Increased Demand From Europe And China, Lower US Output, Boost Oil Prices By 3%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Prices Surge 3% Amidst Soaring European and Chinese Demand and US Production Slowdown

Global oil prices experienced a significant 3% jump today, driven by a confluence of factors pointing towards a tightening supply market. Increased demand from Europe and China, coupled with a slowdown in US oil production, has sent a clear signal to investors: the days of cheap crude may be over. This surge marks a significant shift in the energy market landscape and has implications for consumers and businesses worldwide.

European Energy Crisis Fuels Demand: The ongoing energy crisis in Europe, exacerbated by the Russia-Ukraine conflict and reduced Russian gas supplies, has forced a substantial shift towards oil-based energy sources. Countries are scrambling to secure alternative energy supplies, leading to a dramatic increase in oil imports. This increased demand from Europe is a major contributor to the price hike. Analysts predict this trend will continue throughout the winter months, potentially pushing prices even higher.

China's Reopening and Economic Growth: China's reopening after strict COVID-19 lockdowns has reignited its massive economy, leading to a surge in oil consumption. Increased industrial activity and transportation needs are driving a significant increase in oil demand from the world's second-largest economy. This heightened demand further exacerbates the global supply-demand imbalance.

US Production Lags Behind: While the US remains a significant oil producer, output has recently plateaued and even declined slightly. Several factors contribute to this slowdown, including difficulties in securing permits for new drilling projects, labor shortages, and reduced investment in the sector. This lower-than-expected US production further restricts the global supply, contributing directly to the price increase.

Implications for Consumers and Businesses: The 3% surge in oil prices will likely translate into higher prices at the pump for consumers. Businesses, particularly those reliant on transportation, will also feel the pinch, with potential increases in operating costs and the possibility of higher prices for goods and services. This ripple effect underscores the interconnectedness of the global energy market and its profound impact on the global economy.

Looking Ahead: Uncertainty Remains: While the current price surge is significant, predicting future trends remains challenging. Geopolitical instability, further shifts in global demand, and potential changes in US production levels all contribute to the uncertainty. However, the current confluence of factors strongly suggests that oil prices are likely to remain elevated in the near term. Investors and consumers should brace for continued volatility in the energy market.

Key Takeaways:

- Increased European demand: Driven by the energy crisis and reduced Russian gas.

- Booming Chinese demand: Resulting from economic reopening and increased activity.

- US production slowdown: Due to permitting issues, labor shortages, and reduced investment.

- Higher prices at the pump: Consumers will likely see increased fuel costs.

- Impact on businesses: Increased operating costs and potential price hikes for goods and services.

This situation highlights the complex interplay of global events and their impact on the energy sector. Monitoring these trends closely is crucial for both businesses and individuals navigating this volatile market. The coming months will be critical in determining the long-term trajectory of oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Increased Demand From Europe And China, Lower US Output, Boost Oil Prices By 3%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

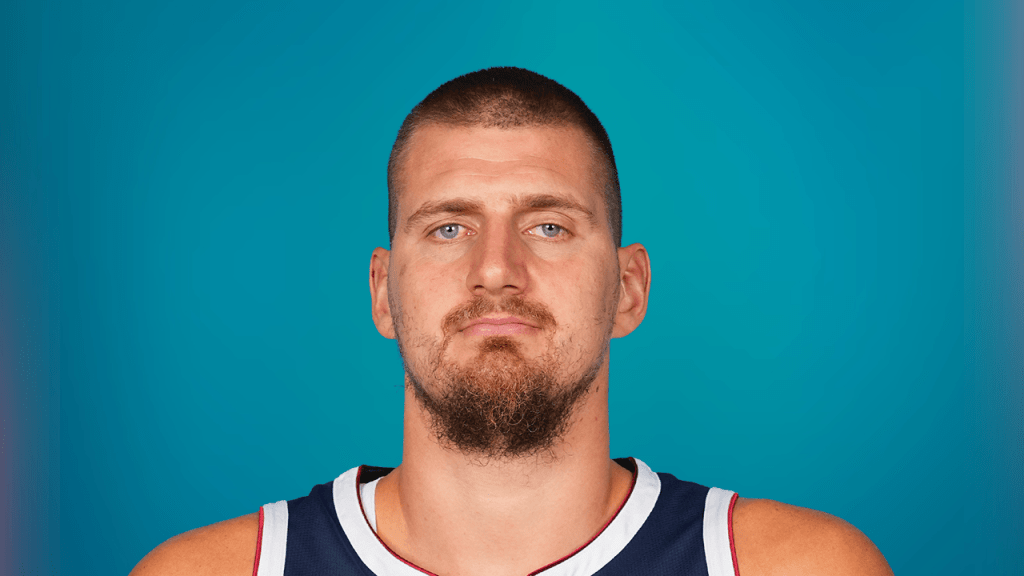

Free Throw Merchant Jokics Amusing Response To Fan Taunts

May 08, 2025

Free Throw Merchant Jokics Amusing Response To Fan Taunts

May 08, 2025 -

Kano Pillars Musa Confirmed For Super Eagles Unity Cup Tournament

May 08, 2025

Kano Pillars Musa Confirmed For Super Eagles Unity Cup Tournament

May 08, 2025 -

Kris Bryants Back Procedure Impact On Rockies Season

May 08, 2025

Kris Bryants Back Procedure Impact On Rockies Season

May 08, 2025 -

Todays Match Nssr Vs Itt Dream11 Prediction Fantasy Football Tips And Captain Picks

May 08, 2025

Todays Match Nssr Vs Itt Dream11 Prediction Fantasy Football Tips And Captain Picks

May 08, 2025 -

Broken Brains A Literary Exploration Of Mental Illness

May 08, 2025

Broken Brains A Literary Exploration Of Mental Illness

May 08, 2025

Latest Posts

-

The Josh Hartnett Renaissance A New Era Of Risky Roles

May 08, 2025

The Josh Hartnett Renaissance A New Era Of Risky Roles

May 08, 2025 -

Hyeseong Kim On Getting On Base Analysis Of 10 1 Win

May 08, 2025

Hyeseong Kim On Getting On Base Analysis Of 10 1 Win

May 08, 2025 -

Unexpected Boost 200 Summer Cost Of Living Payment Arrives Early

May 08, 2025

Unexpected Boost 200 Summer Cost Of Living Payment Arrives Early

May 08, 2025 -

Uk Summer Cost Of Living Payments Early Release Date Announced

May 08, 2025

Uk Summer Cost Of Living Payments Early Release Date Announced

May 08, 2025 -

Impressive Trading Figures Ragnarok Online Web3 Spin Off Exceeds 1 M Ron

May 08, 2025

Impressive Trading Figures Ragnarok Online Web3 Spin Off Exceeds 1 M Ron

May 08, 2025