How Oil And Gas Companies Are Secretly Fueling The Bitcoin Network

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How Oil and Gas Companies Are Secretly Fueling the Bitcoin Network

The environmental impact of Bitcoin mining is a hotly debated topic. While many focus on the energy consumption of individual miners, a less-discussed, yet potentially significant, contributor is emerging: the clandestine involvement of oil and gas companies. This article delves into the surprising ways these energy giants are subtly powering the Bitcoin network, highlighting the environmental implications and the lack of transparency surrounding this practice.

The Silent Partnership: Flares, Waste, and Bitcoin Mining

For years, oil and gas companies have wrestled with the problem of gas flaring – the burning off of excess natural gas at drilling sites. This practice, while environmentally damaging, is often cheaper than capturing and transporting the gas. However, a lucrative alternative is quietly emerging: using this wasted energy to power Bitcoin mining operations.

The allure for these companies is clear. Gas flaring is expensive, often resulting in fines and reputational damage. Converting this wasted resource into Bitcoin mining revenue offers a potential profit stream while simultaneously mitigating environmental penalties, at least in the short term. The secrecy surrounding these arrangements stems from the negative public perception of both gas flaring and Bitcoin's energy consumption.

Beyond Flaring: The Broader Energy Mix

The use of flared gas isn't the only way oil and gas companies are indirectly contributing to the Bitcoin network. Some are investing directly in Bitcoin mining facilities, leveraging their access to cheap and often dirtier energy sources like coal and natural gas. This allows them to mine Bitcoin at a lower cost than their competitors who rely on cleaner, more expensive energy.

This hidden involvement raises significant concerns:

- Environmental Impact: Utilizing fossil fuels for Bitcoin mining undermines efforts to transition to renewable energy sources and exacerbates climate change. The carbon footprint of Bitcoin is already substantial; the contribution of oil and gas companies significantly magnifies this problem.

- Lack of Transparency: The secretive nature of these partnerships makes it difficult to accurately assess the true environmental impact of Bitcoin mining and hold these companies accountable for their contribution to carbon emissions.

- Ethical Concerns: Critics argue that this practice allows oil and gas companies to indirectly profit from a technology that is increasingly associated with environmental concerns, effectively greenwashing their operations.

The Need for Regulation and Transparency

The lack of transparency surrounding the oil and gas industry's involvement in Bitcoin mining necessitates stricter regulations and increased reporting requirements. Governments need to implement policies that encourage the disclosure of energy sources used for Bitcoin mining and incentivize the transition to renewable energy sources. This includes:

- Mandatory Reporting of Energy Sources: Requiring Bitcoin mining operations to publicly disclose their energy sources would shed light on the extent of fossil fuel usage within the network.

- Carbon Tax on Fossil Fuel-Based Mining: Implementing a carbon tax on Bitcoin mining operations powered by fossil fuels would incentivize a shift towards renewable energy.

- Incentivizing Renewable Energy Adoption: Subsidies and tax breaks for Bitcoin mining operations that utilize renewable energy sources would encourage a greener approach.

The Future of Bitcoin and Energy

The relationship between Bitcoin and the oil and gas industry is complex and evolving. While the allure of profit from waste energy is undeniable, the long-term sustainability of this practice is questionable. Increased transparency and regulatory oversight are crucial to ensuring a more environmentally responsible future for Bitcoin and the energy sector as a whole. The future hinges on a responsible transition to cleaner energy sources, not merely repurposing waste from a polluting industry. The environmental cost is too high to ignore.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Oil And Gas Companies Are Secretly Fueling The Bitcoin Network. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Enhanced Security Triage Strike Ready Ai Platform For Proactive Threat Response

Apr 26, 2025

Enhanced Security Triage Strike Ready Ai Platform For Proactive Threat Response

Apr 26, 2025 -

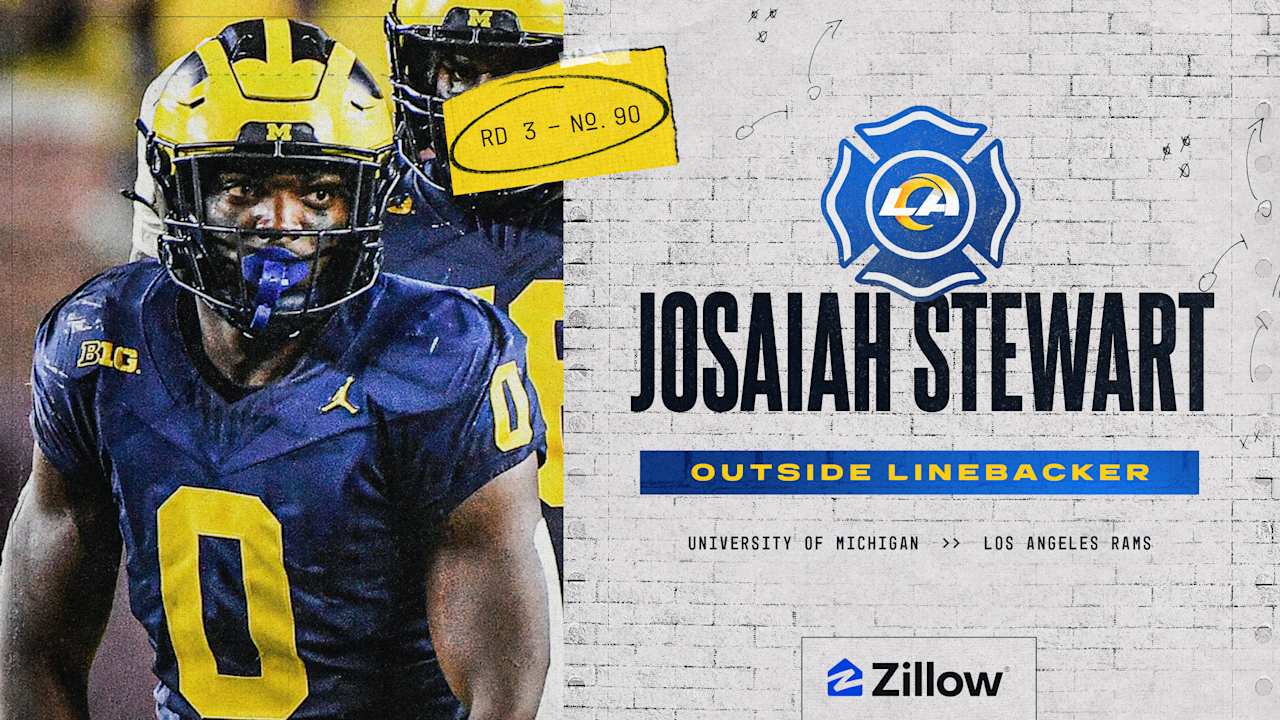

Nfl Draft 2025 Rams Bolster Defense With Josaiah Stewart Selection

Apr 26, 2025

Nfl Draft 2025 Rams Bolster Defense With Josaiah Stewart Selection

Apr 26, 2025 -

12 Rate Hike Looms For Consumers Energy Customers

Apr 26, 2025

12 Rate Hike Looms For Consumers Energy Customers

Apr 26, 2025 -

Might And Magic Fates A Web3 Trading Card Game From Ubisoft And Immutable

Apr 26, 2025

Might And Magic Fates A Web3 Trading Card Game From Ubisoft And Immutable

Apr 26, 2025 -

Ge 2025 Tampines Grc Pap Rally Draws Large Crowd At Temasek Jc

Apr 26, 2025

Ge 2025 Tampines Grc Pap Rally Draws Large Crowd At Temasek Jc

Apr 26, 2025