Important Tax Updates From The IRS: Impact On Your 2023 Filing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Important Tax Updates from the IRS: Impact on Your 2023 Filing

The 2023 tax season is here, and the IRS has implemented several key changes that could significantly impact your return. Staying informed about these updates is crucial to ensure you file accurately and avoid potential penalties. This comprehensive guide breaks down the most important changes and their implications for your 2023 tax filing.

Key Changes Affecting Your 2023 Tax Return

The IRS has announced several significant modifications to tax laws and procedures for the 2023 tax year. Understanding these changes is vital for accurate and timely filing.

1. Adjusted Standard Deduction Amounts:

The standard deduction amounts have been adjusted for inflation. This means that the amount you can deduct without itemizing may be higher than in previous years. Check the official IRS website for the most up-to-date figures for your filing status (single, married filing jointly, etc.). This adjustment can lead to a higher refund or a lower tax liability for many taxpayers.

2. Changes to Child Tax Credit (CTC):

While the expanded Child Tax Credit from 2021 has expired, the standard CTC remains in place. However, it's crucial to verify your eligibility requirements and the applicable credit amounts. Factors such as the age of your qualifying children and your income level will influence the amount you can claim.

3. Inflation Adjustments to Tax Brackets:

The IRS annually adjusts income tax brackets to account for inflation. This means that the income thresholds for each tax bracket have increased. While this might seem like a small change, it can impact your overall tax liability, potentially placing you in a lower tax bracket than you might have been in the previous year. Consult a tax professional or use tax software to determine the exact impact on your specific situation.

4. Enhanced IRS Online Services:

The IRS has continuously improved its online services, making it easier to file your taxes electronically and track your refund. Utilizing the IRS website for filing and accessing information is strongly recommended for a smoother and more efficient tax filing experience. Features like the IRS2Go mobile app offer convenient access to your account information.

5. Increased Penalties for Non-Compliance:

The IRS is cracking down on tax evasion and non-compliance. Penalties for late filing and inaccurate reporting have remained relatively consistent, but the agency is actively pursuing individuals and businesses who fail to meet their tax obligations. Accurate and timely filing is more important than ever to avoid potential penalties and interest charges.

Tips for Navigating the 2023 Tax Season

- Gather all necessary documents early: This includes W-2s, 1099s, and any other relevant tax forms.

- Use tax software or hire a tax professional: This can help ensure accuracy and avoid costly mistakes.

- File electronically: E-filing is faster, safer, and more efficient.

- Keep records: Maintain organized records of your tax documents for at least three years.

- Understand the new changes: Familiarize yourself with the updates to avoid any surprises.

Conclusion: Proactive Planning is Key

The changes implemented by the IRS for the 2023 tax year underscore the importance of proactive planning and accurate record-keeping. By understanding these updates and utilizing available resources, taxpayers can navigate the tax season effectively and confidently. Remember to consult with a qualified tax professional if you have any questions or require personalized guidance. Don't wait until the last minute – start preparing your taxes today!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Important Tax Updates From The IRS: Impact On Your 2023 Filing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

High Scoring Canucks To Battle Top Ranked Rocket Nhl Preview

Apr 07, 2025

High Scoring Canucks To Battle Top Ranked Rocket Nhl Preview

Apr 07, 2025 -

Afl Live Final Team Selections Power Vs Saints Starting 2 50 Pm Acst

Apr 07, 2025

Afl Live Final Team Selections Power Vs Saints Starting 2 50 Pm Acst

Apr 07, 2025 -

Gemma Atkinson And Gorka Marquez Balancing Strictly And Family Life

Apr 07, 2025

Gemma Atkinson And Gorka Marquez Balancing Strictly And Family Life

Apr 07, 2025 -

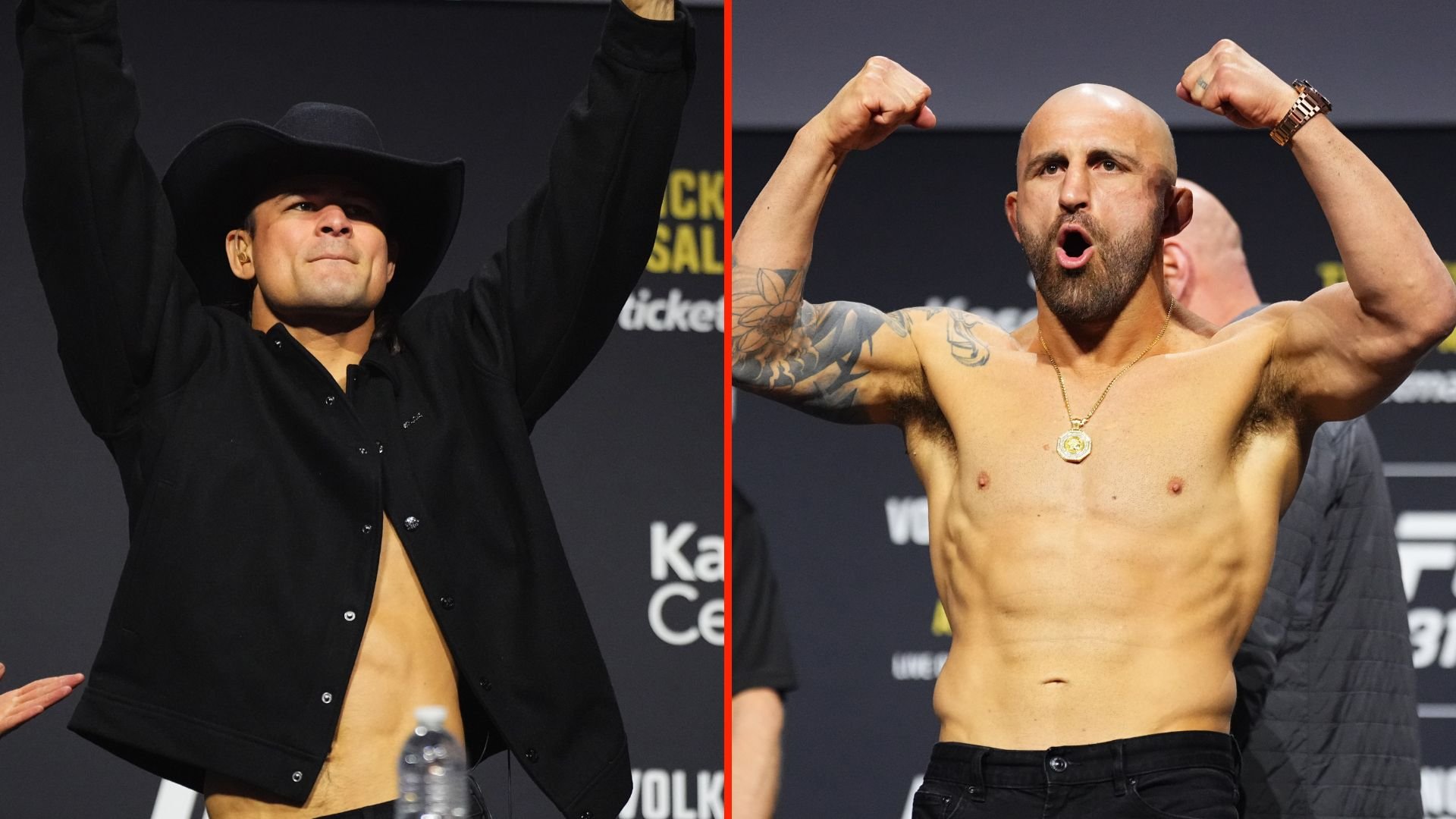

Agreement Reached Volkanovski And Lopes Name Same Featherweight Contender

Apr 07, 2025

Agreement Reached Volkanovski And Lopes Name Same Featherweight Contender

Apr 07, 2025 -

Keep Your Head Navigating Market Downturns With A Timeless Perspective

Apr 07, 2025

Keep Your Head Navigating Market Downturns With A Timeless Perspective

Apr 07, 2025