Investasi Obligasi: Konglomerat Indonesia Rilis Obligasi Rp 1 Triliun, Bunga 9,3%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investasi Obligasi: Konglomerat Indonesia Rilis Obligasi Rp 1 Triliun, Bunga 9,3% – Peluang Emas atau Risiko Tersembunyi?

Indonesia's investment landscape heats up as a major conglomerate launches a Rp 1 trillion bond offering, boasting a 9.3% interest rate. Is this a golden opportunity for investors, or are there hidden risks?

The Indonesian investment market is buzzing with the news of a significant bond issuance. A prominent Indonesian conglomerate (name withheld pending official announcement) has announced plans to release Rp 1 trillion (approximately US$66 million) worth of bonds, offering a compelling interest rate of 9.3%. This development presents a compelling investment opportunity, but prospective investors should carefully weigh the potential rewards against the inherent risks.

High Interest Rate: A Tempting Proposition

The 9.3% interest rate is undeniably attractive in the current market climate. This significantly surpasses many other fixed-income investment options, making it particularly appealing to investors seeking higher returns. For those seeking diversification beyond stocks or other volatile assets, this high-yield bond offering might seem like a strong contender. The potential for substantial passive income is a key draw for many investors, especially in a time of economic uncertainty.

Understanding the Risks: Due Diligence is Crucial

While the high interest rate is a significant advantage, investors must conduct thorough due diligence before committing their funds. Several factors need careful consideration:

- Credit Rating: The credit rating of the issuing conglomerate is paramount. A strong credit rating indicates a lower risk of default. Investors should thoroughly research the company's financial health and stability.

- Maturity Date: The maturity date of the bond dictates the length of time your investment will be locked. Longer maturity dates generally offer higher yields but also increase the risk associated with potential changes in interest rates or the issuer's financial situation.

- Inflation: While the 9.3% interest rate seems attractive, it's crucial to consider the current inflation rate in Indonesia. The real return on investment (ROI) needs to be calculated after factoring in inflation to determine the actual profit.

- Market Volatility: The bond market, like any other market, is subject to volatility. External economic factors, both domestic and global, can influence the value of the bond before maturity.

Who Should Consider this Investment?

This bond offering may be suitable for investors with a moderate-to-high-risk tolerance and a long-term investment horizon. It's particularly appealing to those:

- Seeking higher returns compared to low-yield savings accounts or government bonds.

- Comfortable with a moderate level of risk associated with corporate bonds.

- Possessing a long-term investment strategy and are not reliant on immediate liquidity.

The Bottom Line: Informed Decisions are Key

The Rp 1 trillion bond issuance by this Indonesian conglomerate presents both opportunities and challenges. The high interest rate is undoubtedly enticing, but investors should prioritize thorough research and understand the risks involved. Consult with a qualified financial advisor to assess whether this investment aligns with your individual financial goals and risk profile before making any decisions. Remember, informed investment decisions are crucial for mitigating potential losses and maximizing returns in the dynamic Indonesian investment market. Stay updated on financial news and market trends for the most current information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investasi Obligasi: Konglomerat Indonesia Rilis Obligasi Rp 1 Triliun, Bunga 9,3%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nuggets Vs Warriors Aaron Gordon Injury And Game Outlook

Mar 18, 2025

Nuggets Vs Warriors Aaron Gordon Injury And Game Outlook

Mar 18, 2025 -

When Will A Solana Spot Etf Launch Franklin Templeton Seeks Sec Approval

Mar 18, 2025

When Will A Solana Spot Etf Launch Franklin Templeton Seeks Sec Approval

Mar 18, 2025 -

Nuclear Saltwater Rocket Propulsion A Realistic Path To Faster Than Ever Space Travel

Mar 18, 2025

Nuclear Saltwater Rocket Propulsion A Realistic Path To Faster Than Ever Space Travel

Mar 18, 2025 -

Data Driven Golf Exploring The Rise Of Tech On The Course

Mar 18, 2025

Data Driven Golf Exploring The Rise Of Tech On The Course

Mar 18, 2025 -

Google Pixel 9a Benchmark Early Performance Hints Revealed

Mar 18, 2025

Google Pixel 9a Benchmark Early Performance Hints Revealed

Mar 18, 2025

Latest Posts

-

No Charges For Canadian Hockey Player Matt Petgrave In Adam Johnson Death

Apr 30, 2025

No Charges For Canadian Hockey Player Matt Petgrave In Adam Johnson Death

Apr 30, 2025 -

Arsenal Target Martinelli Willing To Fight For Starting Striker Role

Apr 30, 2025

Arsenal Target Martinelli Willing To Fight For Starting Striker Role

Apr 30, 2025 -

Investimentos Da Berkshire Greg Abel O Escolhido De Buffett Toma As Redeas

Apr 30, 2025

Investimentos Da Berkshire Greg Abel O Escolhido De Buffett Toma As Redeas

Apr 30, 2025 -

Exploring The Reasons Behind The Black Family Travel Boom

Apr 30, 2025

Exploring The Reasons Behind The Black Family Travel Boom

Apr 30, 2025 -

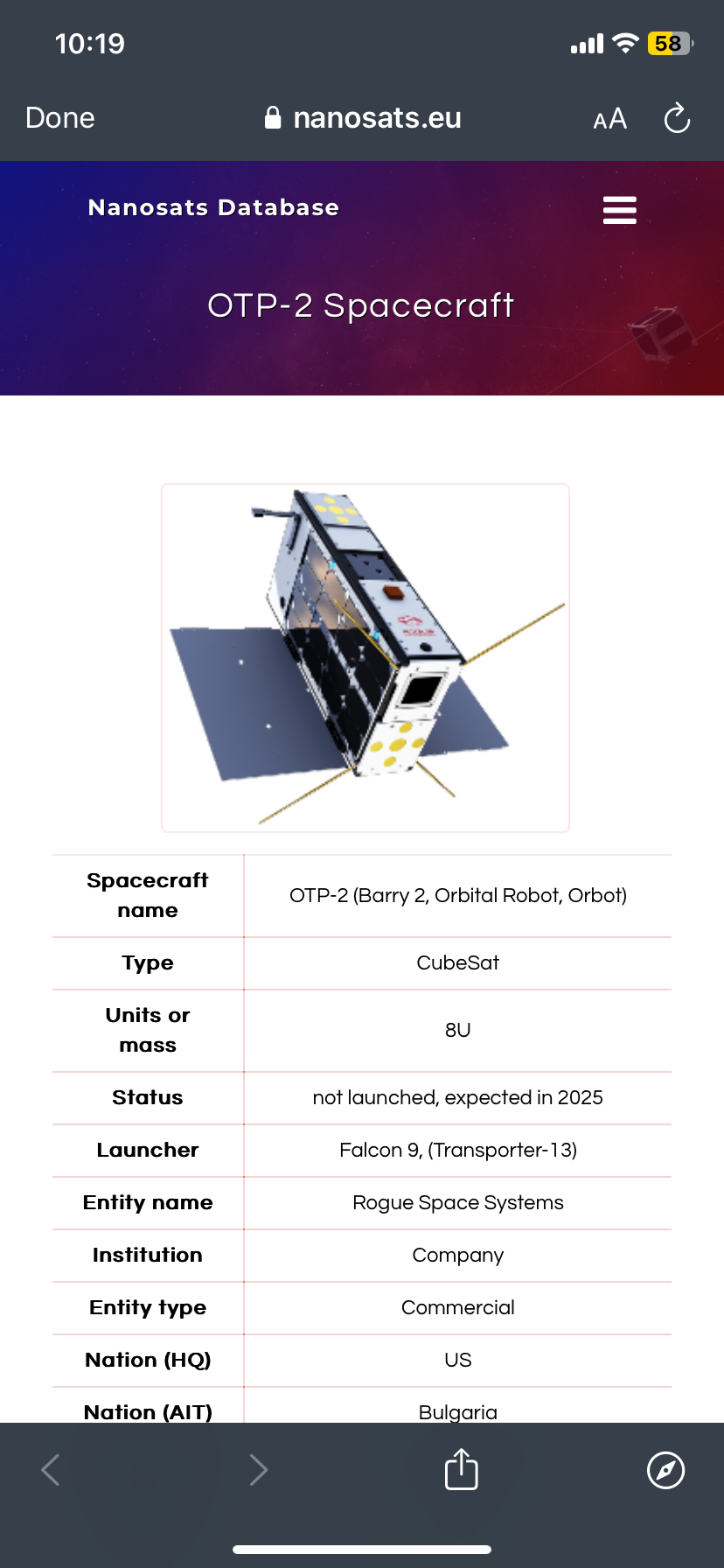

Two Novel Propulsion Experiments Reported On Otp 2

Apr 30, 2025

Two Novel Propulsion Experiments Reported On Otp 2

Apr 30, 2025