Hudson's Bay Company Sells Up To 28 Store Leases: Details On The Deal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hudson's Bay Company Sells Up to 28 Store Leases: A Strategic Shift or Sign of Trouble?

The iconic Hudson's Bay Company (HBC) has announced the sale of up to 28 of its store leases to Primaris REIT, a Canadian real estate investment trust. This significant deal, valued at approximately $1.05 billion, marks a major shift in HBC's real estate strategy and has sparked considerable speculation about the future of the retail giant. While HBC maintains this is a strategic move to optimize its portfolio, analysts are weighing the implications of this substantial divestment.

Details of the Deal:

The agreement involves the sale of ground leases for up to 28 HBC properties across Canada. While the exact locations haven't been publicly disclosed in full, the deal includes prominent locations in major Canadian cities. The sale is structured as a sale-leaseback arrangement, meaning HBC will continue to operate its stores in these locations under long-term lease agreements with Primaris REIT. This approach allows HBC to inject significant capital into the business while maintaining its retail presence in key markets.

HBC's Rationale: A Strategic Repositioning?

HBC has framed the sale as a strategic move to enhance its financial flexibility and unlock the value of its substantial real estate holdings. The influx of capital generated from this transaction will likely be used to bolster its digital transformation efforts, improve its supply chain, and potentially fund future acquisitions or expansion in other areas. The company has been actively investing in its e-commerce platform and omnichannel strategy in recent years, seeking to compete effectively in the rapidly evolving retail landscape. By divesting some of its real estate, HBC can focus on core competencies and invest in areas vital for long-term growth.

Market Reactions and Analyst Perspectives:

The market's reaction to the news has been mixed. Some analysts view the sale as a positive sign, highlighting HBC's proactive approach to adapting to changing market conditions and strengthening its balance sheet. Others express concern, viewing the sale of such a large number of leases as a potential indicator of underlying financial challenges or a lack of confidence in the long-term viability of brick-and-mortar stores. The long-term implications of this strategic shift remain to be seen, and further analysis is needed to fully assess its impact on HBC's overall performance.

What this means for shoppers:

While the sale of the leases might raise concerns for some, shoppers can likely expect business to continue as usual at the affected stores. HBC will remain the tenant, and the stores should continue to operate under the Hudson's Bay banner without any immediate disruptions to services or offerings. However, the long-term impacts of this real estate strategy shift remain to be seen.

Key Takeaways:

- Significant Capital Infusion: HBC gains significant capital to reinvest in its business.

- Sale-Leaseback Arrangement: HBC maintains its retail presence in key locations.

- Focus on Digital Transformation: The capital injection will likely support HBC's ongoing digital investments.

- Mixed Market Reactions: Analysts hold differing views on the long-term implications of the deal.

- Uncertainty Remains: The full impact on HBC's future remains to be seen.

The sale of up to 28 store leases by HBC represents a bold move with potentially significant consequences. Only time will tell if this strategic repositioning will ultimately benefit the company and secure its place in the competitive Canadian retail market. Further updates and analysis will be crucial in understanding the long-term effects of this major transaction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hudson's Bay Company Sells Up To 28 Store Leases: Details On The Deal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Memorial Day Weekend Outlook Unsettled Conditions Likely

May 24, 2025

Memorial Day Weekend Outlook Unsettled Conditions Likely

May 24, 2025 -

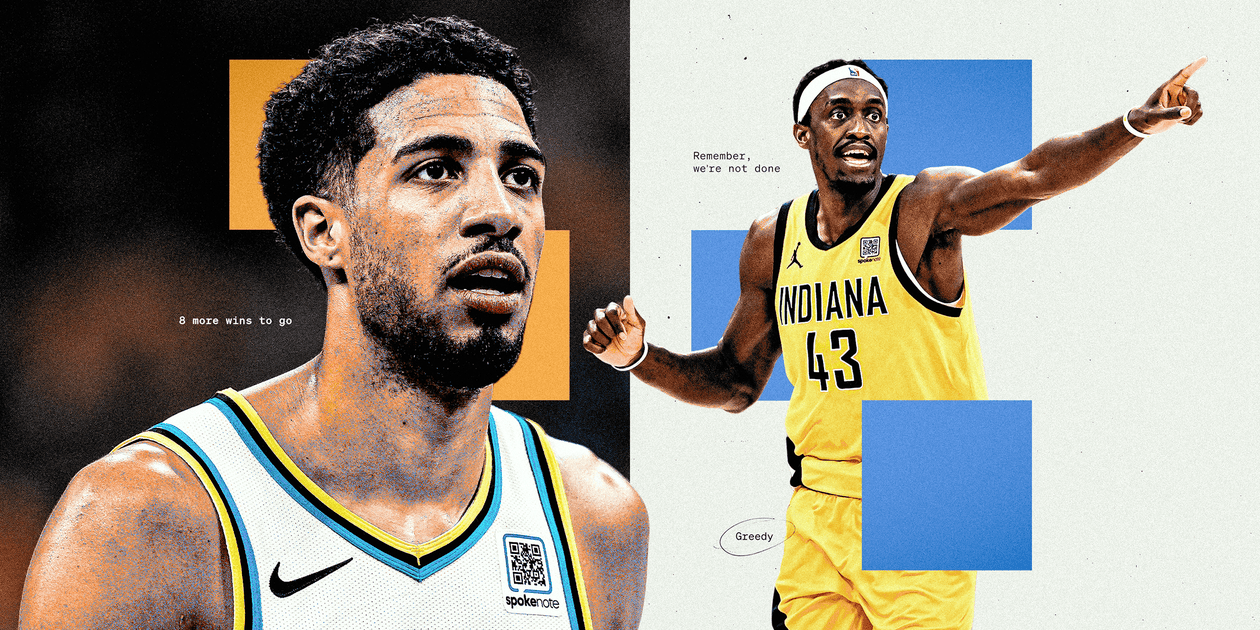

Nba Playoffs The Indiana Pacers Unexpected Championship Bid

May 24, 2025

Nba Playoffs The Indiana Pacers Unexpected Championship Bid

May 24, 2025 -

Customer Payment Plans Secure Tvs And Air Pods With Klarna

May 24, 2025

Customer Payment Plans Secure Tvs And Air Pods With Klarna

May 24, 2025 -

Live Afl Match Fremantles Opportunity To Turn Season Around Against Port Adelaide

May 24, 2025

Live Afl Match Fremantles Opportunity To Turn Season Around Against Port Adelaide

May 24, 2025 -

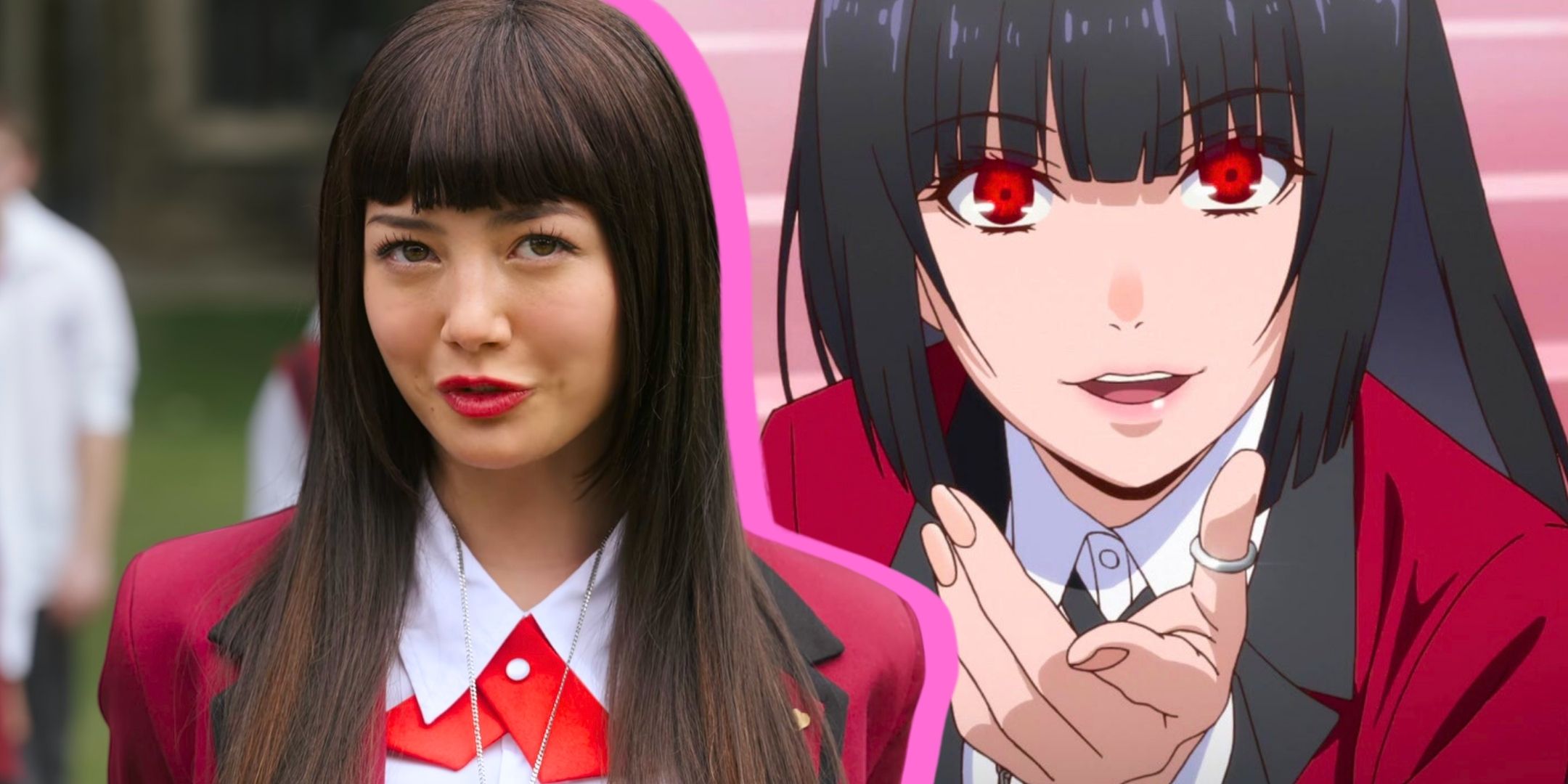

Live Action Anime Series On Netflix High Viewership Amidst Polarizing Reviews

May 24, 2025

Live Action Anime Series On Netflix High Viewership Amidst Polarizing Reviews

May 24, 2025