Indian Stock Market Downturn: Analyzing The Causes Of The Sensex And Nifty Drop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

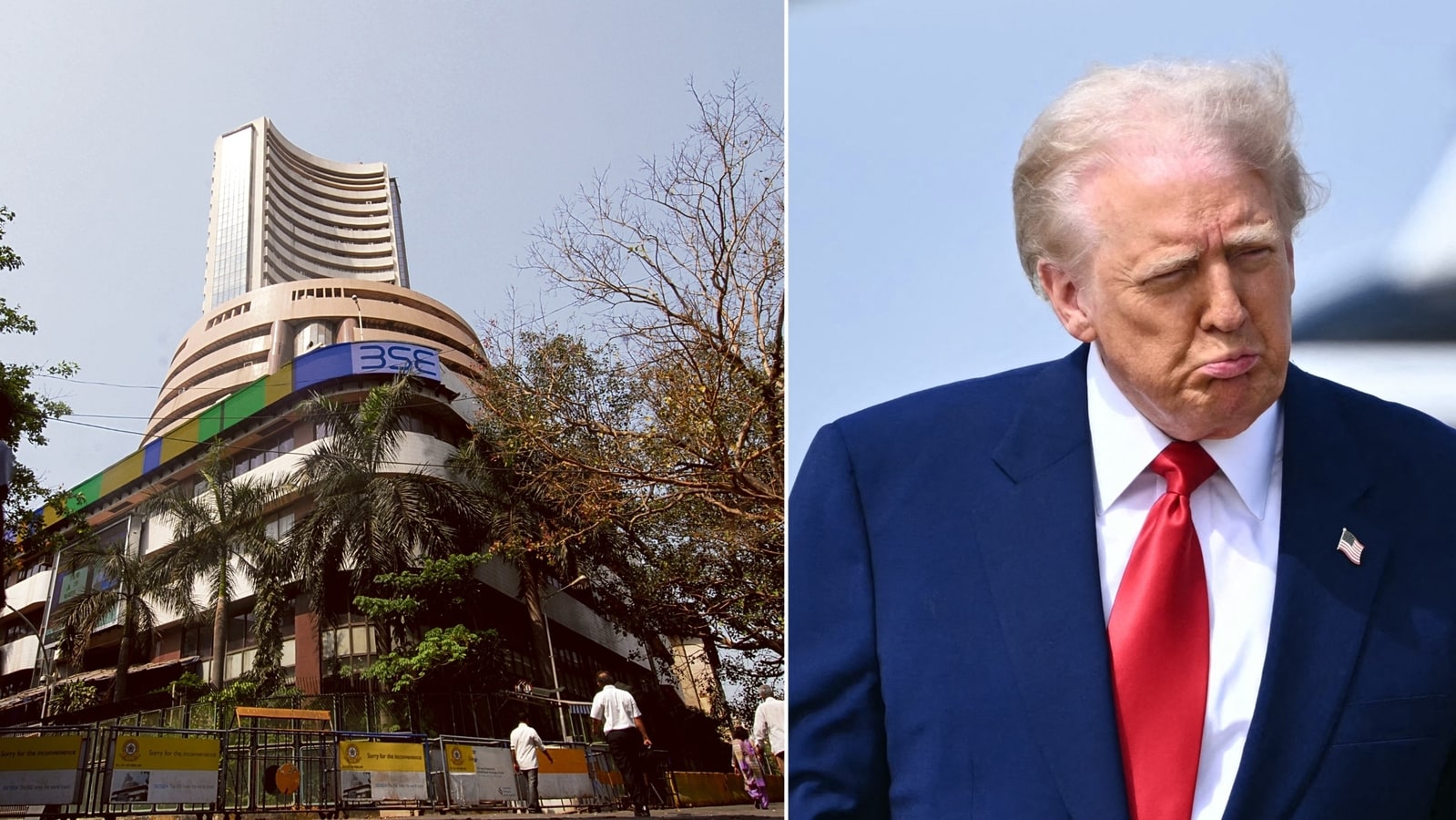

Indian Stock Market Downturn: Analyzing the Causes of the Sensex and Nifty Drop

India's stock market experienced a significant downturn recently, with the Sensex and Nifty indices experiencing considerable drops. This article delves into the key factors contributing to this market volatility, offering insights for investors and market watchers.

The recent decline in the Indian stock market, reflected in the substantial fall of the Sensex and Nifty, has sent ripples through the financial landscape. While market fluctuations are inherent, the scale of this downturn warrants a closer examination of its underlying causes. Understanding these factors is crucial for investors to navigate the current climate and make informed decisions.

H2: Global Headwinds: A Major Contributing Factor

The global economic environment plays a significant role in influencing Indian markets. Several global headwinds have contributed to the recent slump:

-

Rising Interest Rates: Aggressive interest rate hikes by major central banks worldwide, including the US Federal Reserve, to combat inflation have impacted global liquidity. This tightening of monetary policy often leads to capital outflows from emerging markets like India, putting downward pressure on stock prices.

-

Geopolitical Uncertainty: The ongoing war in Ukraine, coupled with escalating geopolitical tensions in other regions, continues to create uncertainty in the global economy. This uncertainty discourages investment and fuels market volatility.

-

Inflationary Pressures: Persistent high inflation globally impacts consumer spending and corporate profits, negatively affecting market sentiment and leading to stock price corrections.

H2: Domestic Concerns Adding to the Pressure

While global factors play a significant role, several domestic issues have also contributed to the Sensex and Nifty drop:

-

Rupee Depreciation: The weakening of the Indian Rupee against the US dollar increases the cost of imports and reduces the purchasing power of Indian consumers. This can negatively impact corporate earnings and investor confidence.

-

Foreign Institutional Investor (FII) Outflows: FIIs have been net sellers in the Indian stock market recently, further exacerbating the downward pressure on indices like the Sensex and Nifty. These outflows often reflect concerns about global economic conditions and their potential impact on India.

-

High Crude Oil Prices: India is a significant importer of crude oil. Persistently high crude oil prices increase the country's current account deficit and inflationary pressures, impacting overall economic growth and market sentiment.

H3: Sector-Specific Weakness

The downturn isn't uniform across all sectors. Certain sectors have been disproportionately affected, including:

-

Information Technology (IT): The IT sector, a major contributor to the Indian stock market, has faced headwinds due to slowing global tech spending and concerns about a potential recession in major markets.

-

Real Estate: Rising interest rates have impacted the real estate sector, making borrowing more expensive and potentially slowing down growth.

H2: Looking Ahead: Navigating the Volatility

The current market downturn presents both challenges and opportunities for investors. A cautious approach is recommended, focusing on:

-

Diversification: A well-diversified portfolio can help mitigate risk and reduce the impact of market volatility.

-

Long-Term Perspective: Investors with a long-term investment horizon should avoid panic selling and focus on the underlying fundamentals of their investments.

-

Fundamental Analysis: Thorough due diligence and fundamental analysis are crucial for making informed investment decisions during periods of market uncertainty.

Conclusion:

The recent downturn in the Indian stock market is a complex phenomenon driven by a combination of global and domestic factors. Understanding these contributing factors is crucial for investors to navigate the current volatility and make informed decisions. While the short-term outlook may remain uncertain, a long-term perspective and a well-defined investment strategy remain key to success in the Indian stock market. Staying informed about macroeconomic trends and geopolitical developments is essential for mitigating risks and capitalizing on opportunities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Indian Stock Market Downturn: Analyzing The Causes Of The Sensex And Nifty Drop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A Year Of Hamster Kombat Assessing The Web3 Gaming Landscape

Apr 07, 2025

A Year Of Hamster Kombat Assessing The Web3 Gaming Landscape

Apr 07, 2025 -

Fase Grup Esl Mobile Masters 2025 Jadwal Pertandingan 12 Tim Unggulan

Apr 07, 2025

Fase Grup Esl Mobile Masters 2025 Jadwal Pertandingan 12 Tim Unggulan

Apr 07, 2025 -

Verstappen Edges Out Rivals Takes Pole In Dramatic Japanese Gp Qualifying

Apr 07, 2025

Verstappen Edges Out Rivals Takes Pole In Dramatic Japanese Gp Qualifying

Apr 07, 2025 -

Space X Super Heavy Booster 14 Relaunch Date For Flight 9 Announced

Apr 07, 2025

Space X Super Heavy Booster 14 Relaunch Date For Flight 9 Announced

Apr 07, 2025 -

Gold Market Forecast 40 Crash Predicted But Long Term Outlook Remains Positive

Apr 07, 2025

Gold Market Forecast 40 Crash Predicted But Long Term Outlook Remains Positive

Apr 07, 2025