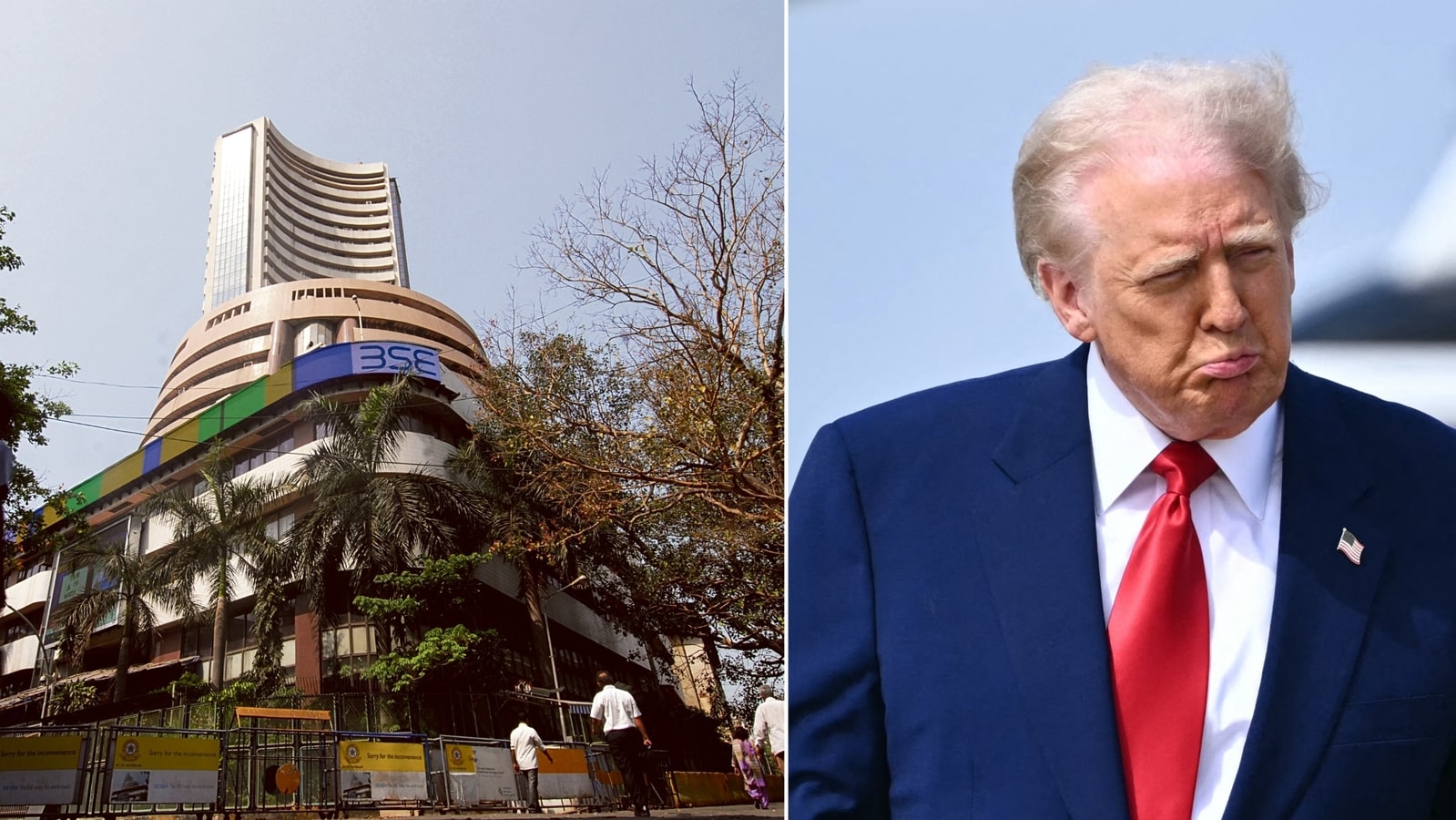

Indian Market Crash Today: Sensex, Nifty Fall Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Indian Market Crash Today: Sensex, Nifty Fall Explained

Indian stock markets experienced a significant downturn today, with the Sensex and Nifty indices plunging sharply. This unexpected fall has sent ripples through the financial world, leaving investors concerned and seeking answers. This article delves into the potential causes behind this market crash, examining the contributing factors and their impact on the Indian economy.

What Happened Today?

The Indian stock market witnessed a dramatic fall today, with the benchmark indices, Sensex and Nifty, experiencing substantial losses. The Sensex plummeted by [Insert Percentage]% to close at [Insert Closing Value], while the Nifty 50 index fell by [Insert Percentage]% to [Insert Closing Value]. This represents a significant decline and signifies a period of market volatility. This crash follows [mention recent market trends, e.g., a period of relative stability or recent gains].

Reasons Behind the Indian Market Crash:

Several factors likely contributed to today's sharp decline. It's crucial to understand that market crashes are often multifaceted, with no single cause solely responsible. Here are some key potential factors:

1. Global Economic Headwinds:

- Inflationary pressures: Persistent global inflation continues to impact investor sentiment. Rising interest rates globally, aimed at curbing inflation, can negatively affect economic growth and corporate earnings, leading to market corrections.

- Geopolitical uncertainties: Ongoing geopolitical tensions, such as the war in Ukraine, contribute to market uncertainty and risk aversion among investors. These uncertainties can trigger sudden sell-offs.

- Recession fears: Growing concerns about a potential global recession are fueling anxieties among investors. A recessionary environment typically leads to decreased corporate profitability and reduced investment.

2. Domestic Factors:

- Rising interest rates in India: The Reserve Bank of India (RBI)'s recent interest rate hikes, although aimed at controlling inflation, can also dampen economic activity and impact corporate earnings. Higher borrowing costs can affect business investment and consumer spending.

- Rupee depreciation: A weakening Indian Rupee against the US dollar can impact import costs and potentially fuel inflation, further pressuring the market.

- Specific sector performance: Poor performance of specific sectors, such as [mention specific sectors if applicable, e.g., IT or real estate], can negatively influence the overall market sentiment.

3. Investor Sentiment and Market Psychology:

- Profit-booking: Some investors might have engaged in profit-booking, selling their holdings to secure profits after a period of market gains. This selling pressure can contribute to a downward spiral.

- Panic selling: Fear and uncertainty can lead to panic selling, exacerbating the market decline as investors rush to exit their positions.

What Does This Mean for Investors?

Today's market crash underscores the inherent risks associated with stock market investments. While short-term volatility is common, investors should adopt a long-term perspective and make informed decisions based on thorough research and risk assessment. Diversification of portfolios is crucial to mitigate risks.

Looking Ahead:

The immediate future of the Indian stock market remains uncertain. While a rebound is possible, further volatility is anticipated. Investors should closely monitor global and domestic economic indicators, as well as company-specific news, to make informed decisions. Seeking advice from a qualified financial advisor is recommended, particularly during times of market uncertainty. The RBI's actions and government policies will play a significant role in shaping the market's trajectory in the coming weeks and months. Continued monitoring of Sensex and Nifty performance is essential for staying informed.

Keywords: Indian Market Crash, Sensex, Nifty, Stock Market Fall, Indian Economy, Global Economic Headwinds, Inflation, Geopolitical Uncertainty, Recession, RBI, Interest Rates, Rupee Depreciation, Investor Sentiment, Market Volatility, Profit Booking, Panic Selling.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Indian Market Crash Today: Sensex, Nifty Fall Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Public Outrage Explodes Millions Protest Trump And Musks Actions

Apr 08, 2025

Public Outrage Explodes Millions Protest Trump And Musks Actions

Apr 08, 2025 -

Bitcoin Market Caution Understanding The Limitations Of This Popular Metric

Apr 08, 2025

Bitcoin Market Caution Understanding The Limitations Of This Popular Metric

Apr 08, 2025 -

Malmoependeln Brak Malmoe Och Region Skane I Konflikt

Apr 08, 2025

Malmoependeln Brak Malmoe Och Region Skane I Konflikt

Apr 08, 2025 -

School Bus Cancellations Announced For North Zone Schools

Apr 08, 2025

School Bus Cancellations Announced For North Zone Schools

Apr 08, 2025 -

Monte Carlo Masters Martinez Portero Advances To Second Round

Apr 08, 2025

Monte Carlo Masters Martinez Portero Advances To Second Round

Apr 08, 2025