Indian Market Crash Today: Sensex And Nifty Fall Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

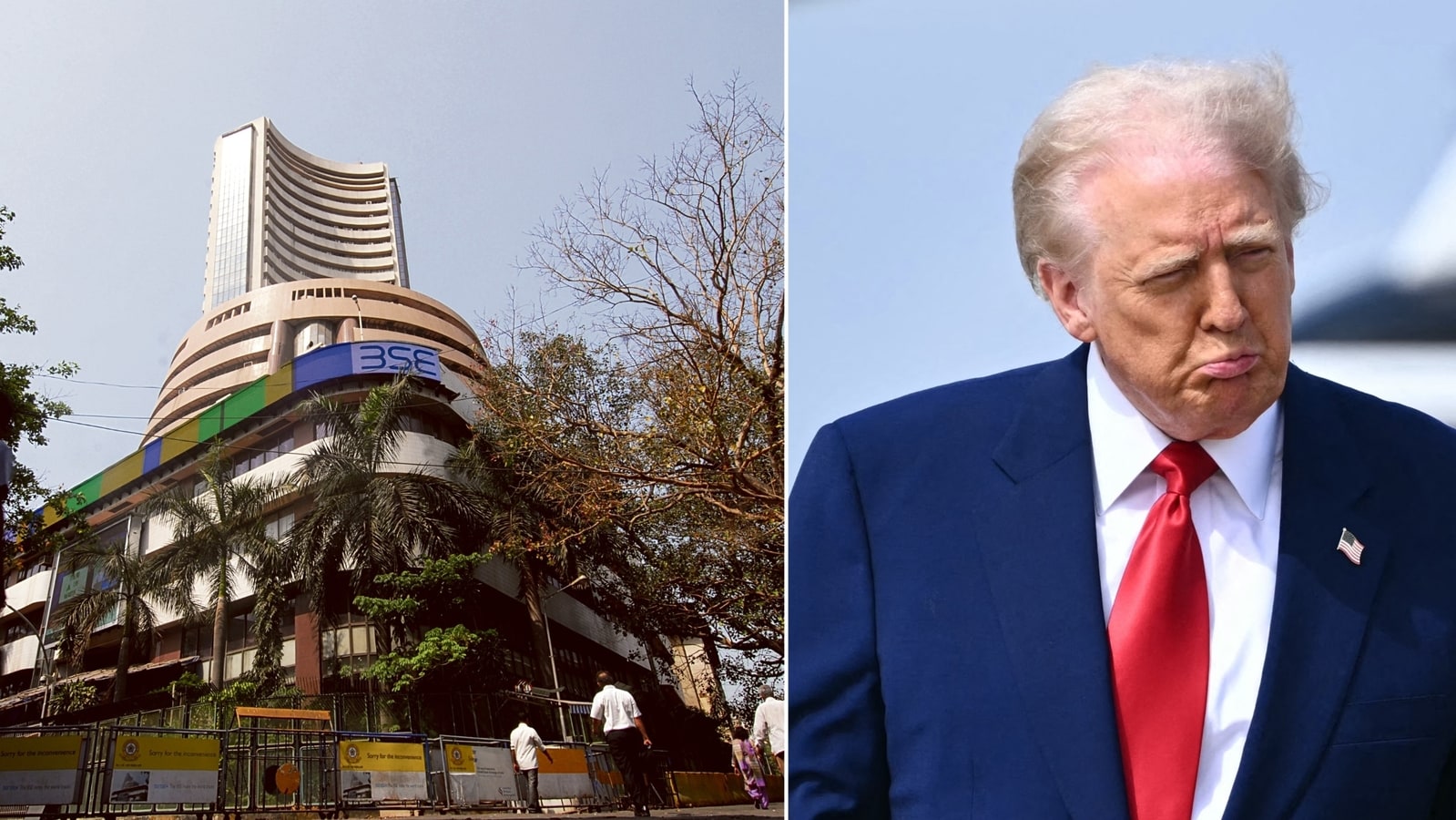

Indian Market Crash Today: Sensex and Nifty Fall Explained

A Sudden Plunge: Understanding the Market Volatility

India's stock markets experienced a significant downturn today, leaving investors reeling and prompting urgent questions about the cause of the sudden crash. Both the Sensex and Nifty, key indicators of the Indian stock market's performance, saw substantial falls, triggering concerns about the overall economic health and future market trends. This article delves into the reasons behind this volatility, examining the contributing factors and exploring potential implications.

Sensex and Nifty in Freefall: Key Figures and Impacts

The Sensex, representing the 30 largest and most actively traded stocks on the Bombay Stock Exchange (BSE), plummeted by [Insert Percentage]% today, closing at [Insert Closing Value]. Similarly, the Nifty 50 index, tracking the 50 largest companies listed on the National Stock Exchange of India (NSE), experienced a sharp decline of [Insert Percentage]%, ending the day at [Insert Closing Value]. This dramatic fall wiped out billions of rupees in investor wealth, sending shockwaves through the financial sector.

Unpacking the Causes: Multiple Factors at Play

While pinpointing a single cause for such a significant market drop is difficult, several factors likely contributed to today's crash:

-

Global Economic Uncertainty: The ongoing global economic slowdown, fueled by high inflation, rising interest rates, and geopolitical tensions (particularly the war in Ukraine), significantly impacts investor sentiment. Concerns about a potential global recession are weighing heavily on emerging markets like India.

-

Foreign Institutional Investor (FII) Outflows: FIIs have been net sellers in the Indian market for several months, withdrawing significant investments. This outflow of foreign capital puts downward pressure on stock prices. Today's crash might be amplified by a renewed wave of FII selling.

-

Rupee Depreciation: The weakening Indian Rupee against the US dollar adds to the woes. A weaker rupee makes Indian assets less attractive to foreign investors and can further exacerbate FII outflows.

-

Inflationary Pressures: Persistent inflation in India, despite recent rate hikes by the Reserve Bank of India (RBI), continues to erode purchasing power and dampen investor confidence. Concerns about future inflation impacting corporate earnings likely contributed to the sell-off.

-

Sector-Specific Concerns: Negative news or performance within specific sectors, such as [mention any specific sectors significantly affected], can also trigger widespread selling pressure.

Looking Ahead: What Does the Future Hold?

The market's reaction to today's crash will be crucial in determining the short-term and long-term outlook. While panic selling is a natural response to such volatility, experts advise against impulsive decisions. A thorough assessment of individual investment portfolios and risk tolerance is crucial.

Expert Opinions and Market Analysis:

[Include quotes from market analysts and experts offering their perspectives on the situation and potential future market movements. This section should include names and affiliations of the experts].

Navigating Volatility: Tips for Investors

- Stay informed: Keep abreast of market developments and economic news to make informed decisions.

- Diversify your portfolio: Spreading investments across different asset classes reduces overall risk.

- Avoid panic selling: Emotional reactions can lead to poor investment choices.

- Consult a financial advisor: Seek professional advice before making any significant investment changes.

The Indian stock market's dramatic fall today highlights the inherent risks associated with investing. Understanding the underlying factors and adopting a prudent approach are crucial for navigating market volatility and protecting your investments. The situation warrants close monitoring in the coming days and weeks. Further updates will be provided as the market evolves.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Indian Market Crash Today: Sensex And Nifty Fall Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Market Meltdown Dow Futures Collapse Exceeds 1000 Points Amidst Tariff Fears

Apr 07, 2025

Market Meltdown Dow Futures Collapse Exceeds 1000 Points Amidst Tariff Fears

Apr 07, 2025 -

Significant Losses For China Major Indices Down Over 7 Today

Apr 07, 2025

Significant Losses For China Major Indices Down Over 7 Today

Apr 07, 2025 -

Brasil Previsoes Economicas Semanais Copom Ipca E A Influencia Da China

Apr 07, 2025

Brasil Previsoes Economicas Semanais Copom Ipca E A Influencia Da China

Apr 07, 2025 -

Solve Nyt Connections Sports Puzzle April 6th 195 Solutions

Apr 07, 2025

Solve Nyt Connections Sports Puzzle April 6th 195 Solutions

Apr 07, 2025 -

Navigating Market Uncertainty My Top 2 Stock Picks

Apr 07, 2025

Navigating Market Uncertainty My Top 2 Stock Picks

Apr 07, 2025