India Gold Prices Today: Retreat Continues After Record Highs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

India Gold Prices Today: Retreat Continues After Record Highs

India's gold market experienced a continued price decline today, following a recent surge to record highs. This retreat offers a potential buying opportunity for investors, but analysts caution against impulsive decisions. Understanding the factors driving this price fluctuation is crucial for navigating the market effectively.

The precious metal's price has been on a rollercoaster ride in recent weeks. After hitting unprecedented peaks, driven by a confluence of global factors, gold prices in India are now showing signs of correction. This fluctuation impacts not only investors but also the wider Indian economy, given the significant role gold plays in the country's cultural and financial landscape.

Factors Contributing to the Price Drop

Several factors contribute to the current decline in India's gold prices:

-

Strengthening US Dollar: The US dollar's recent strengthening against other major currencies, including the Indian Rupee, has exerted downward pressure on gold prices. Gold, typically priced in USD, becomes more expensive for buyers using other currencies when the dollar appreciates.

-

Easing Inflation Concerns: While inflation remains a concern globally, recent economic data suggests a potential easing in inflationary pressures. This reduces the safe-haven demand for gold, which often rises during periods of high inflation.

-

Increased Interest Rates: Central banks globally are continuing to grapple with inflation by raising interest rates. Higher interest rates typically make non-interest-bearing assets like gold less attractive compared to interest-bearing investments.

-

Profit-booking by Investors: After the recent surge to record highs, many investors are taking profits, leading to increased selling pressure and contributing to the price correction.

What This Means for Indian Investors

The current price drop presents a potential opportunity for investors looking to buy gold at a more favorable price. However, caution is advised. It's crucial to consider long-term investment strategies and avoid making impulsive decisions based on short-term market fluctuations. Consult with a financial advisor before making any investment decisions.

For those already invested in gold, the price dip may not necessarily require immediate action. Holding onto gold investments during periods of market volatility is a common strategy, especially given its long-term value retention.

Looking Ahead: Predicting Future Gold Prices in India

Predicting future gold prices is inherently challenging, given the interplay of numerous global and local factors. However, analysts suggest several factors to watch:

- Geopolitical events: Global political instability and uncertainty can significantly impact gold prices, boosting demand as a safe-haven asset.

- US Federal Reserve policy: The Federal Reserve's monetary policy decisions will continue to have a significant influence on the US dollar and subsequently, gold prices.

- Indian Rupee performance: The strength or weakness of the Indian Rupee against the US dollar will directly affect the price of gold in India.

- Domestic demand: Festival seasons and wedding demand within India can significantly affect domestic gold prices.

In conclusion, the recent retreat in India's gold prices offers a nuanced situation for investors. While the price drop might represent a buying opportunity for some, careful analysis and consideration of long-term investment strategies are crucial. Staying informed about global economic indicators and market trends is essential for navigating this dynamic market effectively. Remember to consult with a financial professional for personalized advice tailored to your specific financial situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on India Gold Prices Today: Retreat Continues After Record Highs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

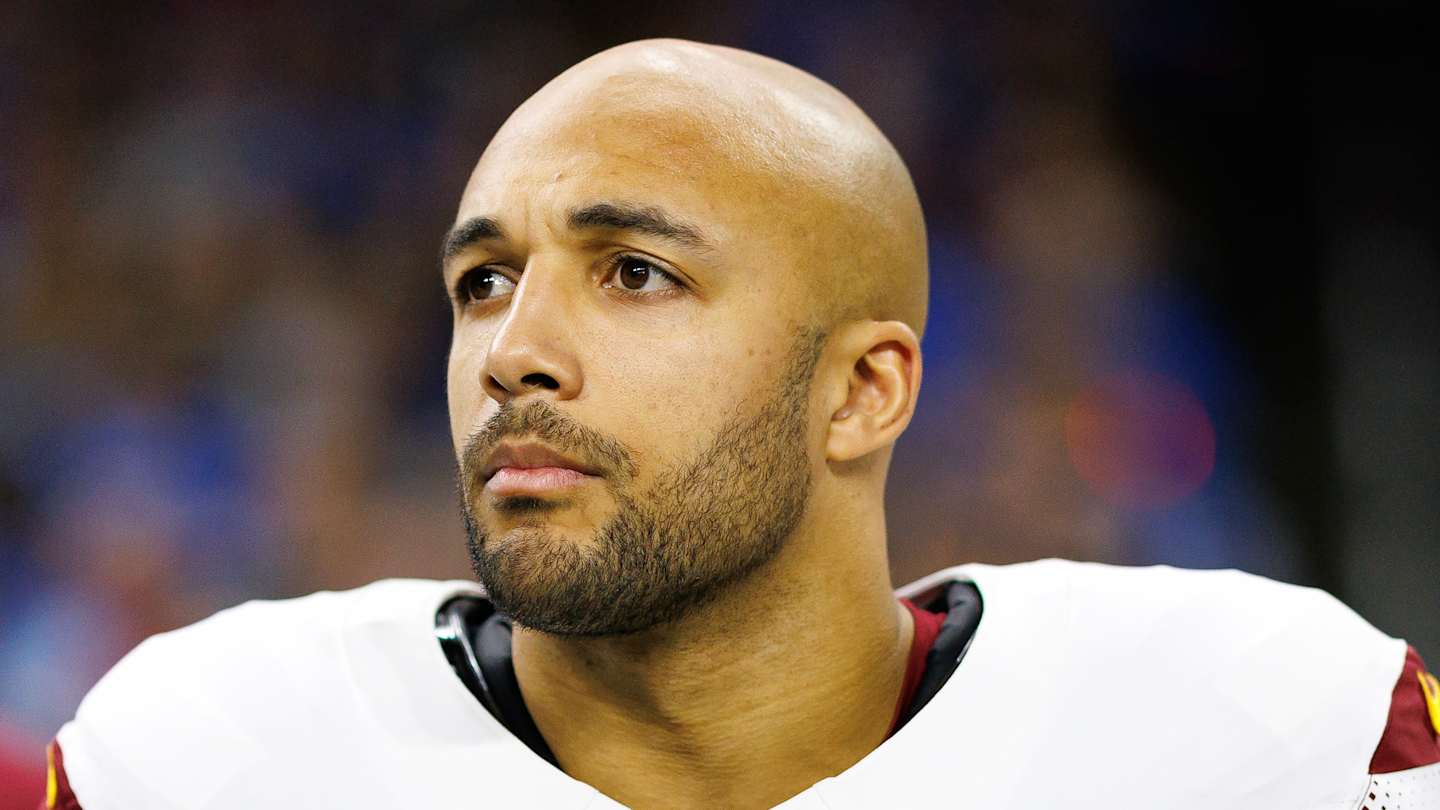

Seven Washington Commanders Likely To Retire After This Season

Apr 08, 2025

Seven Washington Commanders Likely To Retire After This Season

Apr 08, 2025 -

Mcg Security Incident Fans Face Long Queues After Thursday Nights Events

Apr 08, 2025

Mcg Security Incident Fans Face Long Queues After Thursday Nights Events

Apr 08, 2025 -

Analyzing Space X Starships Potential For Global Cargo And Fuel Market Disruption

Apr 08, 2025

Analyzing Space X Starships Potential For Global Cargo And Fuel Market Disruption

Apr 08, 2025 -

Beaten Down Tech Stocks Q2 Investment Opportunities For Analysts

Apr 08, 2025

Beaten Down Tech Stocks Q2 Investment Opportunities For Analysts

Apr 08, 2025 -

Fenomena Jumbo Film Animasi Indonesia Pecahkan Rekor 1 Juta Penonton Dalam Seminggu

Apr 08, 2025

Fenomena Jumbo Film Animasi Indonesia Pecahkan Rekor 1 Juta Penonton Dalam Seminggu

Apr 08, 2025