How Tesla's Pricing Strategy Impacts Its Market Share Among Comparable EVs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tesla's Price Wars: How Aggressive Pricing Impacts its EV Market Share

Tesla's recent price cuts have sent shockwaves through the electric vehicle (EV) market, sparking debate about their impact on Tesla's market share and the broader EV landscape. While the strategy has boosted sales in the short term, the long-term effects remain uncertain and depend on several crucial factors. This article delves into the complexities of Tesla's pricing strategy and its influence on its standing amongst comparable EVs.

The Price-Volume Game: A Double-Edged Sword

Tesla's aggressive pricing, often described as a "price war," aims to increase market share by making its vehicles more accessible. Lower prices attract budget-conscious consumers and potentially entice buyers away from competitors like Ford, Chevrolet, Hyundai, and Rivian. This volume-driven approach relies on economies of scale – selling more cars to offset lower profit margins per vehicle.

However, this strategy presents a double-edged sword. The immediate increase in sales might come at the expense of profitability, potentially impacting Tesla's overall financial health and investor confidence. Furthermore, frequent price fluctuations can erode brand loyalty and create uncertainty among potential buyers.

Analyzing the Competition: Who Wins, Who Loses?

Tesla's price cuts have undoubtedly put pressure on competitors. Established automakers offering comparable EVs, like the Ford Mustang Mach-E and Chevrolet Bolt, face the challenge of matching Tesla's lower prices without sacrificing their own profit margins. This pressure could lead to further price wars, benefiting consumers but potentially hurting the overall profitability of the EV sector.

- Winners: Consumers benefit from lower prices and increased choices. Tesla, in the short term, sees boosted sales and market share.

- Losers: Established automakers struggle to maintain profitability in the face of price competition. Tesla, in the long term, might suffer reduced profit margins if the strategy isn't sustainable.

Beyond Price: Features, Brand Image, and the Charging Network

Price is a critical factor, but it's not the only one influencing consumer choices. Tesla's success isn't solely based on cost; its strong brand image, sophisticated technology, and extensive Supercharger network contribute significantly to its market appeal.

These factors often outweigh price considerations for many buyers. While price cuts broaden the appeal, the overall Tesla experience – encompassing features, performance, and charging infrastructure – remains a key differentiator.

Long-Term Sustainability and the Future of EV Pricing

The long-term effectiveness of Tesla's price-driven strategy remains to be seen. Maintaining profitability while competing aggressively on price requires careful management of production costs and supply chains. Furthermore, the strategy could backfire if it damages the perception of Tesla's brand prestige.

The industry is also evolving rapidly. The emergence of new competitors and technological advancements will continually reshape the EV market, influencing pricing strategies and consumer choices. Tesla's ability to adapt to these changes will be crucial to its continued success.

Conclusion: A Complex Equation

Tesla's pricing strategy is a complex calculation, balancing market share, profitability, and brand image. While the immediate impact on sales is evident, the long-term consequences are yet to unfold. The coming months and years will reveal whether this bold strategy truly cements Tesla's dominance in the EV market or leads to unforeseen challenges. The ongoing price war will undoubtedly continue to shape the future of the electric vehicle industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Tesla's Pricing Strategy Impacts Its Market Share Among Comparable EVs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

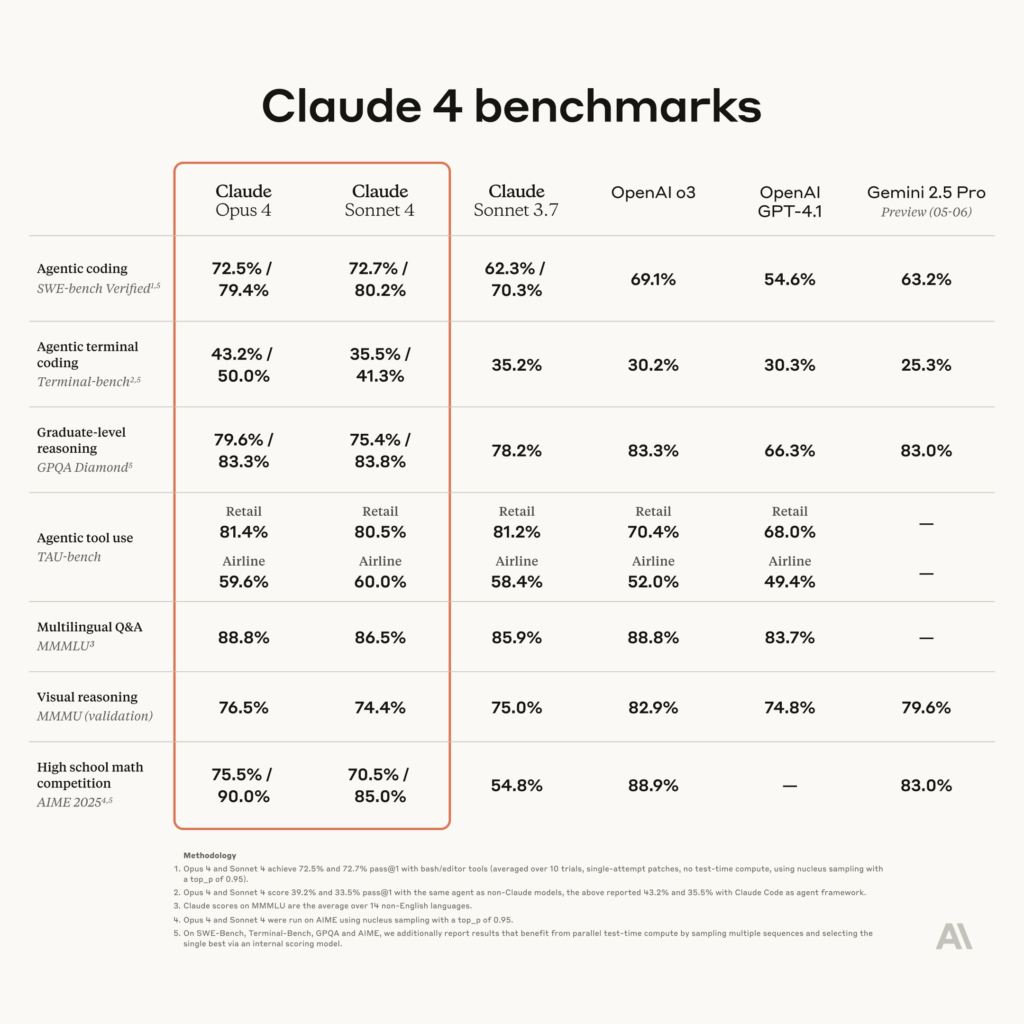

Agentic Coding Revolution Anthropics Claude 4 With Sonnet And Opus Features

May 25, 2025

Agentic Coding Revolution Anthropics Claude 4 With Sonnet And Opus Features

May 25, 2025 -

Star Wars On Your Samsung Tv Disney Art Collection Features Qled Neo Qled And The Frame

May 25, 2025

Star Wars On Your Samsung Tv Disney Art Collection Features Qled Neo Qled And The Frame

May 25, 2025 -

Hate Crime Crackdown Promised For Birmingham Pride By West Midlands Pcc

May 25, 2025

Hate Crime Crackdown Promised For Birmingham Pride By West Midlands Pcc

May 25, 2025 -

Your Essential Guide Top 10 Bands Playing Slam Dunk Festival 2025

May 25, 2025

Your Essential Guide Top 10 Bands Playing Slam Dunk Festival 2025

May 25, 2025 -

Unexpected Health Crisis Billy Joel Cancels Tour Amidst Brain Condition Battle

May 25, 2025

Unexpected Health Crisis Billy Joel Cancels Tour Amidst Brain Condition Battle

May 25, 2025

Latest Posts

-

Solve Nyt Wordle Today Hints And Answer For Friday May 23rd

May 25, 2025

Solve Nyt Wordle Today Hints And Answer For Friday May 23rd

May 25, 2025 -

Rtx 5060 Review Fiasco What Went Wrong And What It Means For You

May 25, 2025

Rtx 5060 Review Fiasco What Went Wrong And What It Means For You

May 25, 2025 -

Stars Vs Oilers A Look At Pete De Boers Coaching Ahead Of The Game

May 25, 2025

Stars Vs Oilers A Look At Pete De Boers Coaching Ahead Of The Game

May 25, 2025 -

Belgian Cats Mununga Blijft Kalm Ondanks Linskens Afwezigheid

May 25, 2025

Belgian Cats Mununga Blijft Kalm Ondanks Linskens Afwezigheid

May 25, 2025 -

Bristols Love Saves The Day Dates Tickets And Faqs

May 25, 2025

Bristols Love Saves The Day Dates Tickets And Faqs

May 25, 2025