Inflation And Tariffs: How Rising Prices Are Dampening Consumer Sentiment In May

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation and Tariffs: How Rising Prices are Dampening Consumer Sentiment in May

Record-high inflation and persistent tariffs are casting a long shadow over consumer sentiment in May, leaving many Americans feeling the pinch. The combination of these economic pressures is creating a perfect storm, impacting purchasing decisions and fueling anxieties about the future. This isn't just about a few extra dollars at the grocery store; it's a fundamental shift in how consumers approach spending, with potentially significant consequences for the broader economy.

May's Consumer Price Index (CPI) Report: A Wake-Up Call

The latest CPI report painted a stark picture, revealing inflation stubbornly refusing to cool down. While the year-over-year increase may have slightly moderated, the underlying pressures remain significant. The cost of essential goods like food and energy continues to climb, forcing households to make difficult choices and prioritize spending. This squeeze is directly impacting consumer confidence, as evidenced by several key indicators.

The Impact of Tariffs on Everyday Goods

Tariffs, designed to protect domestic industries, have inadvertently added to the inflationary pressures. These duties on imported goods, including many consumer staples, increase the final cost passed on to consumers. While some argue that tariffs protect jobs, the reality for many is that increased prices for everyday items like clothing, electronics, and furniture are significantly impacting their purchasing power.

Consumer Sentiment Plummets: A Deeper Dive

Several key indicators point to a sharp decline in consumer sentiment:

- Reduced Discretionary Spending: Consumers are increasingly cutting back on non-essential purchases, opting instead to focus on necessities. This shift is particularly evident in sectors like restaurants, entertainment, and travel.

- Increased Savings Rates (but not for the right reasons): While savings rates may appear higher, this is largely driven by necessity, not proactive financial planning. Consumers are forced to save less, not choose to save more.

- Growing Economic Anxiety: Surveys show a rise in consumer anxiety about the future economic outlook, leading to hesitation in making significant purchases like homes or cars.

- Shifting Purchasing Habits: Consumers are actively seeking out cheaper alternatives, comparing prices more rigorously, and employing strategies like couponing and bulk buying to stretch their budgets.

H2: The Long-Term Implications

The dampening of consumer sentiment presents a serious challenge to economic growth. Reduced consumer spending translates to decreased demand, potentially leading to:

- Slowed Economic Growth: A significant drop in consumer spending can trigger a ripple effect throughout the economy, impacting businesses and employment.

- Increased Business Uncertainty: Businesses face uncertainty about future demand, leading to potential hiring freezes or even layoffs.

- Potential for Recession: Prolonged periods of low consumer confidence and reduced spending can increase the risk of a recession.

H2: What Can Be Done?

Addressing the current economic climate requires a multifaceted approach:

- Targeted Inflation Control Measures: The Federal Reserve's monetary policy plays a crucial role in managing inflation. However, striking a balance between controlling inflation and avoiding a recession is a delicate task.

- Tariff Review and Reform: A critical review of existing tariffs is needed to determine their effectiveness and impact on consumer prices. Reforms could involve reducing or eliminating tariffs on essential goods.

- Government Support Programs: Targeted support programs, such as expanded food assistance or housing subsidies, can help mitigate the impact of rising prices on vulnerable populations.

Conclusion:

The current economic climate presents significant challenges for consumers and the broader economy. The combination of inflation and tariffs is eroding consumer confidence, leading to reduced spending and increased economic anxiety. Addressing these issues requires a concerted effort from policymakers, businesses, and individuals to navigate this period of uncertainty and promote sustainable economic growth. The coming months will be critical in determining the long-term consequences of these economic pressures.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation And Tariffs: How Rising Prices Are Dampening Consumer Sentiment In May. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Transformative Power Of Mars Mapping Insights And Discoveries

May 17, 2025

The Transformative Power Of Mars Mapping Insights And Discoveries

May 17, 2025 -

Nyt Strands May 16th Game 439 Find The Answers Here

May 17, 2025

Nyt Strands May 16th Game 439 Find The Answers Here

May 17, 2025 -

Trump Legal Teams Delaware Chancery Court Trip Key Details And Implications

May 17, 2025

Trump Legal Teams Delaware Chancery Court Trip Key Details And Implications

May 17, 2025 -

Quantum Computing Profitability 17 Million Net Income From Arizona Foundry

May 17, 2025

Quantum Computing Profitability 17 Million Net Income From Arizona Foundry

May 17, 2025 -

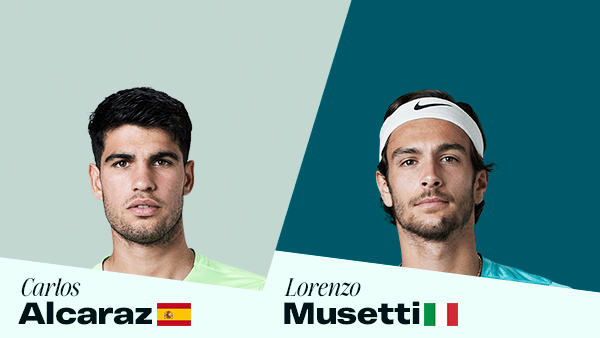

Alcaraz Vs Musetti Rome Semifinal Match Preview And Viewing Guide

May 17, 2025

Alcaraz Vs Musetti Rome Semifinal Match Preview And Viewing Guide

May 17, 2025