How Wall Street And ETFs Are Propelling US Bitcoin Dominance To Unprecedented Levels

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How Wall Street and ETFs are Propelling US Bitcoin Dominance to Unprecedented Levels

The United States is rapidly solidifying its position as the global epicenter for Bitcoin trading and investment, a surge fueled by the confluence of Wall Street's growing embrace of crypto and the burgeoning popularity of Bitcoin exchange-traded funds (ETFs). This unprecedented dominance isn't just a trend; it's a tectonic shift reshaping the global cryptocurrency landscape.

The Wall Street Effect: Institutional Adoption Drives Growth

For years, Bitcoin's image was inextricably linked to the Wild West of unregulated markets. However, the entrance of major financial institutions – from BlackRock's groundbreaking Bitcoin ETF application to other giants quietly accumulating Bitcoin reserves – has fundamentally altered the narrative. This institutional adoption has legitimized Bitcoin in the eyes of mainstream investors, attracting billions in capital and driving up demand.

- Increased Regulatory Clarity: While regulatory hurdles remain, the increasing engagement of established financial players is pushing for clearer and more consistent regulatory frameworks in the US. This fosters a more stable and attractive environment for investors.

- Sophisticated Trading Strategies: Wall Street brings advanced trading strategies and sophisticated risk management tools to the Bitcoin market, increasing liquidity and potentially reducing volatility in the long run.

- Enhanced Market Infrastructure: Institutional participation is leading to improvements in market infrastructure, including better custody solutions and more robust trading platforms, further solidifying the US as a premier Bitcoin hub.

The ETF Revolution: Accessibility Fuels Mass Adoption

The potential approval of multiple Bitcoin ETFs in the US represents a monumental leap forward for cryptocurrency accessibility. ETFs offer a user-friendly and regulated gateway for retail investors to gain exposure to Bitcoin without the complexities of directly buying and storing the asset.

- Simplified Investment: ETFs dramatically reduce the barrier to entry for everyday investors, allowing them to participate in the Bitcoin market through familiar brokerage accounts.

- Increased Liquidity: The influx of retail investors through ETFs significantly boosts market liquidity, making it easier to buy and sell Bitcoin at competitive prices.

- Mainstream Acceptance: The approval of Bitcoin ETFs signals a major step towards mainstream acceptance of cryptocurrencies, further legitimizing Bitcoin's role as a potential asset class.

Global Implications: A Shift in the Geopolitical Landscape?

The US's growing dominance in Bitcoin has significant geopolitical implications. As the world's largest economy and a major financial center, the US's embrace of Bitcoin could influence global cryptocurrency regulations and potentially accelerate the adoption of Bitcoin as a global asset. This could challenge the influence of other countries that have been previously considered frontrunners in the crypto space.

Challenges and Future Outlook:

While the current trajectory is bullish, challenges remain. Regulatory uncertainty, volatility inherent to the cryptocurrency market, and potential future regulatory crackdowns are factors that could influence the future trajectory. However, with Wall Street's continued engagement and the potential for widespread ETF adoption, the US's dominance in the Bitcoin market appears poised to continue its ascent for the foreseeable future. This creates both exciting opportunities and significant risks for investors and policymakers alike. The coming years will be crucial in defining the long-term impact of this unprecedented surge in US Bitcoin dominance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Wall Street And ETFs Are Propelling US Bitcoin Dominance To Unprecedented Levels. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Supreme Court Disability Rights Cases Heated Arguments Limited Impact Expected

Apr 29, 2025

Supreme Court Disability Rights Cases Heated Arguments Limited Impact Expected

Apr 29, 2025 -

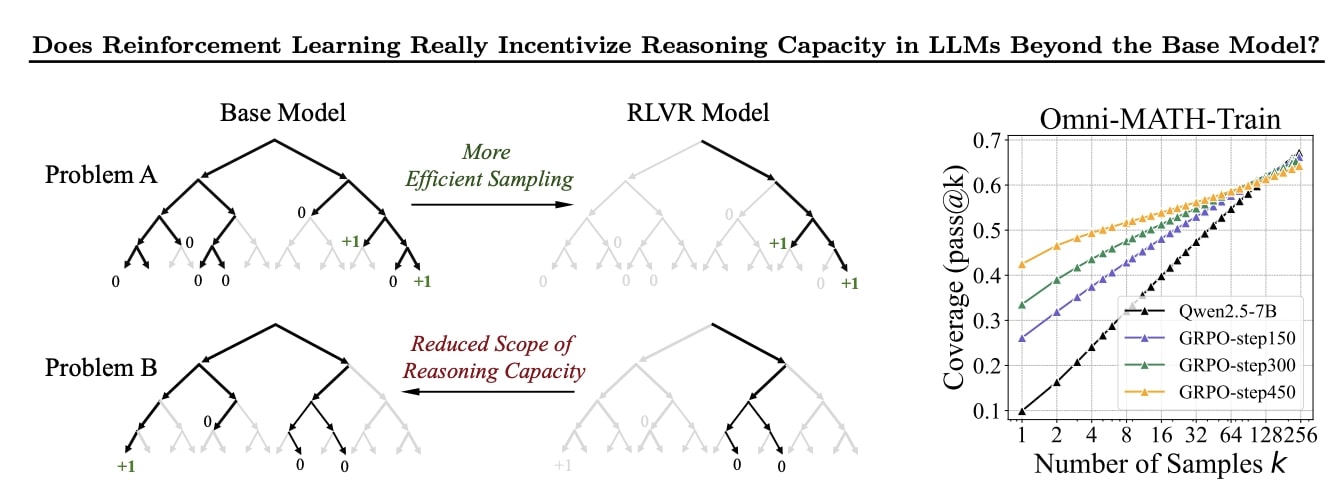

Debunking The Myth Reinforcement Learnings Impact On Ai Performance

Apr 29, 2025

Debunking The Myth Reinforcement Learnings Impact On Ai Performance

Apr 29, 2025 -

The Undisclosed Hamilton Habit Upsetting Ferrari Team

Apr 29, 2025

The Undisclosed Hamilton Habit Upsetting Ferrari Team

Apr 29, 2025 -

Karim Janats Ipl Debut Gujarat Titans Welcome Afghan Spin Wizard

Apr 29, 2025

Karim Janats Ipl Debut Gujarat Titans Welcome Afghan Spin Wizard

Apr 29, 2025 -

May 2025 Could Bombie Token Launch An Airdrop

Apr 29, 2025

May 2025 Could Bombie Token Launch An Airdrop

Apr 29, 2025

Latest Posts

-

Snooker Star Williams In Unique Position Backing Rivals Ahead Of Crucial Crucible Clash

Apr 29, 2025

Snooker Star Williams In Unique Position Backing Rivals Ahead Of Crucial Crucible Clash

Apr 29, 2025 -

Unnamed Country Holds Up Trade Deal Commerce Secretarys Announcement

Apr 29, 2025

Unnamed Country Holds Up Trade Deal Commerce Secretarys Announcement

Apr 29, 2025 -

Dte Energys Proposed 574 Million Rate Hike Michigan Faces Highest Increase In Decades

Apr 29, 2025

Dte Energys Proposed 574 Million Rate Hike Michigan Faces Highest Increase In Decades

Apr 29, 2025 -

Dte Energy Seeks 574 Million From Customers In New Rate Hike Proposal

Apr 29, 2025

Dte Energy Seeks 574 Million From Customers In New Rate Hike Proposal

Apr 29, 2025 -

Arsenal Fans Response To Lewis Skellys Goal A Players Perspective

Apr 29, 2025

Arsenal Fans Response To Lewis Skellys Goal A Players Perspective

Apr 29, 2025