Interest Rate Shock: Major Bank's Huge Rate Increase Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Interest Rate Shock: Major Bank's Huge Rate Increase Explained

Headline: Interest rates are soaring! A major bank's unexpected rate hike has sent shockwaves through the financial markets. Here's what you need to know.

Introduction: The financial world is reeling after [Bank Name], a major global banking institution, announced a significant and unexpected increase to its interest rates. This dramatic move, [percentage]% increase, is the largest single hike in [Number] years and has sparked concerns about the potential impact on borrowers, savers, and the overall economy. This article breaks down the reasons behind this shock increase and explains what it means for you.

H2: The Unexpected Hike: Why Did [Bank Name] Act So Aggressively?

[Bank Name]'s decision to dramatically increase interest rates wasn't a spontaneous move. Several factors contributed to this bold strategy:

-

Inflationary Pressures: Persistent inflation, currently at [Inflation Percentage]%, remains a major concern globally. Central banks worldwide are grappling with rising prices, and [Bank Name]'s aggressive move suggests they believe more drastic measures are needed to curb inflation. They aim to cool down the economy by making borrowing more expensive, thereby reducing consumer spending.

-

Geopolitical Uncertainty: The ongoing [mention relevant geopolitical event, e.g., war in Ukraine] has further exacerbated inflationary pressures and created economic uncertainty. This instability likely influenced [Bank Name]'s decision to act decisively.

-

Competitive Landscape: The banking sector is highly competitive. While the exact reasoning behind [Bank Name]'s strategy remains partially speculative, some analysts believe this move could be a strategic play to attract more deposits and secure a competitive edge.

H2: What Does This Mean for Borrowers?

The impact on borrowers is likely to be significant. Existing borrowers with variable-rate mortgages, loans, and credit cards will see their monthly payments increase substantially. This could lead to financial strain for many households. New borrowers will face even higher borrowing costs, potentially impacting their ability to afford major purchases like homes or cars.

H3: Protecting Yourself as a Borrower:

- Review your budget: Assess your current financial situation and determine how the increased interest rates will affect your monthly expenses.

- Contact your lender: Discuss options with your lender, such as refinancing or exploring different payment plans.

- Consider debt consolidation: Explore options to consolidate high-interest debts into a lower-interest loan.

H2: What Does This Mean for Savers?

While the increased interest rates present challenges for borrowers, they could be beneficial for savers. Higher interest rates generally mean higher returns on savings accounts and certificates of deposit (CDs). This could encourage increased savings and provide a better return on existing savings.

H3: Maximizing Returns as a Saver:

- Shop around for the best rates: Compare interest rates offered by different banks and financial institutions.

- Consider higher-yield savings options: Explore options such as high-yield savings accounts, CDs, and money market accounts to maximize your returns.

H2: The Broader Economic Impact

The full economic consequences of [Bank Name]'s rate hike are yet to be seen. However, economists predict a potential slowdown in economic growth, impacting consumer spending and investment. The impact on the stock market is also likely to be significant, with potential volatility in the coming weeks and months. Close monitoring of economic indicators and market trends is crucial.

H2: What's Next?

The market is anticipating further reactions from other financial institutions and central banks. The coming weeks will be crucial in assessing the ripple effects of this unprecedented rate increase. Stay informed by following reputable financial news sources and consulting with financial advisors for personalized guidance. This situation underscores the importance of financial literacy and proactive financial planning.

Conclusion: [Bank Name]'s dramatic interest rate hike signifies a significant shift in the global financial landscape. While the move aims to combat inflation, it carries potential risks for borrowers and the wider economy. Understanding the implications and taking appropriate measures is crucial for navigating these turbulent times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Interest Rate Shock: Major Bank's Huge Rate Increase Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eight Takeaways From The Edmonton Oilers 2023 2024 Regular Season

Apr 22, 2025

Eight Takeaways From The Edmonton Oilers 2023 2024 Regular Season

Apr 22, 2025 -

Ge 2025 Nee Soon Grc Mps Ng Tan And Goh Announce Resignation

Apr 22, 2025

Ge 2025 Nee Soon Grc Mps Ng Tan And Goh Announce Resignation

Apr 22, 2025 -

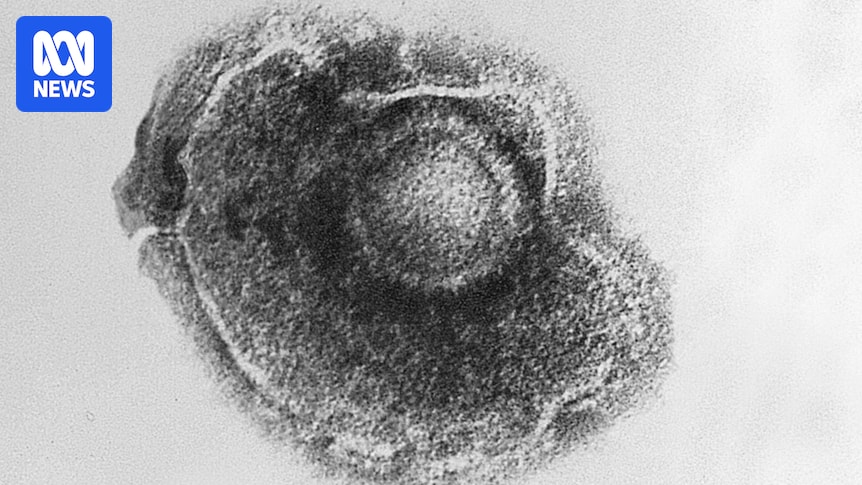

Understanding The Link Between Viruses And Neurodegenerative Diseases Like Dementia

Apr 22, 2025

Understanding The Link Between Viruses And Neurodegenerative Diseases Like Dementia

Apr 22, 2025 -

Singapore Pays Respects Funeral Service For Influential Figure Puan Noor Aishah

Apr 22, 2025

Singapore Pays Respects Funeral Service For Influential Figure Puan Noor Aishah

Apr 22, 2025 -

Increased River Flow Predicted Parishes Brace For Potential Flooding

Apr 22, 2025

Increased River Flow Predicted Parishes Brace For Potential Flooding

Apr 22, 2025