Institutional Investors Drive Billions Into Crypto Assets: Week 3 Update

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Drive Billions into Crypto Assets: Week 3 Update

Record inflows into digital assets signal growing confidence despite market volatility.

The cryptocurrency market experienced another week of significant institutional investment, with billions of dollars flowing into various digital assets. This surge, highlighted in Week 3's update, continues to defy predictions of a prolonged bear market and suggests growing confidence in the long-term potential of cryptocurrencies. While retail investor sentiment remains somewhat cautious, the unwavering commitment from institutional players is a powerful indicator of the sector's resilience.

Billions Poured into Bitcoin and Altcoins:

This week saw a significant increase in investment across the board. Bitcoin, the dominant cryptocurrency, continues to attract the lion's share of institutional capital, with several major investment firms reporting increased holdings. However, the inflow wasn't limited to Bitcoin. Altcoins, alternative cryptocurrencies to Bitcoin, also experienced substantial gains, demonstrating a diversification strategy among institutional investors. This spread of investment across various crypto assets suggests a more sophisticated and less risky approach to cryptocurrency investment.

- Bitcoin (BTC): Investment firms are strategically accumulating BTC, viewing it as a store of value and a hedge against inflation, despite recent price fluctuations.

- Ethereum (ETH): The ongoing development of Ethereum's Layer-2 scaling solutions and the growing popularity of decentralized finance (DeFi) applications continue to draw significant institutional interest in ETH.

- Other Altcoins: Several altcoins with strong fundamentals and innovative technologies also witnessed increased institutional buying, highlighting a broadening of the institutional crypto investment landscape.

Driving Forces Behind Institutional Investment:

Several factors contribute to this sustained institutional interest in crypto assets:

- Inflation Hedge: Many investors see cryptocurrencies, particularly Bitcoin, as a hedge against inflation, especially given the current global economic climate.

- Technological Advancements: Continuous improvements in blockchain technology, such as enhanced scalability and security, are boosting investor confidence.

- Regulatory Clarity (Gradual): Although regulatory uncertainty remains, there's a gradual increase in clarity and acceptance of cryptocurrencies in certain jurisdictions, encouraging more institutional participation.

- Diversification Strategy: Institutional investors are increasingly incorporating crypto assets into their portfolios as a way to diversify and potentially enhance returns.

Challenges Remain:

Despite the positive trends, challenges persist within the cryptocurrency market. Regulatory uncertainties, market volatility, and the ever-present risk of scams and hacks still pose significant hurdles. However, the continued flow of billions from institutional investors demonstrates a growing belief in the long-term viability of the crypto space.

Looking Ahead:

The third week's data paints a compelling picture of a maturing cryptocurrency market, one increasingly driven by sophisticated institutional players. While short-term price fluctuations are inevitable, the sustained institutional investment suggests a positive outlook for the future of crypto assets. It will be crucial to monitor regulatory developments and technological advancements to fully gauge the impact on future investment trends. The next week's update will be critical in assessing whether this bullish trend continues or undergoes a correction. Stay tuned for further analysis and updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Drive Billions Into Crypto Assets: Week 3 Update. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nhl Playoffs Stars Win Game 7 Thriller Round 1 Recap And Live Chat

May 08, 2025

Nhl Playoffs Stars Win Game 7 Thriller Round 1 Recap And Live Chat

May 08, 2025 -

Nba Playoffs Kumingas Potential Return For Warriors Crucial Game 7

May 08, 2025

Nba Playoffs Kumingas Potential Return For Warriors Crucial Game 7

May 08, 2025 -

Streamline Your Workflow In App Image Editing With Gemini

May 08, 2025

Streamline Your Workflow In App Image Editing With Gemini

May 08, 2025 -

Confirmed Stephen Curry Hamstring To Miss Warriors Crucial Game 1

May 08, 2025

Confirmed Stephen Curry Hamstring To Miss Warriors Crucial Game 1

May 08, 2025 -

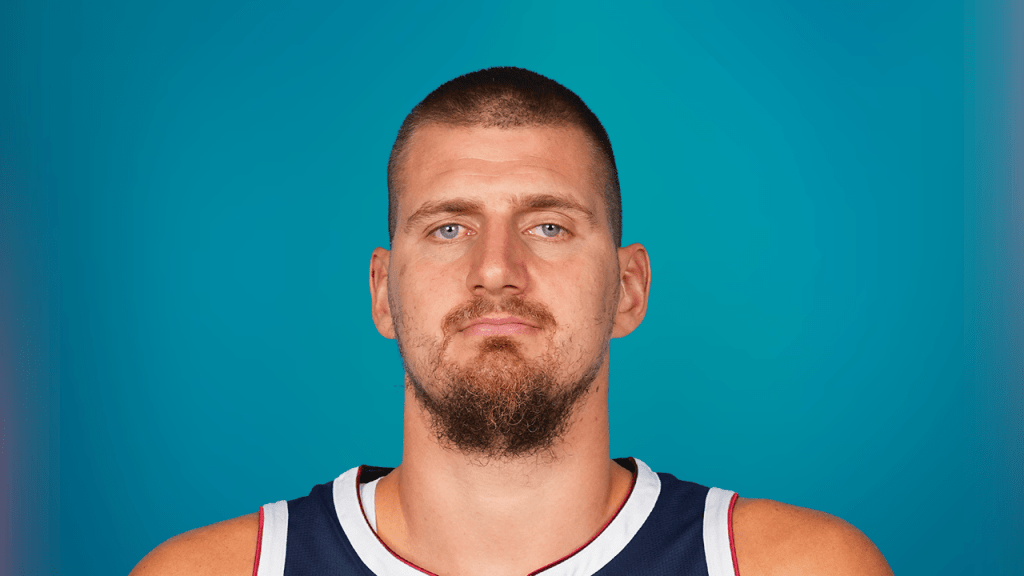

Jokics Relaxed Response To Free Throw Merchant Jeers A Look At The Incident

May 08, 2025

Jokics Relaxed Response To Free Throw Merchant Jeers A Look At The Incident

May 08, 2025

Latest Posts

-

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025 -

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025 -

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025 -

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025 -

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025