Indian Stock Market Downturn: Causes Of The Sensex And Nifty Fall

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

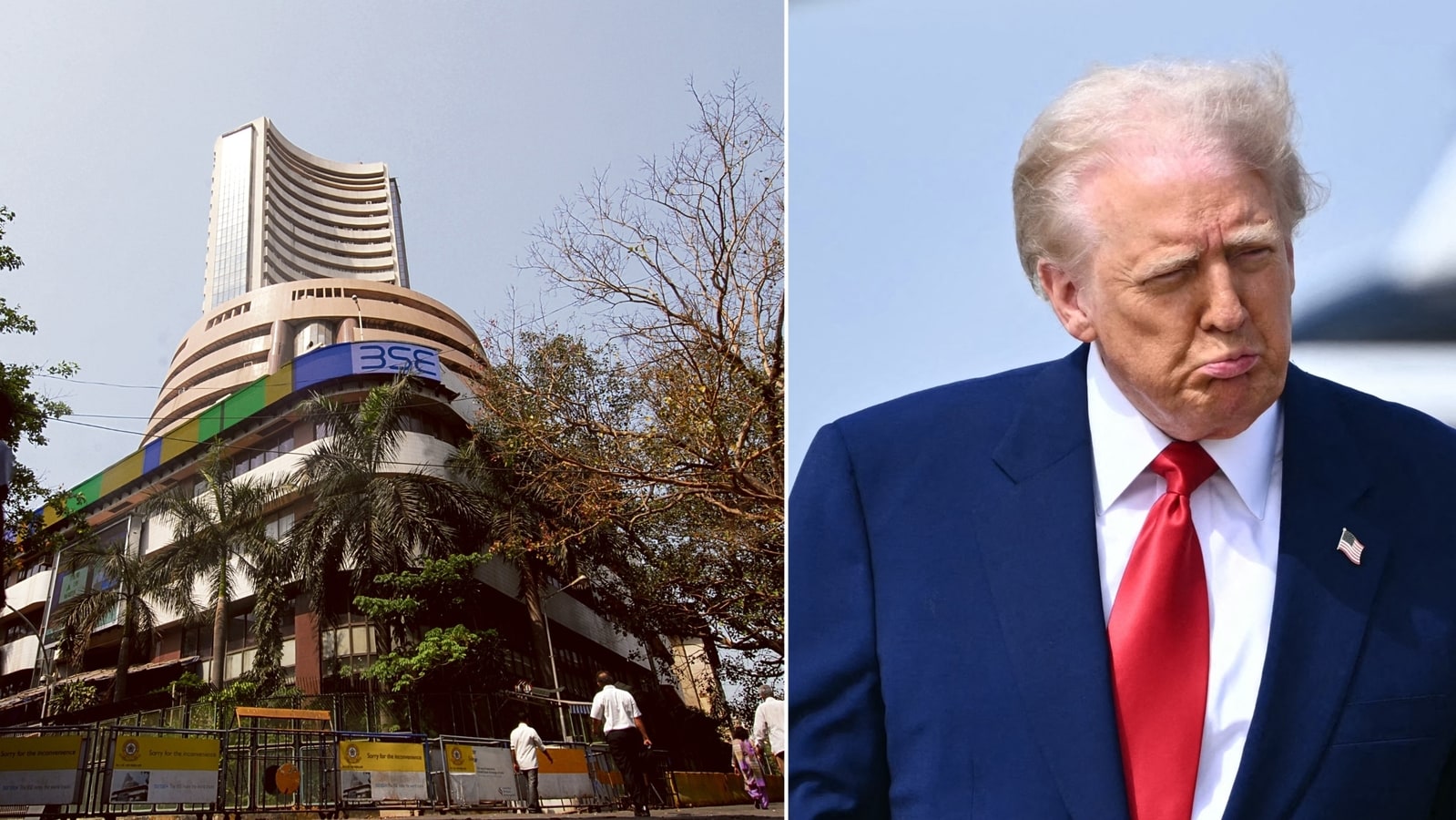

Indian Stock Market Downturn: Unpacking the Sensex and Nifty Fall

The Indian stock market has experienced a significant downturn recently, with both the Sensex and Nifty indices experiencing considerable falls. This volatility has left investors concerned and seeking answers. Understanding the causes behind this decline is crucial for navigating the current market landscape and making informed investment decisions. This article delves into the key factors contributing to the Sensex and Nifty's fall, offering insights for both seasoned and novice investors.

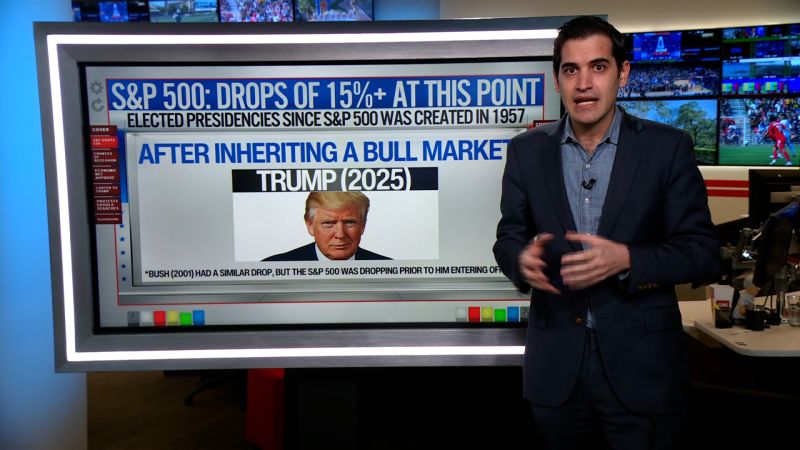

H2: Global Headwinds: A Major Contributing Factor

The global economic climate plays a significant role in influencing Indian markets. Recent global headwinds, including persistent inflation in major economies, aggressive interest rate hikes by central banks (like the US Federal Reserve), and geopolitical uncertainties stemming from the ongoing Russia-Ukraine conflict, have created a ripple effect impacting global markets, including India's. These factors have led to a flight to safety, with investors shifting their capital from emerging markets like India to perceived safer havens.

H2: Domestic Concerns: Inflation and Rupee Depreciation

Beyond global factors, domestic concerns are also contributing to the market downturn. Persistent inflationary pressures within India, driven by rising food and fuel prices, are impacting consumer spending and corporate profitability. Furthermore, the depreciation of the Indian Rupee against the US dollar increases import costs and adds to inflationary pressures, negatively impacting business sentiment and investor confidence.

H3: Impact on Specific Sectors:

The market downturn isn't impacting all sectors equally. Certain sectors are more vulnerable than others. For example:

- Technology Sector: The tech sector has been particularly hard hit due to global tech slowdowns and reduced investor appetite for tech stocks.

- Real Estate: Rising interest rates are making borrowing more expensive, impacting the real estate sector's growth prospects.

- FMCG (Fast-Moving Consumer Goods): While relatively resilient, even the FMCG sector is feeling the pinch due to increased input costs and softening consumer demand.

H2: Foreign Institutional Investor (FII) Outflows:

Foreign Institutional Investors (FIIs) have been significant net sellers in the Indian market recently. This outflow of foreign capital has exerted considerable downward pressure on the Sensex and Nifty. Concerns about global economic slowdown and rising interest rates in developed markets are major reasons behind this FII exodus.

H2: Navigating the Downturn: Strategies for Investors

The current market situation presents both challenges and opportunities for investors. Here are some key strategies to consider:

- Diversification: Diversifying your investment portfolio across different asset classes (equities, bonds, gold, etc.) can mitigate risk.

- Long-Term Perspective: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations should not dictate long-term investment strategies.

- Risk Assessment: Carefully assess your risk tolerance before making any investment decisions.

- Professional Advice: Seeking advice from a qualified financial advisor can provide valuable guidance during periods of market volatility.

H2: Looking Ahead: Potential for Recovery?

While the current outlook appears challenging, the Indian economy possesses inherent strengths. Factors like a young and growing population, robust domestic consumption, and ongoing infrastructure development offer a degree of resilience. The market's future trajectory will depend on how effectively the government addresses domestic challenges and the evolving global economic landscape. While a complete recovery might take time, strategic investment decisions and a long-term perspective are crucial for weathering this storm. Keep a close eye on key economic indicators and global events for further insights. This downturn, while concerning, presents opportunities for those who can navigate the complexities of the current market environment wisely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Indian Stock Market Downturn: Causes Of The Sensex And Nifty Fall. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Myanmar Rebuild After Earthquake And Civil Conflict

Apr 07, 2025

Can Myanmar Rebuild After Earthquake And Civil Conflict

Apr 07, 2025 -

Ais Minecraft Diamond Achievement A Significant Leap In Problem Solving

Apr 07, 2025

Ais Minecraft Diamond Achievement A Significant Leap In Problem Solving

Apr 07, 2025 -

Conheca As Opcoes De Co Propriedade De Imoveis Praia E Campo Ao Seu Alcance

Apr 07, 2025

Conheca As Opcoes De Co Propriedade De Imoveis Praia E Campo Ao Seu Alcance

Apr 07, 2025 -

Sell Off Accelerates Dow Futures Suffer Sharp Decline

Apr 07, 2025

Sell Off Accelerates Dow Futures Suffer Sharp Decline

Apr 07, 2025 -

Top 3 Bargain Tech Stocks Ready To Explode

Apr 07, 2025

Top 3 Bargain Tech Stocks Ready To Explode

Apr 07, 2025