Huge Earnings Miss For Honda: 76% Operating Profit Decline Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Huge Earnings Miss for Honda: 76% Operating Profit Decline Explained

Honda Motor Co., a global automotive giant, has announced a shocking 76% decline in its operating profit for the most recent quarter, sending shockwaves through the financial markets. The drastic fall, from ¥257.7 billion ($1.8 billion) to a mere ¥60.3 billion ($420 million), has left analysts scrambling to understand the underlying causes of this significant underperformance. This unexpected downturn raises serious questions about Honda's future financial prospects and its position in the increasingly competitive automotive landscape.

What Led to Honda's Cratering Profits?

Several factors contributed to Honda's disappointing financial results. The company cited a confluence of challenges, including:

-

Supply Chain Disruptions: Ongoing global supply chain issues continue to plague the automotive industry, impacting Honda's production capabilities and driving up costs. The shortage of semiconductors, in particular, has severely constrained vehicle production, limiting sales and revenue.

-

Increased Raw Material Costs: Soaring prices for raw materials, including steel and various metals, have significantly increased Honda's manufacturing costs, squeezing profit margins. This inflationary pressure, affecting the entire industry, has hit Honda particularly hard.

-

Weakening Yen: The weakening Japanese yen against other major currencies, especially the US dollar, negatively impacted the profitability of Honda's overseas operations. This currency fluctuation reduced the value of earnings generated in foreign markets when translated back into Japanese yen.

-

Shifting Market Demand: The global automotive market is undergoing a significant transformation. The increasing demand for electric vehicles (EVs) and hybrid vehicles presents both opportunities and challenges for traditional automakers like Honda. While Honda is investing in its EV lineup, the transition is proving to be costly and time-consuming. A slower-than-anticipated uptake of their new EV models also impacted profitability.

-

Increased Research and Development Costs: The substantial investment in research and development needed to compete in the evolving automotive landscape, particularly in the EV sector, is impacting short-term profitability. These upfront costs are necessary for long-term growth and competitiveness, but they put immediate pressure on profit margins.

Honda's Response and Future Outlook

Honda acknowledged the severity of the situation and outlined plans to address the challenges. These include optimizing its production processes to mitigate supply chain disruptions, actively negotiating with suppliers to manage rising raw material costs, and accelerating its investment in electric vehicle technology to capitalize on future market trends.

However, the company also cautioned that a full recovery is unlikely in the short term. The ongoing global economic uncertainty and the volatile nature of the automotive market add further complexities. Analysts are closely monitoring Honda's performance, anticipating further developments and assessing the long-term implications of this significant earnings miss.

Implications for Investors and the Automotive Industry

This dramatic earnings decline serves as a stark reminder of the challenges facing the global automotive industry. The confluence of supply chain issues, inflation, and the rapid shift towards electric vehicles creates a volatile and unpredictable environment for established automakers. Investors are closely watching Honda's strategy to navigate these headwinds and determine whether the company can successfully adapt to the changing market landscape. The coming quarters will be crucial in assessing Honda's ability to regain its footing and restore investor confidence. The impact of this earnings miss extends beyond Honda, potentially influencing the overall sentiment towards the automotive sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Huge Earnings Miss For Honda: 76% Operating Profit Decline Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Every Wordle Answer Ever A Comprehensive List Of Past Solutions

May 14, 2025

Every Wordle Answer Ever A Comprehensive List Of Past Solutions

May 14, 2025 -

Open Ai Stargate Project Massive Phase 1 Construction Underway

May 14, 2025

Open Ai Stargate Project Massive Phase 1 Construction Underway

May 14, 2025 -

New Asus Desktop Pc Features Nvidias Fastest Superchip Dvd Drive And Unexplained Slot

May 14, 2025

New Asus Desktop Pc Features Nvidias Fastest Superchip Dvd Drive And Unexplained Slot

May 14, 2025 -

Highway Projects To Include Wildlife Crossings Following Public Fury Over Elephant Tragedy

May 14, 2025

Highway Projects To Include Wildlife Crossings Following Public Fury Over Elephant Tragedy

May 14, 2025 -

200 Megawatt Open Ai Stargate Phase 1 Construction Details Revealed

May 14, 2025

200 Megawatt Open Ai Stargate Phase 1 Construction Details Revealed

May 14, 2025

Latest Posts

-

Leaked Designs Reveal Microsofts Original Windows 11 Start Menu Plans

May 14, 2025

Leaked Designs Reveal Microsofts Original Windows 11 Start Menu Plans

May 14, 2025 -

2025 Singapore Grand Prix Concert Star Studded Lineup Announced

May 14, 2025

2025 Singapore Grand Prix Concert Star Studded Lineup Announced

May 14, 2025 -

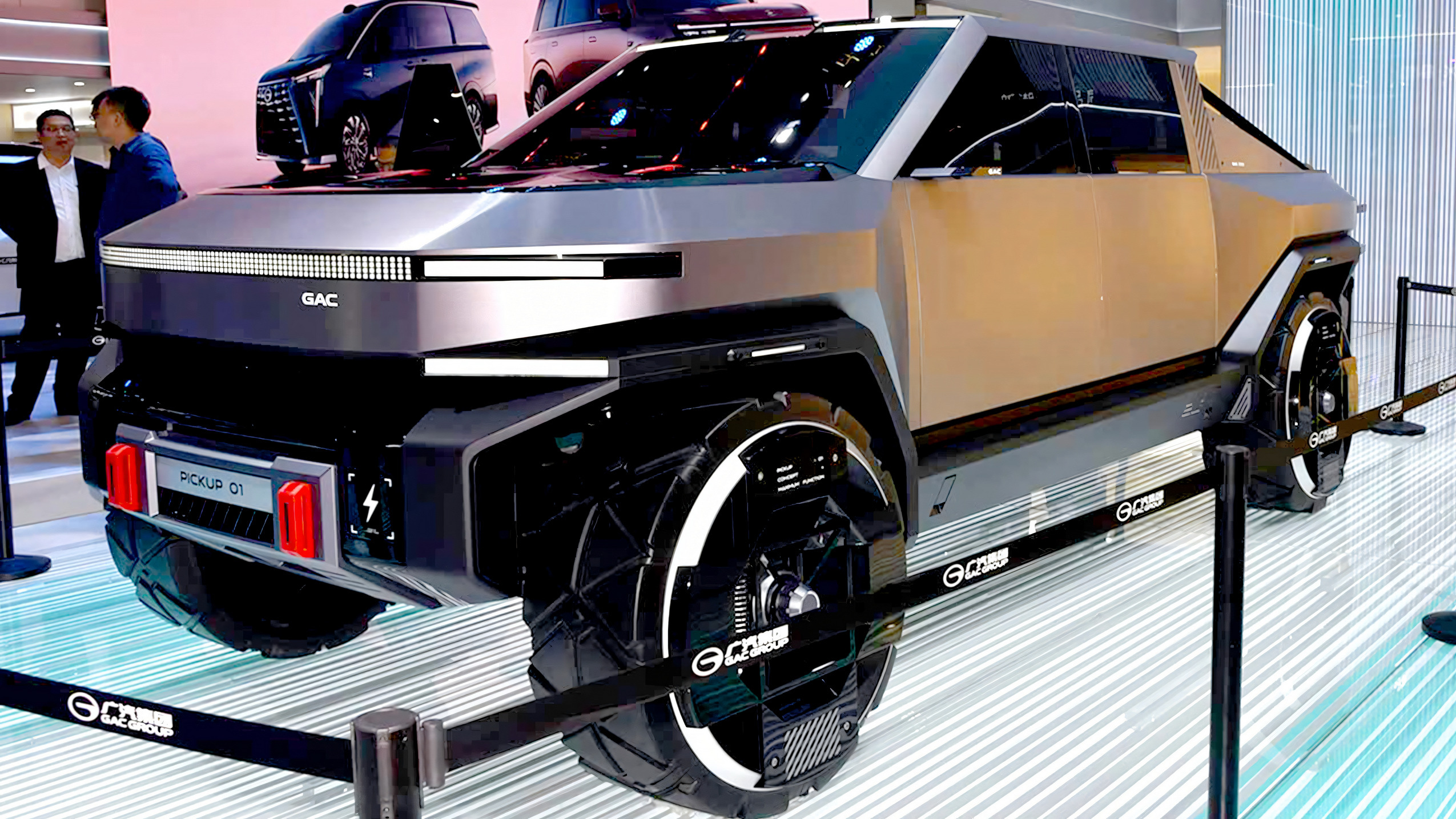

Meet The Chinese Cybertruck Alternative Now In Production

May 14, 2025

Meet The Chinese Cybertruck Alternative Now In Production

May 14, 2025 -

Unraveling Andor Season 2 The Meaning Behind The Final Episode

May 14, 2025

Unraveling Andor Season 2 The Meaning Behind The Final Episode

May 14, 2025 -

Philippines Elections Live Updates Marcos And Duterte Supporters Clash

May 14, 2025

Philippines Elections Live Updates Marcos And Duterte Supporters Clash

May 14, 2025