Institutional Investors Drive Billions Into Crypto: Three-Week Inflow Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Drive Billions into Crypto: A Three-Week Inflow Trend Signals Market Confidence

The cryptocurrency market is experiencing a significant surge in institutional investment, with billions of dollars flowing into digital assets over the past three weeks. This sustained inflow signals a growing confidence in the long-term potential of cryptocurrencies, defying recent market volatility and regulatory uncertainty. Experts believe this trend could mark a crucial turning point, potentially paving the way for broader market adoption and price appreciation.

A Wave of Institutional Buying:

Data from leading crypto analytics firms shows a consistent influx of capital from institutional investors over the past 21 days. This isn't a fleeting trend; it represents a sustained period of significant investment, suggesting a deliberate and strategic approach by major players. The reasons behind this surge are multifaceted, including:

- Increased Regulatory Clarity (in certain jurisdictions): While regulatory frameworks remain a work in progress globally, some jurisdictions have made progress in establishing clearer guidelines for crypto investments, reducing uncertainty for institutional players. This has emboldened larger firms to increase their exposure.

- Diversification Strategies: With traditional markets experiencing fluctuating performance, institutional investors are increasingly diversifying their portfolios into alternative assets, with cryptocurrencies emerging as a compelling option. The potential for high returns, despite inherent risks, is a key driver.

- Technological Advancements: Ongoing improvements in blockchain technology, the development of more robust and scalable platforms, and the emergence of innovative DeFi (Decentralized Finance) applications are all contributing to institutional interest. These advancements address previous concerns regarding scalability and security.

- Strategic Partnerships and Mergers & Acquisitions: The increasing number of strategic partnerships between established financial institutions and crypto companies further validates the sector's legitimacy and attracts further investment. The recent flurry of mergers and acquisitions within the crypto space also points to a maturing market.

Which Cryptocurrencies are Attracting the Most Investment?

While Bitcoin (BTC) remains the dominant asset, attracting the lion's share of institutional investment, altcoins are also experiencing significant inflows. Ethereum (ETH), with its robust smart contract capabilities and growing DeFi ecosystem, is a prime example. Furthermore, institutional interest is expanding to include promising projects in areas like layer-1 scaling solutions and privacy-enhancing cryptocurrencies.

What This Means for the Future of Crypto:

This sustained inflow of institutional capital represents a powerful endorsement of the cryptocurrency market. It suggests a shift in perception, moving away from the speculative asset narrative towards a more mature asset class considered for long-term portfolio diversification. While volatility is inherent to the crypto market, the resilience demonstrated during recent price fluctuations, coupled with institutional investment, points towards increased stability and potentially higher prices in the long term.

Navigating the Risks:

It's crucial to acknowledge the inherent risks associated with cryptocurrency investments. Market volatility, regulatory uncertainty, and the potential for scams remain significant concerns. Investors, especially institutional ones, are employing sophisticated risk management strategies to mitigate these challenges.

Conclusion:

The sustained three-week inflow of billions into the cryptocurrency market by institutional investors signals a significant shift in the industry. This trend signifies growing confidence and acceptance, potentially marking a pivotal moment for the long-term growth and maturation of the cryptocurrency ecosystem. While risks remain, the continued influx of institutional capital suggests a future where cryptocurrencies play a more prominent role in the global financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Drive Billions Into Crypto: Three-Week Inflow Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Haute Scene Archives Final Page Released

May 07, 2025

Haute Scene Archives Final Page Released

May 07, 2025 -

Visa Restrictions Tighten Targeting Nationalities Contributing To Asylum Costs

May 07, 2025

Visa Restrictions Tighten Targeting Nationalities Contributing To Asylum Costs

May 07, 2025 -

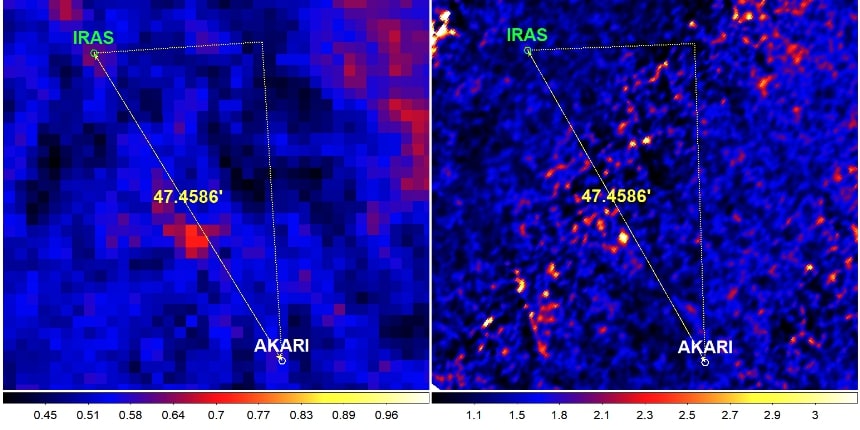

Planet Nine Candidate Found Iras And Akari Data Offer Clues

May 07, 2025

Planet Nine Candidate Found Iras And Akari Data Offer Clues

May 07, 2025 -

Mercury Stars Preseason Debut Uncertain Against Aces

May 07, 2025

Mercury Stars Preseason Debut Uncertain Against Aces

May 07, 2025 -

May 2025 3 Altcoins Face Major Token Unlocks

May 07, 2025

May 2025 3 Altcoins Face Major Token Unlocks

May 07, 2025

Latest Posts

-

Dramatic Victory Knicks Edge Celtics Stand Two Wins From Eastern Conference Finals

May 08, 2025

Dramatic Victory Knicks Edge Celtics Stand Two Wins From Eastern Conference Finals

May 08, 2025 -

Overlooked Symptom Leads To One In A Million Cancer Diagnosis

May 08, 2025

Overlooked Symptom Leads To One In A Million Cancer Diagnosis

May 08, 2025 -

Nikola Jokic On Fan Chants A Lighthearted Reaction To Free Throw Merchant Taunts

May 08, 2025

Nikola Jokic On Fan Chants A Lighthearted Reaction To Free Throw Merchant Taunts

May 08, 2025 -

Genevieve O Reilly And Andor Creator Discuss Mon Mothmas Powerful Senate Scene

May 08, 2025

Genevieve O Reilly And Andor Creator Discuss Mon Mothmas Powerful Senate Scene

May 08, 2025 -

Cassius Turvey Murder Trial Brearley And Palmer Found Guilty

May 08, 2025

Cassius Turvey Murder Trial Brearley And Palmer Found Guilty

May 08, 2025