IHSG Tertekan, Rupiah Sentuh Rp 16.406 Per Dolar AS: Faktor Penyebabnya

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IHSG Tertekan, Rupiah Sentuh Rp 16.406 per Dolar AS: Faktor Penyebabnya

Indeks Harga Saham Gabungan (IHSG) melemah dan rupiah menyentuh level Rp 16.406 per dolar AS. Apa penyebabnya? Mari kita telusuri faktor-faktor yang memicu penurunan ini.

The Indonesian stock market, reflected in the weakening Jakarta Composite Index (IHSG), and the rupiah's fall to Rp 16,406 per US dollar, have sparked concern among investors. This downturn is a result of a confluence of factors, both domestic and global, impacting Indonesia's financial landscape. Understanding these contributing elements is crucial for navigating the current economic climate.

Faktor Global yang Mempengaruhi IHSG dan Rupiah:

-

Kenaikan Suku Bunga The Fed: The Federal Reserve's ongoing interest rate hikes continue to exert significant pressure on emerging markets like Indonesia. Higher US interest rates attract foreign investment away from Indonesia, weakening the rupiah and impacting investor sentiment on the IHSG. This capital outflow directly contributes to the weakening of the Indonesian currency.

-

Kekhawatiran Resesi Global: Global economic slowdown and recessionary fears are casting a long shadow over investor confidence worldwide. Uncertainty about global growth prospects leads to risk aversion, prompting investors to pull back from emerging markets, including Indonesia. This flight to safety further weakens the rupiah and puts downward pressure on the IHSG.

-

Harga Komoditas: Fluctuations in global commodity prices, particularly those of crucial Indonesian exports like palm oil and coal, play a significant role. A decline in commodity prices can negatively impact Indonesia's export earnings and consequently affect the rupiah's exchange rate and overall market sentiment.

Faktor Domestik yang Mempengaruhi IHSG dan Rupiah:

-

Inflasi: Persistent inflationary pressures within Indonesia erode purchasing power and can dampen consumer spending. This, in turn, impacts corporate earnings and investor confidence, leading to a decline in the IHSG. Managing inflation effectively is crucial for stabilizing the rupiah and boosting market confidence.

-

Defisit Neraca Perdagangan: A persistent trade deficit, where imports exceed exports, puts pressure on the rupiah. This imbalance reflects a need for more foreign currency to finance imports, increasing demand for US dollars and weakening the Indonesian Rupiah.

-

Ketidakpastian Politik: While Indonesia generally enjoys political stability, any domestic political uncertainty or unexpected policy changes can spook investors and negatively impact both the IHSG and the rupiah.

Apa yang Harus Diperhatikan ke Depan?

Investors should closely monitor global economic developments, particularly US monetary policy and commodity price movements. Domestically, the government's efforts to control inflation and manage the trade deficit will be key factors influencing the IHSG and rupiah's performance. Diversification of investment portfolios and a cautious approach are advisable in this volatile market environment.

Kesimpulan:

The recent downturn in the IHSG and the weakening rupiah are complex issues stemming from a combination of global and domestic factors. While challenges exist, understanding these factors allows for more informed decision-making and navigating the current market conditions effectively. Staying updated on economic news and policy changes is crucial for investors and businesses alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IHSG Tertekan, Rupiah Sentuh Rp 16.406 Per Dolar AS: Faktor Penyebabnya. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Electric Vehicle Revolution Byds 5 Minute Charge Technology

Mar 18, 2025

Electric Vehicle Revolution Byds 5 Minute Charge Technology

Mar 18, 2025 -

Is This Trade A Win For The Lakers Evaluating The Proposed Raptors Center Deal

Mar 18, 2025

Is This Trade A Win For The Lakers Evaluating The Proposed Raptors Center Deal

Mar 18, 2025 -

Petrosea Buka Penawaran Obligasi Dan Sukuk Rp1 5 Triliun Detail Dan Cara Berinvestasi

Mar 18, 2025

Petrosea Buka Penawaran Obligasi Dan Sukuk Rp1 5 Triliun Detail Dan Cara Berinvestasi

Mar 18, 2025 -

Toppin Delivers Again Clutch Performance Leads Pacers To Victory

Mar 18, 2025

Toppin Delivers Again Clutch Performance Leads Pacers To Victory

Mar 18, 2025 -

Solve Nyt Strands Puzzle 378 March 16 Complete Guide With Hints

Mar 18, 2025

Solve Nyt Strands Puzzle 378 March 16 Complete Guide With Hints

Mar 18, 2025

Latest Posts

-

Controversy In Madrid Champions Temper Costs Him Tournament Spot

Apr 29, 2025

Controversy In Madrid Champions Temper Costs Him Tournament Spot

Apr 29, 2025 -

Tuesdays Calgary Forecast Cloudy Skies High Winds And Thunderstorm Potential

Apr 29, 2025

Tuesdays Calgary Forecast Cloudy Skies High Winds And Thunderstorm Potential

Apr 29, 2025 -

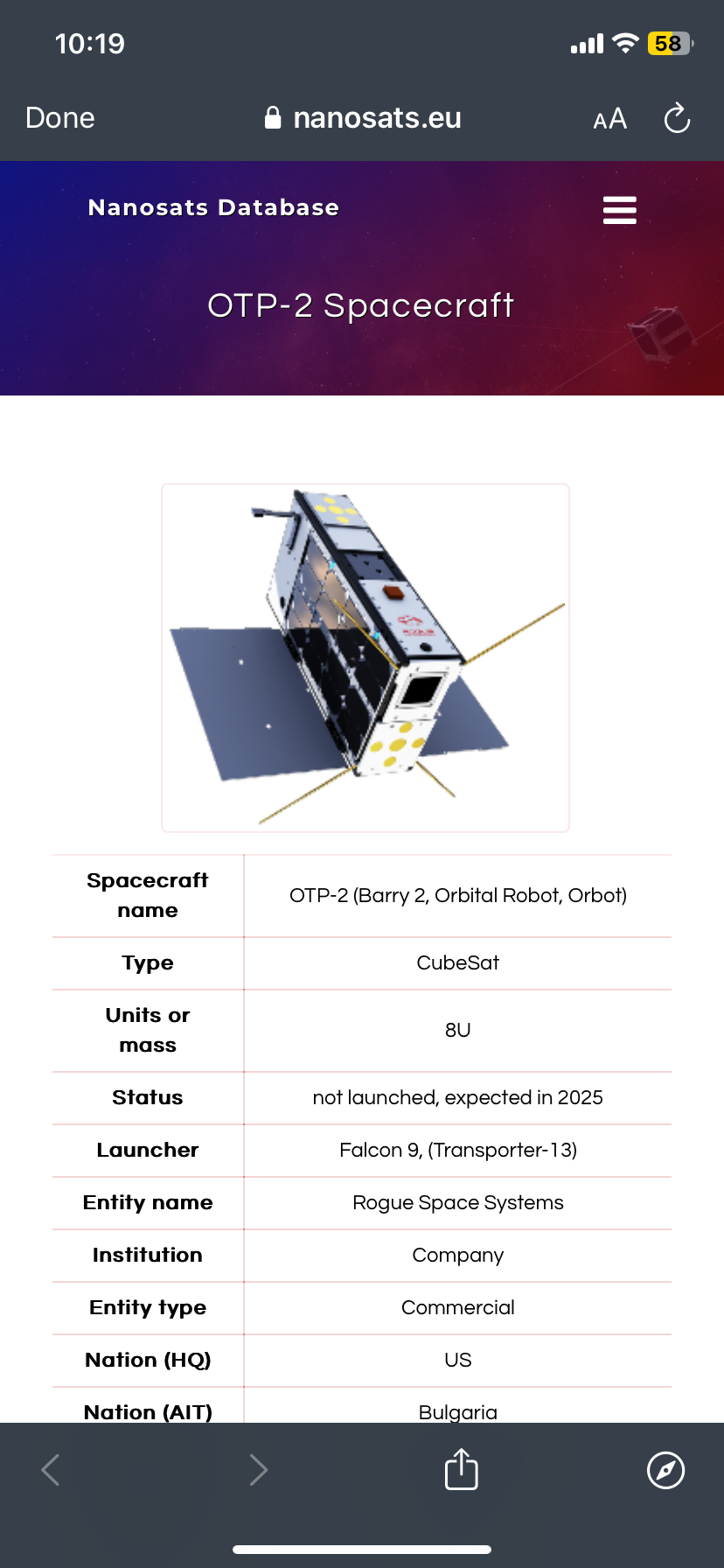

Otp 2 Propulsion Experiments Two Key Tests Detailed

Apr 29, 2025

Otp 2 Propulsion Experiments Two Key Tests Detailed

Apr 29, 2025 -

Us Uk Trade Deal Trump Tariffs Remain A Hurdle Pending Parliamentary Vote

Apr 29, 2025

Us Uk Trade Deal Trump Tariffs Remain A Hurdle Pending Parliamentary Vote

Apr 29, 2025 -

Axar Patels Death Bowling Choices Right Or Wrong

Apr 29, 2025

Axar Patels Death Bowling Choices Right Or Wrong

Apr 29, 2025