Institutional Investors Fuel Billions In Crypto Inflows: Three-Week Trend Continues

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Fuel Billions in Crypto Inflows: Three-Week Trend Continues

Record inflows into crypto markets signal growing institutional confidence despite recent market volatility. The cryptocurrency market is experiencing a significant surge in institutional investment, with billions of dollars flowing into digital assets over the past three weeks. This sustained influx signifies a growing belief in the long-term potential of cryptocurrencies, despite recent price fluctuations and regulatory uncertainty. Experts suggest this trend could mark a pivotal moment for crypto adoption and mainstream acceptance.

Three Weeks of Consistent Growth:

The past three weeks have witnessed a remarkable upswing in institutional investment, a stark contrast to the hesitancy seen earlier this year. Several factors are contributing to this bullish trend:

- Increased Regulatory Clarity (in certain jurisdictions): While global regulatory landscapes remain fragmented, some jurisdictions have shown progress in providing clearer frameworks for crypto trading and investment, encouraging institutional participation.

- Improved Infrastructure: The maturation of custodial solutions and trading platforms specifically designed for institutional investors has significantly lowered barriers to entry and reduced risk concerns.

- Strategic Diversification: Many institutional investors view cryptocurrencies as a valuable addition to their portfolios, offering diversification benefits beyond traditional asset classes. They see potential for significant returns in the long term.

- BlackRock's Influence: The entry of major players like BlackRock, a global investment behemoth, into the Bitcoin ETF market has sent powerful signals to other institutional investors, legitimizing crypto as a viable asset class.

Billions Pouring In:

While precise figures vary depending on the reporting source, various market analysis firms consistently report billions of dollars in net inflows into crypto funds and investment vehicles. This represents a substantial commitment from institutional players, signifying a shift towards broader acceptance within the financial industry.

Specific Asset Focus:

While Bitcoin continues to dominate institutional interest, inflows are also seen across various altcoins, including Ethereum, Solana, and others. This diversification highlights the growing understanding and acceptance of the broader cryptocurrency ecosystem beyond Bitcoin’s dominance.

Challenges Remain:

Despite the positive trend, challenges persist. Regulatory uncertainty remains a key concern, especially in the US, where clear guidelines are still lacking. Volatility continues to be a feature of the cryptocurrency market, presenting inherent risks. However, the sustained institutional inflows suggest that these risks are being weighed against the potential for significant returns.

The Future of Institutional Crypto Investment:

The current trend points towards increasing institutional involvement in the cryptocurrency market. As regulatory clarity improves and infrastructure matures, we can expect this trend to continue, potentially leading to greater price stability and wider mainstream adoption. This continued influx of capital will be crucial in solidifying the position of cryptocurrencies within the global financial system. The next few months will be critical in observing whether this three-week trend continues its upward trajectory or faces significant headwinds. This ongoing story will require close monitoring by both market analysts and investors alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Fuel Billions In Crypto Inflows: Three-Week Trend Continues. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

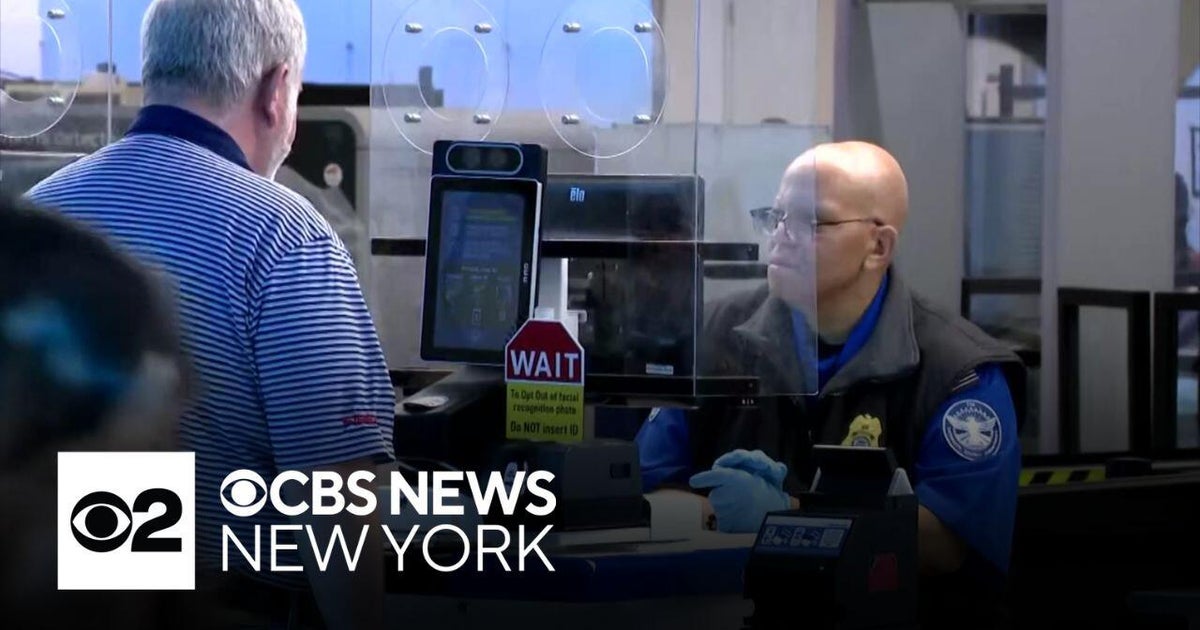

Tsa Extends Grace Period Important Information For Travelers Lacking Real Ids

May 07, 2025

Tsa Extends Grace Period Important Information For Travelers Lacking Real Ids

May 07, 2025 -

Statement Ong Ye Kung And Chee Hong Tat On Allegations Regarding Su Haijin

May 07, 2025

Statement Ong Ye Kung And Chee Hong Tat On Allegations Regarding Su Haijin

May 07, 2025 -

Situacao Critica No Rio Grande Do Sul Balanco Das Chuvas Com 75 Vitimas E Deficit De Agua E Luz

May 07, 2025

Situacao Critica No Rio Grande Do Sul Balanco Das Chuvas Com 75 Vitimas E Deficit De Agua E Luz

May 07, 2025 -

Vintage Baby Names Inspiration From Dame Laura Kennys Choice And 8 More

May 07, 2025

Vintage Baby Names Inspiration From Dame Laura Kennys Choice And 8 More

May 07, 2025 -

Indiana Pacers Vs Cleveland Cavaliers May 6 2025 Game Recap And Box Score

May 07, 2025

Indiana Pacers Vs Cleveland Cavaliers May 6 2025 Game Recap And Box Score

May 07, 2025

Latest Posts

-

Andors Unexpected Star Benjamin Bratt And His Impact On The Series

May 08, 2025

Andors Unexpected Star Benjamin Bratt And His Impact On The Series

May 08, 2025 -

Nba Playoffs Warriors Defeat Timberwolves In Game 1 Despite Curry Injury

May 08, 2025

Nba Playoffs Warriors Defeat Timberwolves In Game 1 Despite Curry Injury

May 08, 2025 -

User Trust Under Fire Google Ceo Responds To Dojs Proposed Changes

May 08, 2025

User Trust Under Fire Google Ceo Responds To Dojs Proposed Changes

May 08, 2025 -

2nd And 3rd Stimulus Checks Claiming Unreceived Payments In Pennsylvania

May 08, 2025

2nd And 3rd Stimulus Checks Claiming Unreceived Payments In Pennsylvania

May 08, 2025 -

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025