Interest Rate Cut Expected Amid Growing Stock Market Instability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Interest Rate Cut Expected Amid Growing Stock Market Instability

Global markets are bracing for a potential interest rate cut as stock market volatility intensifies. Concerns over inflation's persistence coupled with recent banking sector anxieties have fueled speculation that central banks, particularly the Federal Reserve, may intervene to stabilize the economy. This potential shift in monetary policy could significantly impact investors and consumers alike.

The recent turbulence in the stock market, marked by sharp fluctuations and significant losses, has raised alarm bells among economists and analysts. Factors contributing to this instability include persistent inflation, geopolitical uncertainty, and lingering concerns about the health of the banking sector following recent collapses. These factors are interconnected, creating a complex and volatile economic landscape.

Why an Interest Rate Cut is Anticipated

The expectation of an interest rate cut stems primarily from the need to counteract the negative impacts of the stock market downturn. Lower interest rates typically stimulate economic activity by making borrowing cheaper for businesses and consumers. This, in turn, can boost spending and investment, potentially stabilizing the market.

-

Combating Inflationary Pressures: While seemingly counterintuitive given persistent inflation, a rate cut could be considered if the central bank assesses that the risks of a deep recession outweigh the dangers of slightly higher inflation. A slowing economy naturally reduces inflationary pressures.

-

Preventing a Credit Crunch: The recent banking sector instability has raised fears of a credit crunch, where lending becomes significantly restricted. A rate cut can help alleviate these concerns by making it easier for banks to lend and for businesses to access capital.

-

Supporting Stock Market Recovery: Lower interest rates can make equities more attractive to investors compared to bonds, potentially leading to a rebound in the stock market. This, however, hinges on investor confidence and a broader improvement in the economic outlook.

Potential Downsides of an Interest Rate Cut

While an interest rate cut offers potential benefits, it also carries risks. Lower interest rates could:

-

Fuel Inflation: If the economy is already experiencing inflationary pressures, a rate cut could exacerbate the problem by increasing demand and putting upward pressure on prices.

-

Weaken the Currency: Lower interest rates can make a country's currency less attractive to foreign investors, leading to depreciation and potentially increasing import costs.

-

Increase Government Debt: Lower interest rates can increase government borrowing costs in the long run, potentially impacting national debt levels.

What to Expect Next

The coming weeks will be crucial in determining the central bank's response to the current market instability. Investors and consumers should closely monitor economic indicators, central bank announcements, and market reactions to gauge the likelihood of an interest rate cut and its potential impact on their portfolios and financial well-being. Experts predict increased volatility until a clearer picture of the economic outlook emerges. Diversification of investment portfolios and careful financial planning remain crucial strategies in navigating this period of uncertainty. This situation underscores the importance of staying informed and adapting strategies based on evolving market conditions. The interplay between inflation, stock market performance, and interest rate policy continues to be a dominant narrative in global finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Interest Rate Cut Expected Amid Growing Stock Market Instability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

You Season 5 Release Date Netflixs Thriller Finale Unveiled

Apr 22, 2025

You Season 5 Release Date Netflixs Thriller Finale Unveiled

Apr 22, 2025 -

Next Big Future Exclusive Presidential Intervention Needed For Space X Dome

Apr 22, 2025

Next Big Future Exclusive Presidential Intervention Needed For Space X Dome

Apr 22, 2025 -

Exceptional Student Zac Gondelman 26 Receives Truman Scholarship At Brandeis

Apr 22, 2025

Exceptional Student Zac Gondelman 26 Receives Truman Scholarship At Brandeis

Apr 22, 2025 -

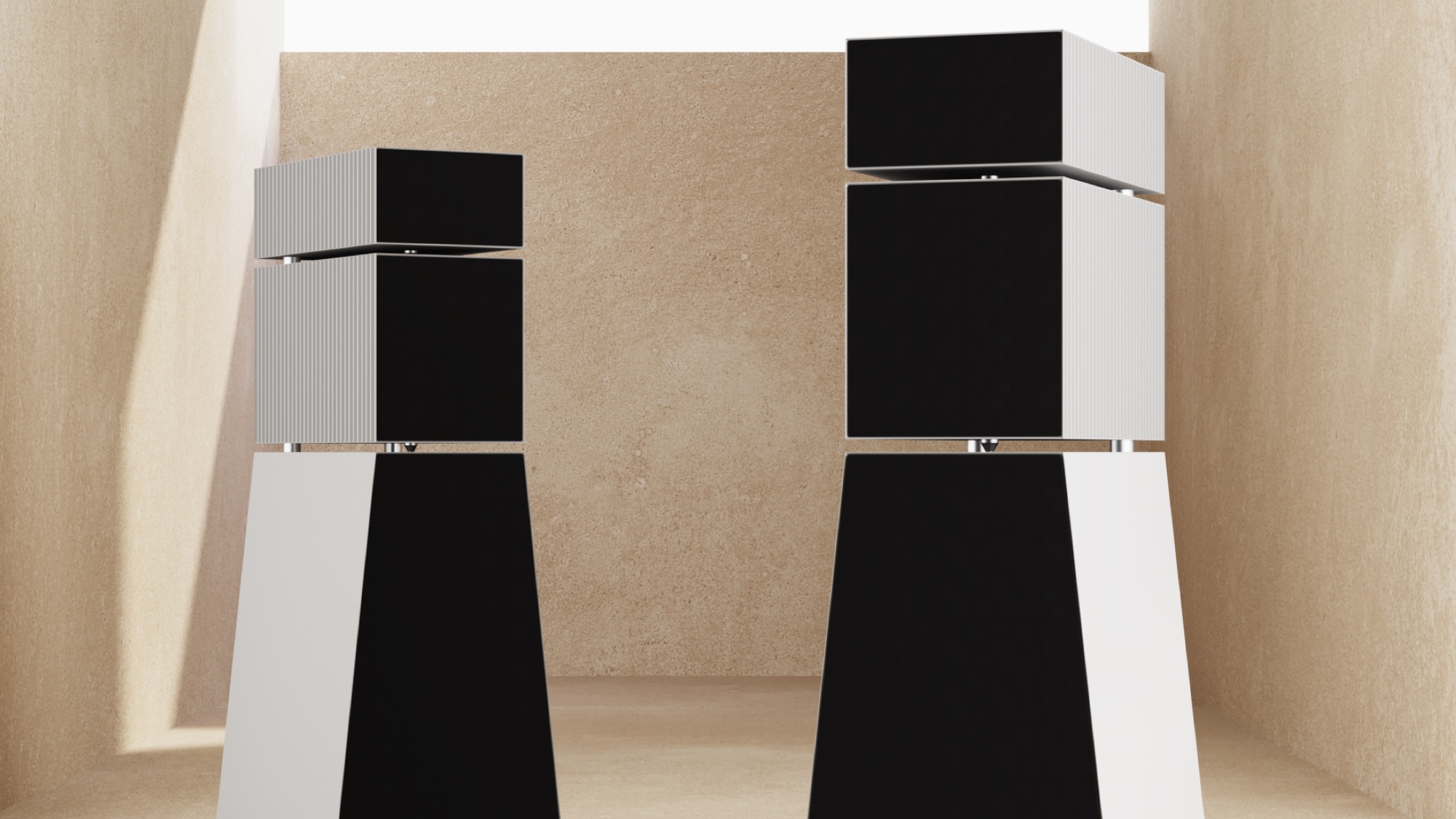

High End Audio The Design And Performance Of Unique Luxury Speakers

Apr 22, 2025

High End Audio The Design And Performance Of Unique Luxury Speakers

Apr 22, 2025 -

Pride And Prejudice 2005 The Enduring Appeal Of A Timeless Classic

Apr 22, 2025

Pride And Prejudice 2005 The Enduring Appeal Of A Timeless Classic

Apr 22, 2025