Increased Tariffs: A Threat To Netflix's Share Price?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Increased Tariffs: A Threat to Netflix's Share Price?

The streaming giant, Netflix, faces a potential storm brewing on the horizon – increased tariffs. While seemingly unrelated to the entertainment industry, rising import duties on goods and services could significantly impact Netflix's bottom line and, consequently, its share price. This isn't a hypothetical threat; the ripple effects of global trade policies are already being felt across various sectors, and the streaming industry is far from immune.

How Tariffs Impact Netflix Indirectly

Netflix's primary costs aren't directly tied to imported goods like physical media. However, the impact is indirect but substantial:

-

Increased Production Costs: Many of Netflix's original productions rely on international collaborations. Increased tariffs on imported equipment, technology, and even post-production services (like sound mixing and special effects done overseas) directly inflate the budget for these shows. This, in turn, reduces profitability per production.

-

Higher Infrastructure Costs: Maintaining Netflix's global infrastructure, including servers and network equipment, often involves importing components. Tariffs on these components translate to higher operational costs, squeezing profit margins.

-

Content Acquisition Costs: Licensing agreements for international shows and films are often subject to fluctuating currency exchange rates, further complicated by tariff-induced economic instability. This can lead to unexpected increases in content acquisition costs, impacting Netflix's ability to offer diverse and competitive programming.

The Ripple Effect: Inflation and Consumer Spending

Increased tariffs contribute to broader inflation. As prices for various goods and services rise, consumers may reassess their discretionary spending. Streaming services, including Netflix, often fall under this category. When household budgets are strained, subscriptions might be among the first casualties, leading to a potential decline in subscriber numbers. This decreased subscriber base directly impacts Netflix's revenue and, ultimately, its share price.

Netflix's Strategies for Mitigation

Netflix isn't a passive player. They are likely employing several strategies to mitigate the effects of increased tariffs:

-

Diversification of Production: Shifting some production to countries with lower tariffs or negotiating favorable trade agreements could help reduce costs.

-

Cost-Cutting Measures: Internal cost-cutting measures, including streamlining operations and potentially reducing marketing spend, are likely under consideration.

-

Price Increases: While unpopular, a price increase might be a necessary response to offset rising costs, but this carries the risk of further subscriber churn.

The Future Outlook: Uncertainty Remains

The impact of increased tariffs on Netflix's share price remains uncertain. Several factors will determine the final outcome, including:

-

The magnitude and duration of tariff increases: A small, short-term increase might be easily absorbed, while a large, sustained increase could prove devastating.

-

Netflix's ability to pass on costs to consumers: The elasticity of demand for Netflix's service will play a crucial role.

-

Global economic conditions: A strong global economy might offset some of the negative impacts, while a recession would likely exacerbate them.

Conclusion:

While not a direct threat, increased tariffs represent a significant risk factor for Netflix's share price. The company's strategic responses and the broader economic climate will ultimately dictate the severity of the impact. Investors should carefully monitor both Netflix's financial performance and global trade developments for clues to future performance. The uncertainty surrounding this issue makes it crucial for investors to maintain a close watch on the evolving situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Increased Tariffs: A Threat To Netflix's Share Price?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Risk Off Sentiment Grips Asia Pacific Hong Kong Stocks Bear The Brunt Of Trade War Concerns

Apr 07, 2025

Risk Off Sentiment Grips Asia Pacific Hong Kong Stocks Bear The Brunt Of Trade War Concerns

Apr 07, 2025 -

Menakar Kinerja Sufmi Dasco Ahmad Sebagai Ketua Badan Legislasi Dpr

Apr 07, 2025

Menakar Kinerja Sufmi Dasco Ahmad Sebagai Ketua Badan Legislasi Dpr

Apr 07, 2025 -

100 Mbarat Ljafy Me Brshlwnt Njah Bahr Wtalq Mstmr

Apr 07, 2025

100 Mbarat Ljafy Me Brshlwnt Njah Bahr Wtalq Mstmr

Apr 07, 2025 -

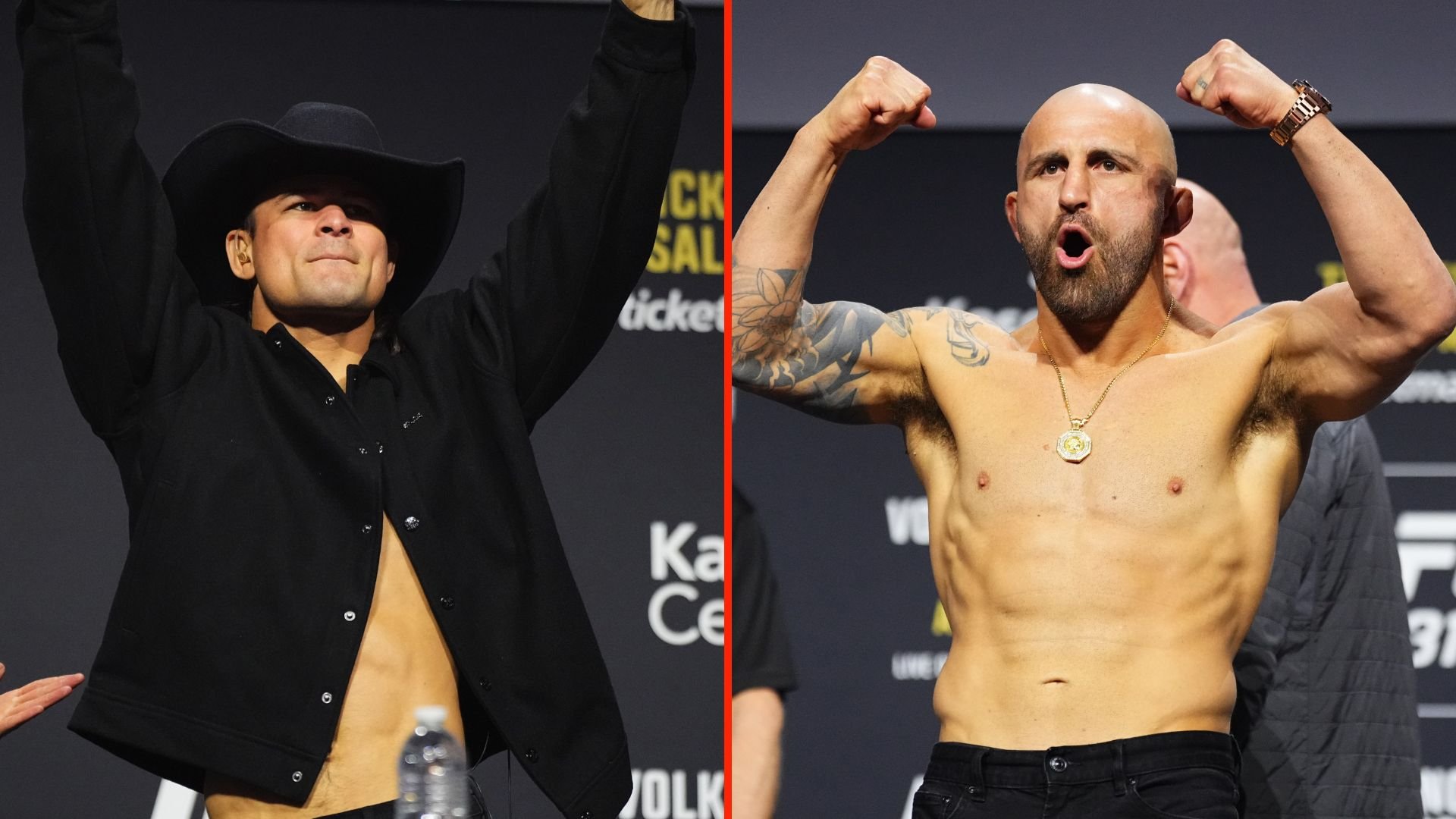

Alexander Volkanovski And Diego Lopes Identical Plans For First Ufc Defense

Apr 07, 2025

Alexander Volkanovski And Diego Lopes Identical Plans For First Ufc Defense

Apr 07, 2025 -

Singapore Ge 2025 Peoples Power Party Targets Ang Mo Kio Grc

Apr 07, 2025

Singapore Ge 2025 Peoples Power Party Targets Ang Mo Kio Grc

Apr 07, 2025