Institutional Buying Spree Sends Bitcoin Soaring Above $106,000

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Buying Spree Sends Bitcoin Soaring Above $106,000

Bitcoin's price has exploded past the $106,000 mark, fueled by a massive influx of institutional investment. This unprecedented surge marks a significant milestone for the cryptocurrency, solidifying its position as a serious asset class for large-scale investors. Experts are buzzing about the implications of this dramatic price jump, predicting further growth and increased mainstream adoption.

The cryptocurrency market has witnessed considerable volatility in recent years, but this latest surge represents a clear shift in the narrative. Gone are the days when Bitcoin was solely the domain of individual investors and tech enthusiasts. Today, major financial institutions are actively participating, driving the price to record highs.

What's Driving the Bitcoin Boom?

Several factors are contributing to this extraordinary Bitcoin price rally:

-

Increased Institutional Adoption: Major corporations and investment firms are increasingly allocating significant portions of their portfolios to Bitcoin. This institutional buying pressure is a primary driver behind the price surge, showcasing a growing confidence in Bitcoin's long-term value. The entry of large players into the market adds significant liquidity and stability.

-

Inflationary Concerns: Global inflationary pressures are pushing investors to seek alternative assets that hedge against inflation. Bitcoin, with its limited supply of 21 million coins, is seen as a valuable inflation hedge, attracting investors looking for protection from eroding purchasing power.

-

Regulatory Clarity (in some regions): While regulatory landscapes remain complex and vary across jurisdictions, some regions are showing signs of greater regulatory clarity for cryptocurrencies. This increased regulatory certainty is encouraging institutional investors who demand a clear legal framework before investing significant capital.

-

Technological Advancements: Ongoing developments in the Bitcoin ecosystem, such as the Lightning Network, are improving transaction speeds and reducing costs, making it more attractive for everyday use and large-scale transactions.

Experts Weigh In

Analysts are cautiously optimistic about Bitcoin's future, with many predicting further growth in the coming months. "This isn't just a speculative bubble," says Dr. Emily Carter, a leading economist specializing in cryptocurrency markets. "We're seeing a fundamental shift in how institutional investors view Bitcoin, recognizing its potential as a valuable store of value and a disruptive technology."

However, caution is warranted. The cryptocurrency market remains volatile, and price corrections are a possibility. Investing in Bitcoin, or any cryptocurrency, carries inherent risks. It's crucial for investors to conduct thorough research and understand the potential downsides before committing capital.

The Future of Bitcoin

The current surge underscores Bitcoin's growing acceptance as a legitimate asset class. The influx of institutional money is not only pushing the price higher but is also injecting much-needed stability into the market. While predicting future price movements remains inherently speculative, the current trend suggests that Bitcoin's journey towards mainstream adoption continues at a rapid pace. The $106,000 milestone represents a significant victory for the cryptocurrency, but it's only the beginning of what could be a much larger story. This institutional buying spree might just be the catalyst that propels Bitcoin to even greater heights. The coming months will be crucial in determining the long-term trajectory of this groundbreaking digital asset.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Buying Spree Sends Bitcoin Soaring Above $106,000. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Weekly Report Card Evaluating Sparks Players Performance Across Two Matches

May 23, 2025

Weekly Report Card Evaluating Sparks Players Performance Across Two Matches

May 23, 2025 -

Alex Marquez Finds Silverstone More To His Liking Yet Acknowledges Marcs Superior Pace

May 23, 2025

Alex Marquez Finds Silverstone More To His Liking Yet Acknowledges Marcs Superior Pace

May 23, 2025 -

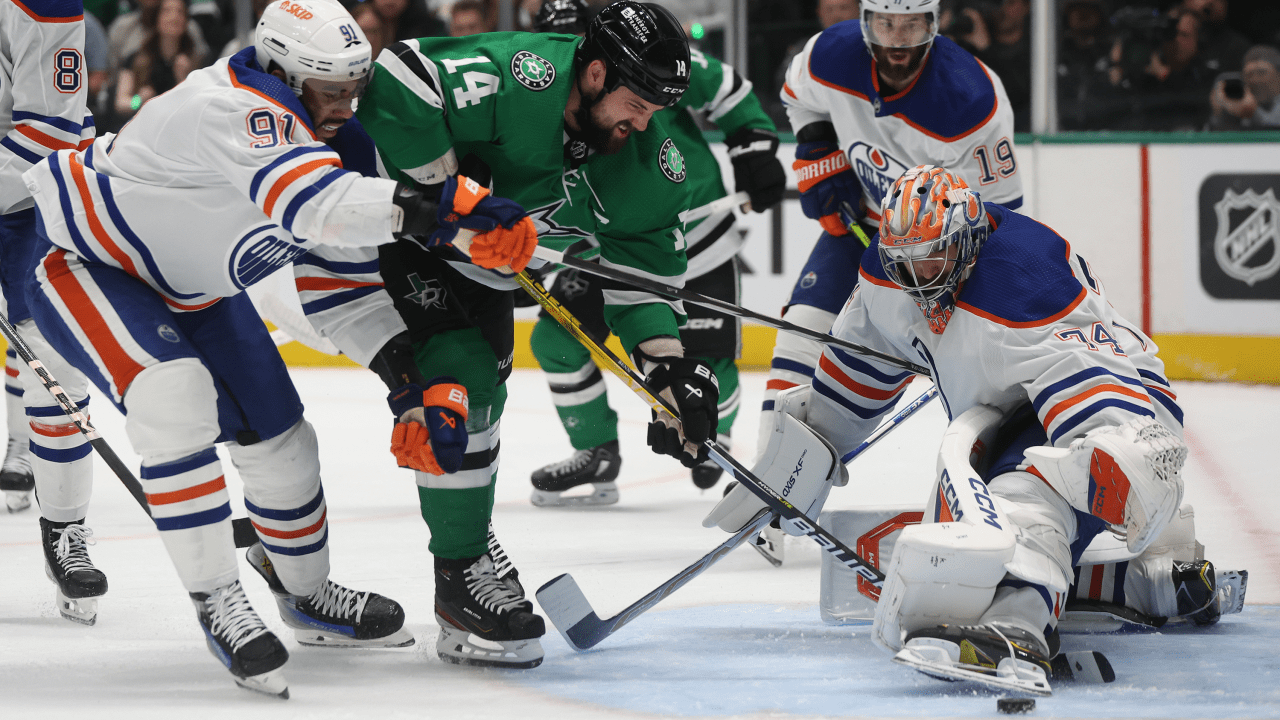

Battle For The West Begins Oilers Stars Game 1 Preview Analysis And Key Matchups

May 23, 2025

Battle For The West Begins Oilers Stars Game 1 Preview Analysis And Key Matchups

May 23, 2025 -

Tonights Game Your Guide To Watching Knicks Vs Pacers Eastern Conference Finals

May 23, 2025

Tonights Game Your Guide To Watching Knicks Vs Pacers Eastern Conference Finals

May 23, 2025 -

Eiza Gonzalez And The Unsolved Mystery Of The Fountain Of Youth

May 23, 2025

Eiza Gonzalez And The Unsolved Mystery Of The Fountain Of Youth

May 23, 2025

Latest Posts

-

Ballerina Critics React To Chaotic New Film

May 23, 2025

Ballerina Critics React To Chaotic New Film

May 23, 2025 -

Ballerina Movie Review Positive Online Buzz Raises Questions About Authenticity

May 23, 2025

Ballerina Movie Review Positive Online Buzz Raises Questions About Authenticity

May 23, 2025 -

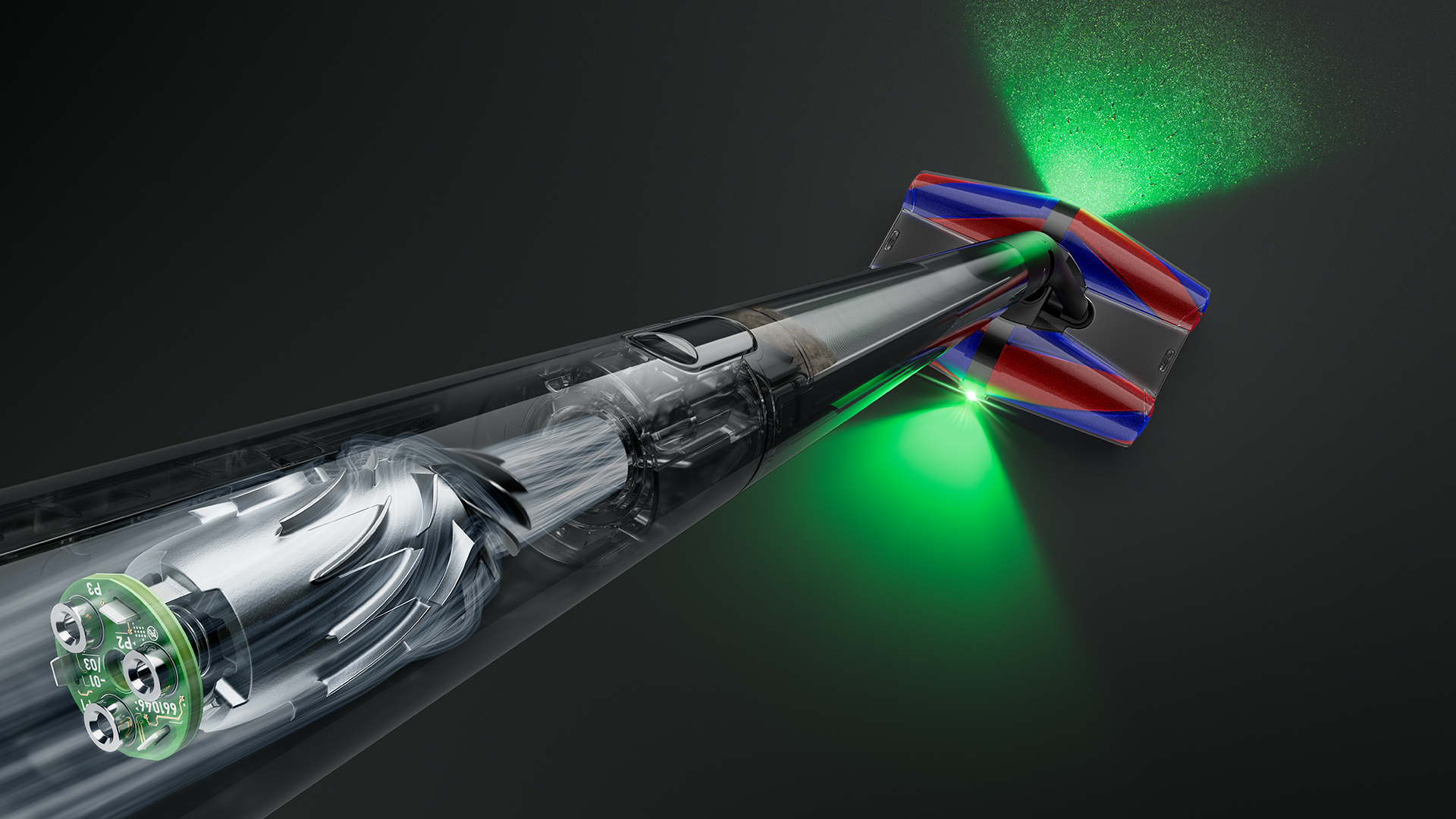

Dyson Unveils Broom Thin Vacuum With Effortless Glide

May 23, 2025

Dyson Unveils Broom Thin Vacuum With Effortless Glide

May 23, 2025 -

Major Traffic Jams Anticipated At Singapore Malaysia Land Checkpoints June Holiday Rush

May 23, 2025

Major Traffic Jams Anticipated At Singapore Malaysia Land Checkpoints June Holiday Rush

May 23, 2025 -

Sgas Historic Season How Shai Gilgeous Alexander Won The Mvp

May 23, 2025

Sgas Historic Season How Shai Gilgeous Alexander Won The Mvp

May 23, 2025