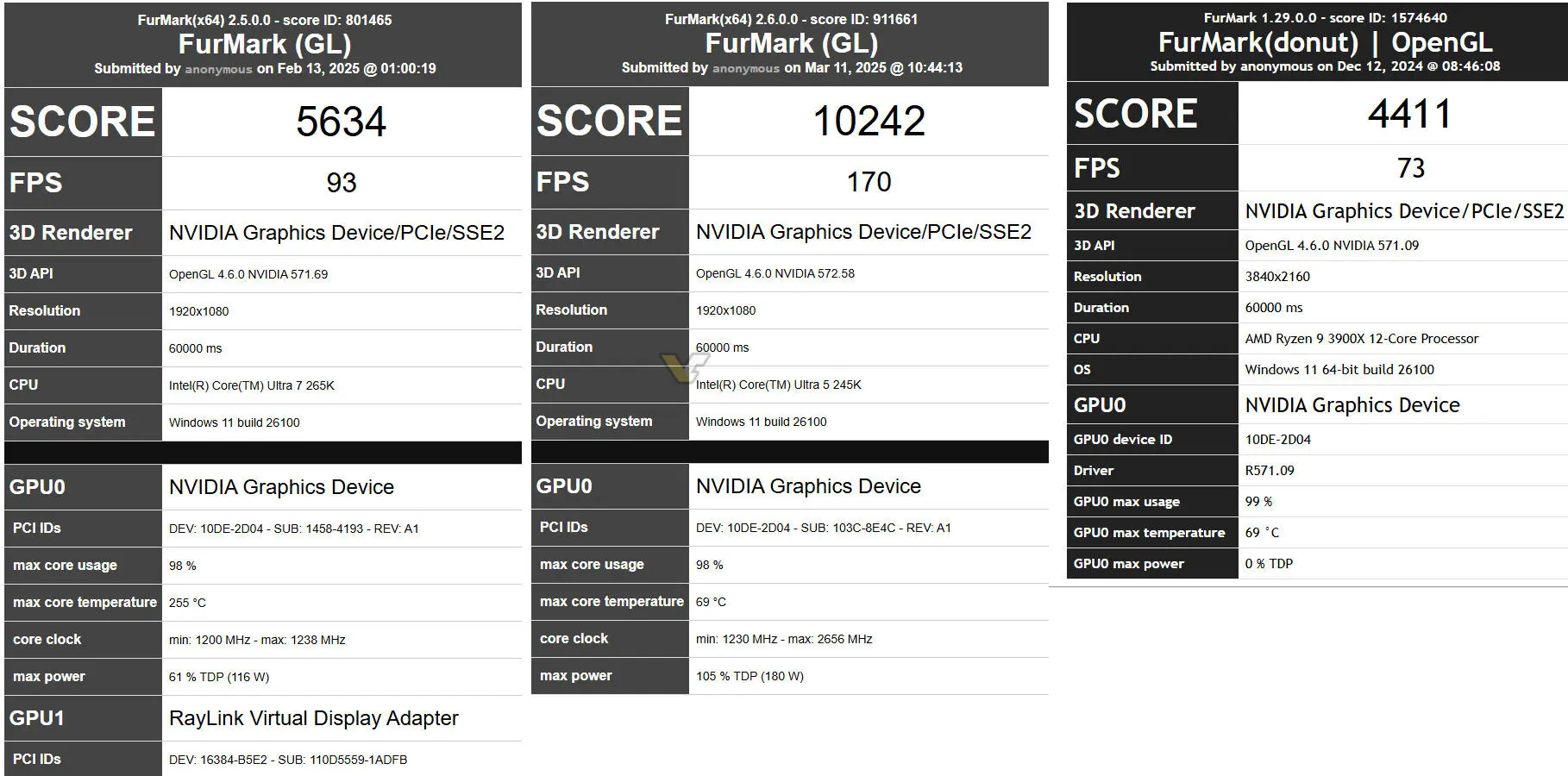

Nvidia Rtx 5060 Ti Performance Benchmarks Surface 180 W Tdp Tested Via Fur Mark

Apr 08, 2025

Nvidia Rtx 5060 Ti Performance Benchmarks Surface 180 W Tdp Tested Via Fur Mark

Apr 08, 2025 -

Black History And Culture A Bonus Episode Conversation With Guest Name S

Apr 08, 2025

Black History And Culture A Bonus Episode Conversation With Guest Name S

Apr 08, 2025 -

Nrlw Bulldogs Announce Wiliame As New Head Coach

Apr 08, 2025

Nrlw Bulldogs Announce Wiliame As New Head Coach

Apr 08, 2025