In-Line Earnings, Raised Guidance Fail To Boost Palantir Stock Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

In-Line Earnings, Raised Guidance Fail to Boost Palantir Stock Price: What Gives?

Palantir Technologies (PLTR) reported second-quarter earnings that met analysts' expectations, and even offered raised guidance for the full year. Yet, the stock price remained stubbornly flat, leaving investors scratching their heads. This unexpected market reaction raises questions about investor sentiment towards the data analytics giant and the broader tech sector. What factors contributed to this underwhelming response, and what does it mean for Palantir's future?

Strong Financials, Tepid Reaction:

Palantir exceeded expectations on several key metrics. Revenue growth, though slightly below some analysts' optimistic predictions, still demonstrated significant year-over-year expansion. The company also delivered positive free cash flow, a critical indicator of financial health. Perhaps most significantly, Palantir raised its full-year revenue guidance, signaling confidence in its growth trajectory. So why the lackluster market response?

Several factors likely contributed to the muted reaction:

-

Heightened Market Volatility: The broader tech sector has experienced significant volatility in recent months, influenced by rising interest rates, inflation concerns, and geopolitical uncertainty. Palantir, as a growth stock, is particularly susceptible to these macroeconomic headwinds. Investors may be hesitant to embrace growth stocks, even with positive earnings reports, in this uncertain environment.

-

Concerns about Long-Term Growth: While Palantir's current performance is strong, some investors may harbor concerns about the company's long-term growth prospects. The market may be pricing in a potential slowdown in future growth, impacting the current stock valuation despite the positive guidance.

-

Competition and Market Saturation: The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share. Investors may be evaluating Palantir's ability to maintain its competitive edge and expand its market penetration in the face of growing competition.

-

Profitability Concerns: While Palantir demonstrated positive free cash flow, some investors may still be scrutinizing its path to sustained profitability. Achieving consistent and substantial profitability is crucial for long-term investor confidence.

Looking Ahead for Palantir:

Despite the underwhelming market reaction to the earnings report, Palantir remains a company with significant potential. Its innovative data analytics platforms continue to attract large government and commercial clients. The raised guidance suggests a belief in continued growth, but the company will need to address investor concerns regarding long-term profitability and sustained growth in a competitive market. Future performance and successful execution of its strategic initiatives will be crucial in regaining investor confidence and driving the stock price upward.

Key Takeaways:

- Palantir's Q2 earnings and raised guidance were largely positive.

- Market reaction was muted due to several factors including macroeconomic concerns and competition.

- Long-term growth and profitability remain key areas of focus for investors.

- The future success of Palantir hinges on navigating market volatility and maintaining a competitive edge.

This unexpected market response highlights the complexities of the investment landscape and the importance of considering both company-specific factors and broader macroeconomic trends when evaluating stock performance. Only time will tell whether Palantir can overcome these challenges and realize its full potential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on In-Line Earnings, Raised Guidance Fail To Boost Palantir Stock Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Met Gala 2025 Analyzing The Best Dressed Celebrities

May 06, 2025

Met Gala 2025 Analyzing The Best Dressed Celebrities

May 06, 2025 -

Oasis Reunion Tour Song Removed Due To Pedophile Lyric Connection

May 06, 2025

Oasis Reunion Tour Song Removed Due To Pedophile Lyric Connection

May 06, 2025 -

Marketing Mystery Solved Marvel Reveals New Title For Thunderbolts Film

May 06, 2025

Marketing Mystery Solved Marvel Reveals New Title For Thunderbolts Film

May 06, 2025 -

Budget Friendly 5 K Japan Nexts Latest Monitor Boasts Near Square Design And 7 M Pixels

May 06, 2025

Budget Friendly 5 K Japan Nexts Latest Monitor Boasts Near Square Design And 7 M Pixels

May 06, 2025 -

Sycamore Gap Tree Vandalism Good Trophy Motive Alleged In Court

May 06, 2025

Sycamore Gap Tree Vandalism Good Trophy Motive Alleged In Court

May 06, 2025

Latest Posts

-

Can Gilgeous Alexander Lead Thunder Past Battle Hardened Nuggets

May 06, 2025

Can Gilgeous Alexander Lead Thunder Past Battle Hardened Nuggets

May 06, 2025 -

Denver Nuggets Vs Oklahoma City Thunder Box Score And Play By Play May 5 2025

May 06, 2025

Denver Nuggets Vs Oklahoma City Thunder Box Score And Play By Play May 5 2025

May 06, 2025 -

Met Gala 2025 Live Coverage Best Dressed And Fashion Highlights

May 06, 2025

Met Gala 2025 Live Coverage Best Dressed And Fashion Highlights

May 06, 2025 -

Cubs Host Giants For Opening 3 Game Series Key Matchup Preview

May 06, 2025

Cubs Host Giants For Opening 3 Game Series Key Matchup Preview

May 06, 2025 -

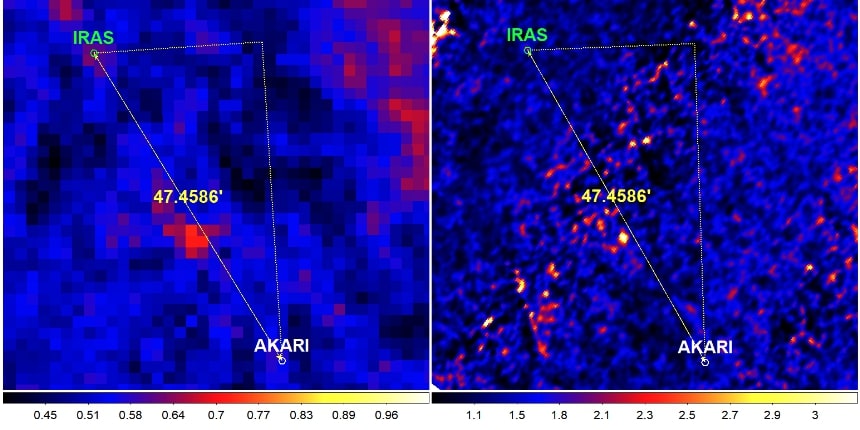

Planet Nine Candidate Identified Re Analysis Of Iras And Akari Infrared Data

May 06, 2025

Planet Nine Candidate Identified Re Analysis Of Iras And Akari Infrared Data

May 06, 2025