How Stripe's $91.5 Billion Valuation Highlights The Growing Importance Of Stablecoins

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stripe's $91.5 Billion Valuation: A Testament to the Rise of Stablecoins

Stripe, the financial infrastructure giant, recently saw its valuation soar to a staggering $91.5 billion. While this impressive figure reflects the company's overall success in powering online payments, a closer look reveals a significant underlying factor: the growing importance and integration of stablecoins within its ecosystem. This news underscores a significant shift in the fintech landscape, highlighting the potential and increasing adoption of these cryptocurrencies pegged to fiat currencies like the US dollar.

<h3>The Stripe-Stablecoin Connection: A Winning Formula</h3>

Stripe's phenomenal growth isn't just about processing credit card payments; it's about offering a comprehensive suite of financial tools for businesses of all sizes. This includes facilitating international transactions, managing payouts, and increasingly, integrating digital assets. The seamless integration of stablecoins into Stripe's platform allows businesses to:

- Reduce transaction costs: Stablecoins offer cheaper and faster cross-border payments compared to traditional methods. This is particularly crucial for businesses operating globally.

- Improve settlement speeds: Unlike traditional banking systems, stablecoin transactions are often significantly faster, leading to improved efficiency and cash flow.

- Enhance accessibility: Stablecoins can offer access to financial services in regions with limited or unreliable banking infrastructure.

- Mitigate volatility: Unlike volatile cryptocurrencies like Bitcoin, stablecoins maintain a relatively stable value, minimizing the risk associated with fluctuating exchange rates.

This robust and efficient infrastructure built around stablecoin integration is a key differentiator for Stripe, attracting businesses seeking streamlined and cost-effective financial solutions.

<h3>Stablecoins: The Catalyst for Fintech Innovation</h3>

Stripe's success isn't an isolated incident. The burgeoning popularity of stablecoins is driving innovation across the entire fintech sector. Their relative stability and ease of use are making them increasingly attractive for:

- Microtransactions: Stablecoins are ideal for small, frequent transactions, opening up new opportunities for businesses in areas like gaming, social media, and the metaverse.

- Decentralized finance (DeFi): Stablecoins are a crucial component of the DeFi ecosystem, providing liquidity and enabling various financial applications.

- Global remittances: They offer a faster, cheaper, and more transparent alternative to traditional remittance services.

<h3>Challenges and Future Outlook for Stablecoins</h3>

Despite the significant growth and advantages, stablecoins still face challenges. Regulatory uncertainty, concerns about backing mechanisms, and potential vulnerabilities remain key areas of focus. However, the increasing integration of stablecoins into mainstream financial systems, exemplified by Stripe's success, suggests a promising future.

<h3>Conclusion: A Stable Future for Fintech</h3>

Stripe's $91.5 billion valuation serves as a powerful indicator of the growing influence of stablecoins in the fintech world. As more businesses embrace these digital assets, we can expect further innovation and expansion in the financial technology landscape. The future of finance is increasingly intertwined with stablecoins, and companies like Stripe are leading the charge towards a more efficient, accessible, and globally connected financial ecosystem. The continued adoption and development of stablecoin technology will undoubtedly be a key driver of future growth in the fintech industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Stripe's $91.5 Billion Valuation Highlights The Growing Importance Of Stablecoins. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

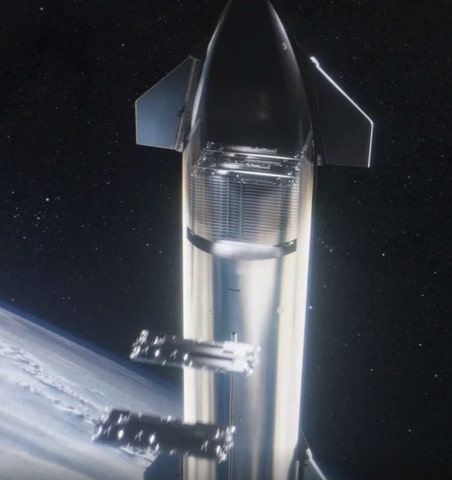

Space X Starship 2025 Launch Target Starlinks 5 Million Users And Giant V3 Satellites

Mar 04, 2025

Space X Starship 2025 Launch Target Starlinks 5 Million Users And Giant V3 Satellites

Mar 04, 2025 -

Space X Starlink Expanding Coverage To Remote Bases And Towns

Mar 04, 2025

Space X Starlink Expanding Coverage To Remote Bases And Towns

Mar 04, 2025 -

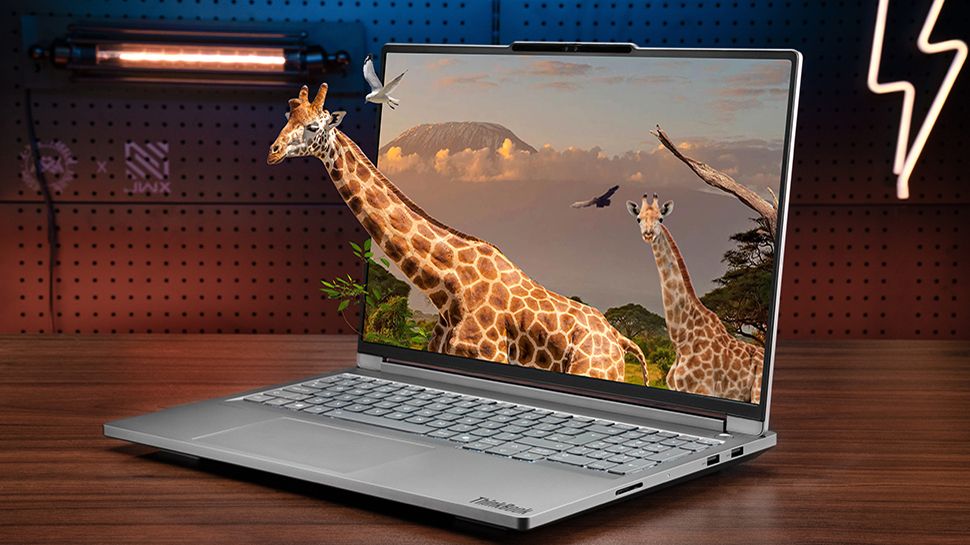

Lenovo Think Book 3 D Review Gorgeous Design But Can It Save Glasses Free 3 D

Mar 04, 2025

Lenovo Think Book 3 D Review Gorgeous Design But Can It Save Glasses Free 3 D

Mar 04, 2025 -

Space X Starship And Starlink 60 Day Orbital Launch Window And Global Connectivity Advancements

Mar 04, 2025

Space X Starship And Starlink 60 Day Orbital Launch Window And Global Connectivity Advancements

Mar 04, 2025 -

This Mini Pc Rivals Apples Mac Studio And Nvidias Digits A Detailed Comparison

Mar 04, 2025

This Mini Pc Rivals Apples Mac Studio And Nvidias Digits A Detailed Comparison

Mar 04, 2025