Impact Of Standard Chartered's Share Buyback On Capital Structure

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered's Share Buyback: Reshaping Capital Structure and Investor Sentiment

Standard Chartered's recent announcement of a significant share buyback program has sent ripples through the financial markets, prompting analysts and investors to scrutinize its impact on the bank's capital structure and future trajectory. This move, representing a substantial commitment of capital, signifies a vote of confidence in the bank's future prospects and a strategic shift in its capital allocation strategy. But what are the real implications? Let's delve deeper.

Understanding the Share Buyback

Standard Chartered's share buyback program involves repurchasing a considerable portion of its own outstanding shares. This action directly reduces the number of shares in circulation. The immediate effect is an increase in earnings per share (EPS) for remaining shareholders, as the same net income is now distributed among fewer shares. This can lead to a higher share price, benefiting existing investors.

Impact on Capital Structure: A Multifaceted Analysis

The impact on Standard Chartered's capital structure is complex and warrants a detailed examination:

-

Increased Return on Equity (ROE): By reducing the number of shares, the bank effectively boosts its ROE. This is a key metric for evaluating a company's profitability relative to shareholder equity. A higher ROE generally indicates improved efficiency and profitability.

-

Reduced Equity Capital: While boosting EPS, the buyback also shrinks the bank's equity capital base. This is a crucial consideration from a regulatory perspective, as banks are subject to stringent capital adequacy requirements (like Basel III accords). Standard Chartered will need to ensure its capital ratios remain compliant post-buyback.

-

Improved Financial Leverage: The buyback program can increase the bank's financial leverage – the ratio of debt to equity. This can amplify both profits and losses. A higher leverage ratio carries inherent risks, particularly during economic downturns.

-

Signal to Investors: The buyback can be interpreted as a positive signal to investors, indicating that the bank's management believes the current share price undervalues the company's intrinsic worth. This can boost investor confidence and potentially attract further investment.

Potential Risks and Considerations

While offering potential benefits, the share buyback also presents certain risks:

-

Opportunity Cost: The capital used for the buyback could have been invested in other potentially higher-return projects, such as expansion into new markets or technological upgrades. This represents an opportunity cost that needs to be carefully considered.

-

Regulatory Scrutiny: Banks operate under strict regulatory frameworks. The buyback must comply with all relevant regulations, and any deviation could lead to penalties.

-

Market Volatility: The success of a share buyback is highly dependent on market conditions. A downturn in the market could negate the positive effects of the buyback.

Conclusion: A Strategic Gamble with Potential Rewards

Standard Chartered's share buyback is a significant strategic move that carries both potential rewards and inherent risks. The ultimate success will depend on several factors, including the effectiveness of the bank's overall business strategy, the prevailing market conditions, and the continued adherence to regulatory requirements. This move necessitates ongoing monitoring of the bank's capital ratios and financial performance to fully assess its long-term impact. The buyback strategy underscores a belief in the bank's future performance, but investors should carefully assess the associated risks before drawing conclusions. Further analysis will be required to ascertain the complete implications of this significant capital allocation decision.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Standard Chartered's Share Buyback On Capital Structure. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Nintendo Switch Console Preorders Delayed By Tariff Disputes

Apr 07, 2025

New Nintendo Switch Console Preorders Delayed By Tariff Disputes

Apr 07, 2025 -

Rabt Mshahdt Mbarat Brshlwnt Wryal Bytys Fy Aldwry Alisbany

Apr 07, 2025

Rabt Mshahdt Mbarat Brshlwnt Wryal Bytys Fy Aldwry Alisbany

Apr 07, 2025 -

Meningkatnya Pemain Judi Online Asal Indonesia Di Kamboja

Apr 07, 2025

Meningkatnya Pemain Judi Online Asal Indonesia Di Kamboja

Apr 07, 2025 -

Market Outlook 3 Altcoins With High Growth Potential This Week

Apr 07, 2025

Market Outlook 3 Altcoins With High Growth Potential This Week

Apr 07, 2025 -

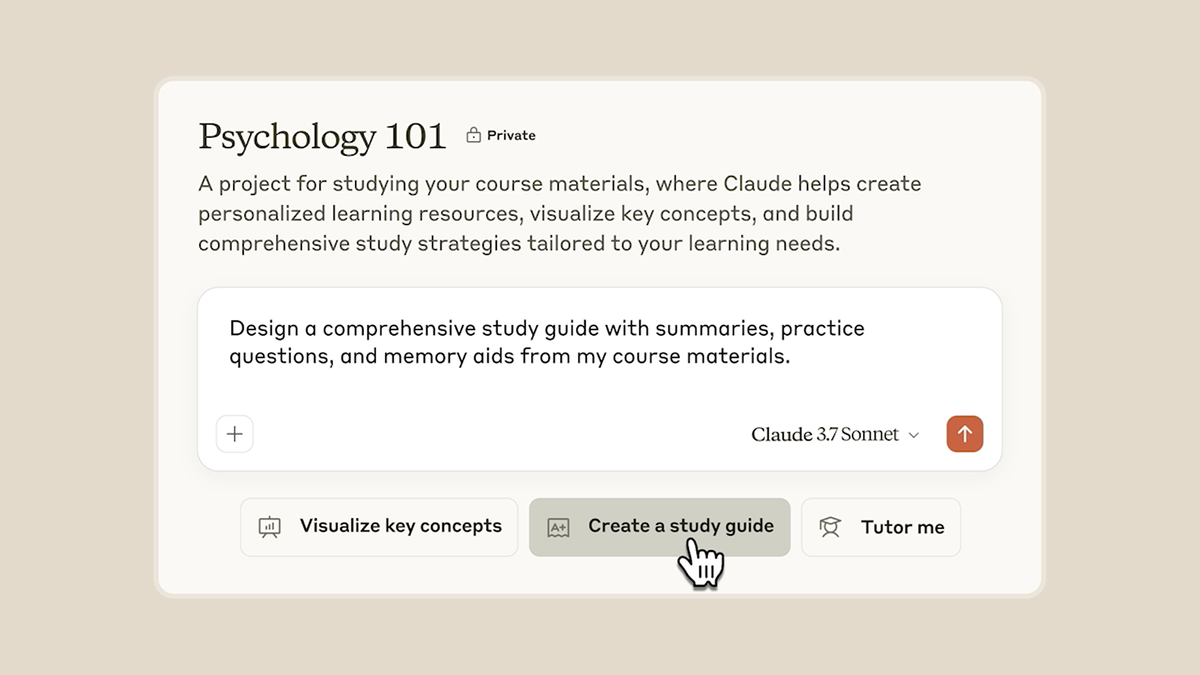

Ace Your Exams Claudes College Study Buddy System

Apr 07, 2025

Ace Your Exams Claudes College Study Buddy System

Apr 07, 2025