Increased Loan Defaults Drive Significant Losses At Klarna

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Increased Loan Defaults Drive Significant Losses at Klarna

Buy Now, Pay Later giant Klarna reports staggering losses, fueled by a surge in loan defaults. The Swedish fintech company, a darling of the pandemic-era boom in online shopping, is facing a harsh reality as rising inflation and a cost-of-living crisis push consumers into financial hardship. Klarna's latest financial report reveals significantly increased losses, directly attributed to a sharp rise in customers failing to repay their loans. This development sends shockwaves through the Buy Now, Pay Later (BNPL) sector, raising questions about the long-term sustainability of this rapidly expanding industry.

A Perfect Storm of Economic Headwinds

Klarna's struggles are not isolated incidents. The company, a major player in the BNPL market, is feeling the pressure of a perfect storm of economic factors. Soaring inflation, increased interest rates, and a general tightening of credit markets have all contributed to a significant increase in consumer debt defaults across the board. This trend is particularly pronounced in the BNPL sector, where many customers utilize these services to purchase non-essential items.

The company's recent financial report highlighted a substantial increase in loan defaults compared to the previous year. While specific figures remain undisclosed pending full report release, analysts suggest the increase is substantial enough to significantly impact Klarna's bottom line and overall financial health. This comes after a period of aggressive expansion and marketing, fueled by substantial investments.

Klarna's Response and Future Outlook

Klarna has acknowledged the challenges and is reportedly implementing several strategies to mitigate further losses. These include:

- Strengthening credit scoring and risk assessment models: A more rigorous approach to loan approvals is expected to reduce the number of high-risk borrowers.

- Increasing collection efforts: The company is investing in more effective methods to recover outstanding payments from defaulting customers.

- Focusing on profitability over growth: The emphasis is shifting from rapid expansion to sustainable profitability, implying a potential slowdown in marketing and new customer acquisition.

- Diversification of revenue streams: Klarna is exploring additional revenue streams beyond its core BNPL offering to reduce dependence on a single revenue source.

However, the long-term effects of these changes remain uncertain. The BNPL sector, as a whole, is facing increased scrutiny from regulators, concerned about potential risks to consumers and the wider financial system. Klarna's experience serves as a stark warning to other BNPL providers about the vulnerabilities inherent in their business model during periods of economic uncertainty.

Implications for the BNPL Industry

Klarna's struggles have significant implications for the entire Buy Now, Pay Later industry. It highlights the inherent risks associated with this type of lending, especially during times of economic instability. Investors are likely to become more cautious about investing in BNPL companies, demanding stricter financial controls and more sustainable business models. Regulators are also likely to increase their oversight of the sector to protect consumers and maintain financial stability.

The future of the BNPL industry will depend on its ability to adapt to changing economic conditions and implement more responsible lending practices. Companies that fail to do so may face a similar fate to Klarna, highlighting the need for a more sustainable and responsible approach to lending in the digital age. The coming months will be crucial in determining whether the BNPL sector can weather the storm or if further consolidation and restructuring are inevitable.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Increased Loan Defaults Drive Significant Losses At Klarna. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Watch Josh Gad And Andrew Rannells Spin The Wheel Exclusive Celebrity Wheel Of Fortune Video

May 21, 2025

Watch Josh Gad And Andrew Rannells Spin The Wheel Exclusive Celebrity Wheel Of Fortune Video

May 21, 2025 -

From Megawatts To Gigawatts Space X Starships Impact On Space Solar Energy Development

May 21, 2025

From Megawatts To Gigawatts Space X Starships Impact On Space Solar Energy Development

May 21, 2025 -

Hurricanes Vs Capitals Aho Highlights Decisive Advantage

May 21, 2025

Hurricanes Vs Capitals Aho Highlights Decisive Advantage

May 21, 2025 -

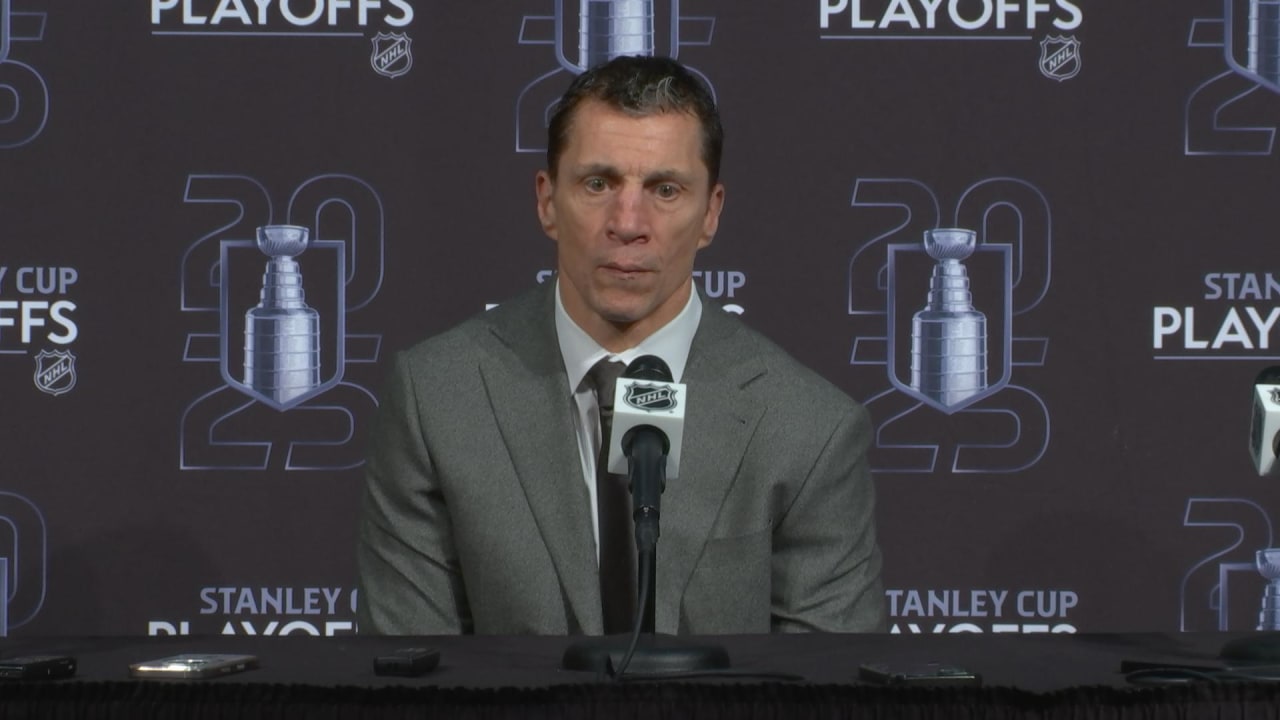

Rod Brind Amour Postgame Interview Insights And Takeaways From Recent Game

May 21, 2025

Rod Brind Amour Postgame Interview Insights And Takeaways From Recent Game

May 21, 2025 -

A Comprehensive Guide To The Nordic Drama Series Secrets We Keep

May 21, 2025

A Comprehensive Guide To The Nordic Drama Series Secrets We Keep

May 21, 2025