How MicroStrategy's STRK Preferred Stock Fuels Its Bitcoin Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How MicroStrategy's STRK Preferred Stock Fuels its Bitcoin Investments

MicroStrategy, a business intelligence company, has become synonymous with its aggressive Bitcoin investment strategy. But how does a software company fund such a monumental undertaking? A key component of its financial engine is its recently issued STRK preferred stock, a novel approach that's attracting significant attention in the financial and cryptocurrency worlds. This article delves into how MicroStrategy's STRK preferred stock directly fuels its Bitcoin acquisitions.

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, under the leadership of CEO Michael Saylor, has consistently championed Bitcoin as a long-term store of value. Their strategy involves accumulating significant amounts of BTC, viewing it as a hedge against inflation and a potentially transformative asset. This bold approach has made them a major player in the Bitcoin market, but it requires substantial capital.

The Role of STRK Preferred Stock

This is where STRK preferred stock comes in. Issued in late 2022, STRK is a unique instrument. It's designed to provide investors with exposure to MicroStrategy's Bitcoin holdings without the volatility inherent in directly owning BTC. Crucially, the proceeds from the sale of STRK directly contribute to MicroStrategy's Bitcoin treasury.

How STRK Funds Bitcoin Purchases:

The mechanism is relatively straightforward:

- Capital Infusion: The sale of STRK shares injects significant capital into MicroStrategy's coffers.

- Direct Allocation: This capital is then directly used to purchase more Bitcoin. This creates a clear and direct link between investor participation and MicroStrategy's Bitcoin accumulation.

- Reduced Dilution: Unlike issuing common stock, which dilutes existing shareholder ownership, STRK preferred stock offers a less dilutive way to raise capital for Bitcoin purchases. This is attractive to both existing and potential investors.

Benefits of the STRK Strategy:

MicroStrategy's approach using STRK offers several advantages:

- Diversification for Investors: Investors gain exposure to Bitcoin's potential without the direct risks associated with its volatility.

- Capital Efficiency for MicroStrategy: It provides a relatively efficient method to fund its Bitcoin strategy without significantly diluting existing shareholders.

- Enhanced Transparency: The link between STRK sales and Bitcoin purchases increases transparency regarding MicroStrategy's investment strategy.

Risks and Considerations:

While the STRK strategy offers several advantages, it's not without risks:

- Bitcoin Price Volatility: The value of STRK is intrinsically linked to the price of Bitcoin. A significant downturn in the Bitcoin market could negatively impact the value of STRK.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain, which could impact the value of both Bitcoin and STRK.

Conclusion: A Unique Approach to Bitcoin Investment

MicroStrategy's use of STRK preferred stock represents a creative and innovative approach to funding its Bitcoin investment strategy. By directly linking investor capital to Bitcoin acquisitions, they've created a mechanism that benefits both the company and its investors. While risks exist, the STRK model provides a compelling example of how traditional finance can intersect with the burgeoning cryptocurrency market. As MicroStrategy continues to accumulate Bitcoin, the success of its STRK strategy will be closely watched by investors and the crypto community alike. The future of this innovative financing method will undoubtedly shape the landscape of corporate Bitcoin investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How MicroStrategy's STRK Preferred Stock Fuels Its Bitcoin Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can The Fa Cup Victory Revitalize Manchester Citys Season

May 18, 2025

Can The Fa Cup Victory Revitalize Manchester Citys Season

May 18, 2025 -

Golf Legend Curtis Strange Condemns Pga Rules Change

May 18, 2025

Golf Legend Curtis Strange Condemns Pga Rules Change

May 18, 2025 -

Fa Cup Finale Crystal Palace Besiegt Manchester City Und Schreibt Geschichte

May 18, 2025

Fa Cup Finale Crystal Palace Besiegt Manchester City Und Schreibt Geschichte

May 18, 2025 -

Ceremony In Rawalpindi Pays Respect To Pakistans Armed Forces

May 18, 2025

Ceremony In Rawalpindi Pays Respect To Pakistans Armed Forces

May 18, 2025 -

Oklahoma Softball Can The Sooners Conquer The California Golden Bears

May 18, 2025

Oklahoma Softball Can The Sooners Conquer The California Golden Bears

May 18, 2025

Latest Posts

-

Unpacking Jonquel Jones Finances Wnba Salary And Total Net Worth

May 18, 2025

Unpacking Jonquel Jones Finances Wnba Salary And Total Net Worth

May 18, 2025 -

O Botafogo E Seus Cinco Jogos Cruciais Para A Temporada 2025

May 18, 2025

O Botafogo E Seus Cinco Jogos Cruciais Para A Temporada 2025

May 18, 2025 -

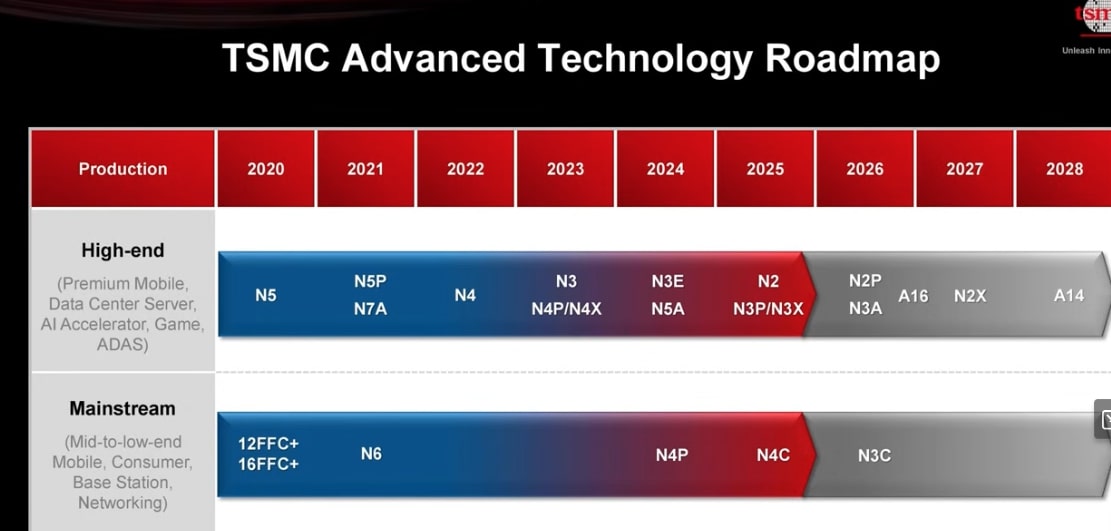

Tsmc Unveils 2028 Roadmap At 2025 Technical Symposium Focus On 1 4nm Node

May 18, 2025

Tsmc Unveils 2028 Roadmap At 2025 Technical Symposium Focus On 1 4nm Node

May 18, 2025 -

Computex 2025 Amds Radeon Gpu Launch Poised For Nvidia Challenge

May 18, 2025

Computex 2025 Amds Radeon Gpu Launch Poised For Nvidia Challenge

May 18, 2025 -

Farewell Guehi Crystal Palace Announce Departure Of Key Defender

May 18, 2025

Farewell Guehi Crystal Palace Announce Departure Of Key Defender

May 18, 2025