Hudson's Bay Sells Up To 28 Store Leases: Details On The Buyer And Future Plans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hudson's Bay Sells Up to 28 Store Leases: A Real Estate Shuffle and What it Means for the Future

Hudson's Bay Company (HBC), the iconic Canadian retailer, has announced the sale of up to 28 of its store leases to Primaris REIT, a Canadian real estate investment trust. This significant real estate transaction marks a strategic shift for HBC, raising questions about its future footprint and the implications for both the company and its customers. The deal, valued at approximately $1.35 billion, involves properties across Canada and represents a substantial portion of HBC's physical retail presence.

Who is Primaris REIT and What are Their Plans?

Primaris REIT is a seasoned player in the Canadian retail real estate market, focusing primarily on owning and managing high-quality retail properties. Their acquisition of these Hudson's Bay leases solidifies their position as a major force in the sector. While the exact plans for the properties remain to be seen, Primaris is likely to leverage its expertise to optimize the properties for continued success, potentially attracting new tenants and revitalizing the spaces. This could involve renovations, lease restructuring, and attracting a diverse range of businesses to maintain a vibrant retail environment. The acquisition also underscores Primaris' confidence in the long-term viability of brick-and-mortar retail, despite the challenges posed by e-commerce.

Impact on Hudson's Bay and its Customers:

This sale represents a significant strategic move for HBC. By offloading these leases, the company is freeing up capital and streamlining its operations. This allows HBC to focus on its core business strategies, potentially including:

- Investment in e-commerce: The freed-up capital can be reinvested in enhancing the online shopping experience, improving logistics, and expanding its digital footprint.

- Refocusing on flagship stores: HBC may concentrate its resources on its most profitable and strategically important locations, creating flagship stores that offer a premium shopping experience.

- Exploring new retail models: The funds could be used to explore innovative retail formats and partnerships, adapting to changing consumer preferences.

However, the sale does raise concerns about potential store closures or changes in the retail landscape. While Hudson's Bay will continue to operate in the sold properties as tenants, the long-term impact on staffing and store layouts remains to be seen. Customers can expect potential changes in store offerings and potentially some restructuring within existing locations.

The Future of Brick-and-Mortar Retail:

The transaction highlights the ongoing evolution of the retail sector. While online shopping continues to grow, brick-and-mortar stores still play a vital role, especially for experiential retail and providing a physical touchpoint for brands. This deal showcases a shift towards innovative partnerships and strategic real estate management within the retail industry, demonstrating a path towards sustained success in a changing market.

Key Takeaways:

- Strategic Shift for HBC: The sale of leases signifies a major strategic shift for Hudson's Bay, allowing the company to refocus its resources and adapt to the evolving retail landscape.

- Growth for Primaris REIT: The acquisition represents significant growth for Primaris REIT, consolidating its position in the Canadian retail real estate market.

- Uncertainty for Customers: While the immediate impact on customers may be minimal, potential changes to store layouts and offerings are possible in the long term.

- Adaptability in Retail: The transaction highlights the increasing adaptability and innovative partnerships within the retail sector as companies navigate the challenges of online competition.

This transaction is a significant development in the Canadian retail and real estate sectors, and its long-term effects will be closely watched in the months and years to come. The future of Hudson's Bay and the impact on its customers will undoubtedly be shaped by the company’s strategic decisions following this major real estate deal.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hudson's Bay Sells Up To 28 Store Leases: Details On The Buyer And Future Plans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ac Milans Threat Ranieris Assessment Of Serie As Top Attacking Talent

May 24, 2025

Ac Milans Threat Ranieris Assessment Of Serie As Top Attacking Talent

May 24, 2025 -

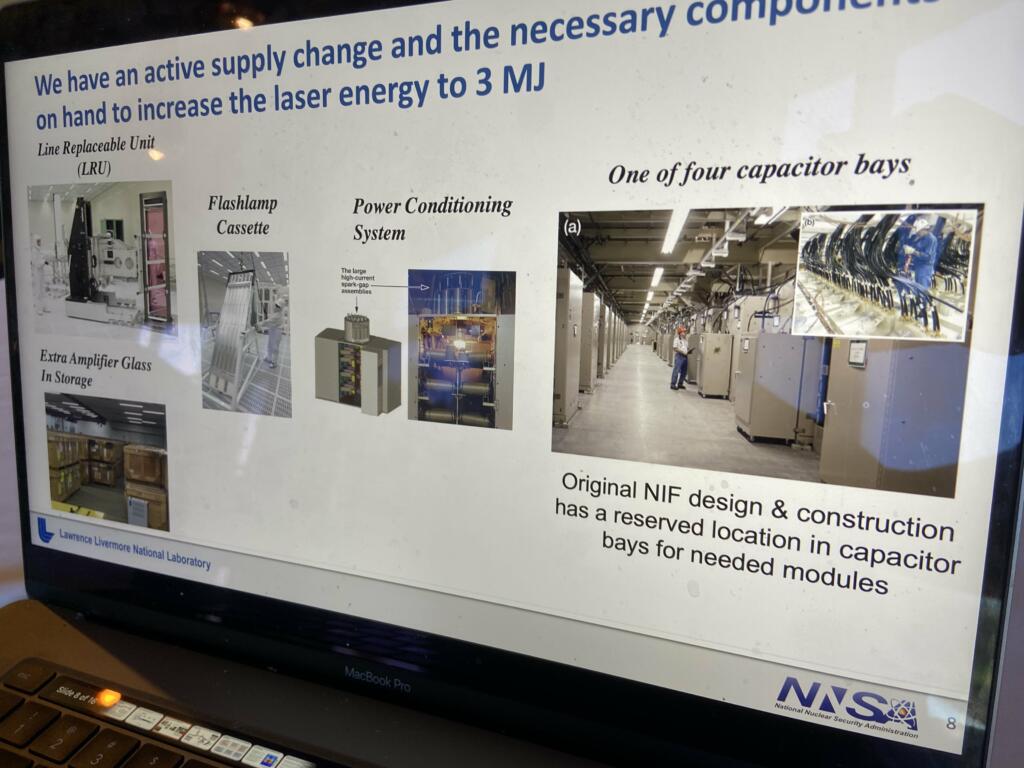

4x Energy Gain In Laser Fusion A Major Leap Forward From Livermore

May 24, 2025

4x Energy Gain In Laser Fusion A Major Leap Forward From Livermore

May 24, 2025 -

Tesla Optimus Video See The Humanoid Robots Cooking Cleaning And Waste Disposal Capabilities

May 24, 2025

Tesla Optimus Video See The Humanoid Robots Cooking Cleaning And Waste Disposal Capabilities

May 24, 2025 -

Laser Fusions Potential For Commercial Energy A Realistic Assessment

May 24, 2025

Laser Fusions Potential For Commercial Energy A Realistic Assessment

May 24, 2025 -

P A Reprend La Route Dates Et Informations Sur Sa Tournee Annoncee

May 24, 2025

P A Reprend La Route Dates Et Informations Sur Sa Tournee Annoncee

May 24, 2025