In-Line Earnings, Upbeat Guidance Fail To Boost Palantir Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

In-Line Earnings, Upbeat Guidance Fail to Boost Palantir Shares: What Went Wrong?

Palantir Technologies (PLTR) reported second-quarter earnings that met analysts' expectations, and even offered upbeat guidance for the third quarter. Yet, despite this seemingly positive news, the company's stock price took a dive. This unexpected market reaction leaves investors questioning the future trajectory of the data analytics giant. What factors contributed to this disappointing performance, and what does it mean for Palantir's long-term prospects?

Strong Financials, Weak Market Sentiment:

Palantir exceeded expectations in several key areas. Revenue for the second quarter reached $533 million, aligning with Wall Street projections. The company also offered optimistic guidance, projecting $555 million to $560 million in revenue for the third quarter, exceeding analyst consensus. This positive financial performance, however, failed to inspire confidence in the market.

Why the Disappointment? Several factors may have contributed:

-

High Valuation Concerns: Palantir continues to trade at a premium valuation compared to its peers. Despite strong growth, some investors remain hesitant given the relatively high price-to-sales ratio. The market may be pricing in slower future growth than the company's guidance suggests.

-

Government Contracts Dependence: A significant portion of Palantir's revenue stems from government contracts. While these contracts provide stability, investors are increasingly concerned about the potential for reduced government spending or delays in contract renewals. This reliance on a single sector exposes Palantir to increased risk.

-

Competition in the Data Analytics Market: The data analytics market is highly competitive, with established players like Microsoft and Google constantly innovating and expanding their offerings. Investors may be questioning Palantir's ability to maintain its competitive edge and sustain its impressive growth rates in the long term.

-

Overall Market Volatility: The broader market conditions also played a role. Recent economic uncertainty and concerns about inflation have impacted investor sentiment across various sectors, making it difficult for even well-performing companies like Palantir to attract significant investment.

Looking Ahead: What's Next for Palantir?

Despite the disappointing market reaction, Palantir's fundamental business remains strong. The company continues to innovate and expand its customer base, both in the commercial and government sectors. The upbeat guidance suggests a confident outlook for the remainder of the year. However, investors will be watching closely to see if Palantir can address the concerns surrounding its valuation, diversification, and competitive landscape.

Key Takeaways:

- Palantir's Q2 earnings met expectations, and Q3 guidance was positive.

- Despite positive financials, the stock price declined, suggesting market skepticism.

- Concerns about valuation, government contract dependence, competition, and broader market volatility likely contributed to the negative reaction.

- Palantir's long-term success hinges on addressing these concerns and demonstrating continued innovation and growth.

The recent market reaction highlights the complex interplay between financial performance, investor sentiment, and broader market conditions. While Palantir's strong financial results are encouraging, the company needs to effectively communicate its long-term growth strategy and address investor concerns to regain market confidence and drive sustainable stock price appreciation. The coming quarters will be crucial in determining whether Palantir can overcome these challenges and solidify its position as a leader in the data analytics market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on In-Line Earnings, Upbeat Guidance Fail To Boost Palantir Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

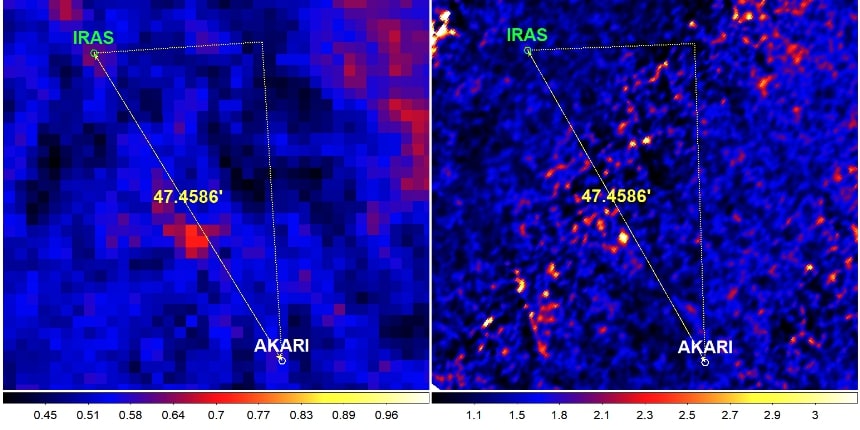

Planet Nine Candidate Emerges New Insights From Iras And Akari Infrared Surveys

May 06, 2025

Planet Nine Candidate Emerges New Insights From Iras And Akari Infrared Surveys

May 06, 2025 -

Soviet Satellites Uncontrolled Descent Potential Earth Impact Next Week

May 06, 2025

Soviet Satellites Uncontrolled Descent Potential Earth Impact Next Week

May 06, 2025 -

5 9 Magnitude Earthquake And Aftershocks Rock Taiwan Residents Report Shaking

May 06, 2025

5 9 Magnitude Earthquake And Aftershocks Rock Taiwan Residents Report Shaking

May 06, 2025 -

Nba Playoffs Jokic Focused On Thunder Not Mvp Trophy

May 06, 2025

Nba Playoffs Jokic Focused On Thunder Not Mvp Trophy

May 06, 2025 -

End Of Mission Russian Spacecraft To Crash Land This Week

May 06, 2025

End Of Mission Russian Spacecraft To Crash Land This Week

May 06, 2025

Latest Posts

-

Behind The Kerfuffle Why This Muppet Is Targeting Pbs

May 06, 2025

Behind The Kerfuffle Why This Muppet Is Targeting Pbs

May 06, 2025 -

Confirmed Ukrainian Drone Takes Down Russian Su 30 In Black Sea

May 06, 2025

Confirmed Ukrainian Drone Takes Down Russian Su 30 In Black Sea

May 06, 2025 -

Thunderbolts Marvel Studios Changes Films Title Days Before Release

May 06, 2025

Thunderbolts Marvel Studios Changes Films Title Days Before Release

May 06, 2025 -

Multiple Earthquakes Hit Taiwan Peak Magnitude Reaches 5 9 Assessing The Damage

May 06, 2025

Multiple Earthquakes Hit Taiwan Peak Magnitude Reaches 5 9 Assessing The Damage

May 06, 2025 -

Jalen Williams Gifts Nick Gallo E T Shirt A Sweet Okc Thunder Gesture

May 06, 2025

Jalen Williams Gifts Nick Gallo E T Shirt A Sweet Okc Thunder Gesture

May 06, 2025