Interest Rate Cuts Less Likely After Trump Upheaval: Bullock's View

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Interest Rate Cuts Less Likely After Trump Upheaval: Bullock's View

The political earthquake following the indictment of former President Donald Trump has seemingly shifted the Federal Reserve's trajectory, making interest rate cuts in the near future less probable, according to prominent economist Dr. Emily Bullock. This unexpected development throws a wrench into market predictions and underscores the intricate interplay between politics and economic policy.

Bullock, a respected voice in macroeconomic analysis and a professor at the prestigious Wharton School, argues that the current political climate introduces significant uncertainty, a factor the Fed deeply considers when setting monetary policy. The indictment and its ensuing political fallout have increased market volatility and injected considerable risk into the economic outlook.

Why the Trump Indictment Matters to Interest Rates:

The immediate impact of the Trump indictment is an increased level of uncertainty, which can lead to:

- Increased Market Volatility: Uncertain political landscapes often translate into volatile stock markets. This instability makes it harder for the Fed to accurately assess the health of the economy and predict future inflation.

- Potential for Reduced Consumer and Business Confidence: Political turmoil can dampen consumer and business confidence, potentially leading to decreased spending and investment, thereby impacting economic growth.

- Shifting Inflationary Pressures: While the initial reaction might be deflationary due to decreased spending, longer-term effects are less clear and could lead to unpredictable inflationary pressures.

These factors, Bullock explains, make the Fed less likely to pursue a course of interest rate cuts. The central bank prioritizes price stability, and the current uncertainty makes it difficult to accurately predict the future trajectory of inflation. Cutting interest rates in a climate of uncertainty could risk exacerbating inflation, undermining the Fed's primary mandate.

Bullock's Predictions and Market Implications:

Dr. Bullock doesn't entirely rule out future rate cuts, emphasizing that the situation remains fluid and dependent on several key economic indicators. However, her analysis suggests that the timing of any potential cuts has been pushed back considerably.

"The Fed is data-driven," Bullock stated in a recent interview. "But the data itself is now clouded by the political upheaval. Until we see a clearer picture of the economic impact of the current political climate, the likelihood of rate cuts diminishes significantly."

This shift in perspective has significant implications for investors and the broader economy. Market analysts are now revising their predictions, anticipating a prolonged period of higher interest rates, potentially impacting borrowing costs for businesses and consumers.

Beyond the Immediate Future:

The long-term economic consequences of the political turmoil remain uncertain. However, Bullock's analysis highlights the critical link between political stability and economic predictability. The current situation underscores the need for clear and consistent policy-making to maintain investor confidence and ensure stable economic growth.

Keywords: Interest rate cuts, Federal Reserve, Fed, Donald Trump, Indictment, Economic uncertainty, Market volatility, Inflation, Dr. Emily Bullock, Wharton School, Monetary policy, Economic outlook, Investment, Borrowing costs, Political stability, Economic growth.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Interest Rate Cuts Less Likely After Trump Upheaval: Bullock's View. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Space Xs Starship Super Heavy Booster 14 A Closer Look At Flight 9

Apr 10, 2025

Space Xs Starship Super Heavy Booster 14 A Closer Look At Flight 9

Apr 10, 2025 -

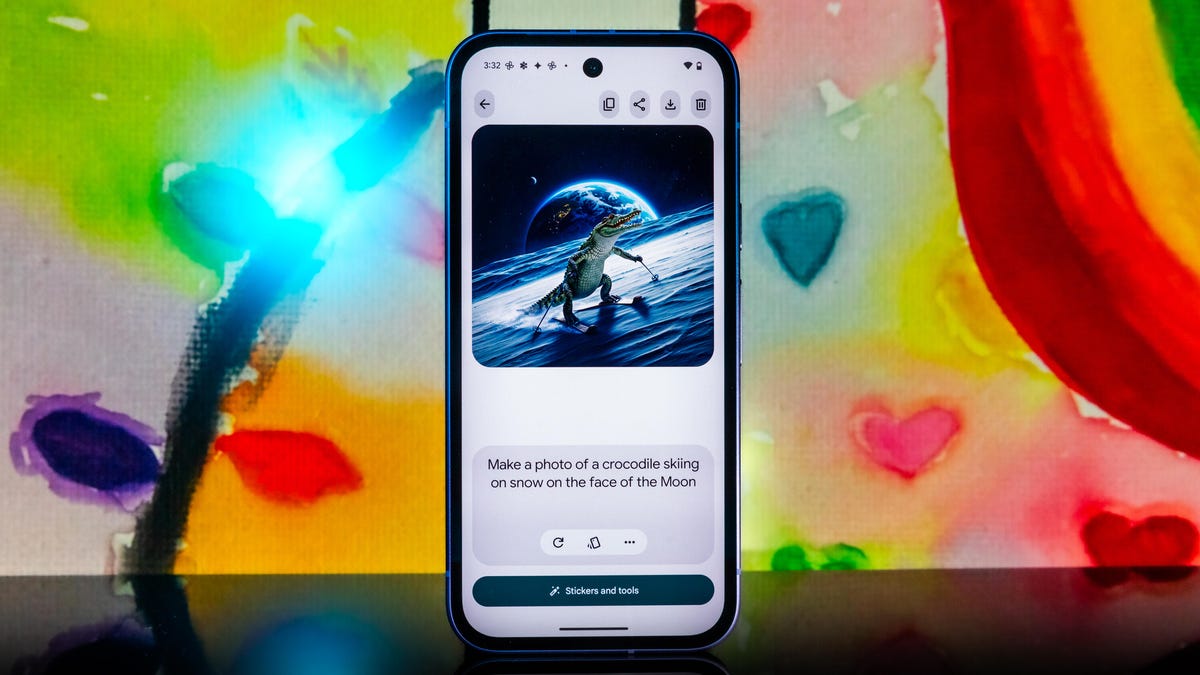

Pixel 9a Review Affordable Excellence Redefined

Apr 10, 2025

Pixel 9a Review Affordable Excellence Redefined

Apr 10, 2025 -

Behind The Scenes Drama Pete Wicks Confronts Roman Kemp After Controversial Strictly Comment

Apr 10, 2025

Behind The Scenes Drama Pete Wicks Confronts Roman Kemp After Controversial Strictly Comment

Apr 10, 2025 -

Tactical Battle Rob Daly Dissects Spurs Vs Eintracht Frankfurt

Apr 10, 2025

Tactical Battle Rob Daly Dissects Spurs Vs Eintracht Frankfurt

Apr 10, 2025 -

Pesan Kehidupan Dari Film Jumbo 9 Quotes Inspiratif

Apr 10, 2025

Pesan Kehidupan Dari Film Jumbo 9 Quotes Inspiratif

Apr 10, 2025