Investigating The Recent Lloyds, Halifax, And Nationwide UK Online Banking Outages

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investigating the Recent Lloyds, Halifax, and Nationwide UK Online Banking Outages: What Happened and What it Means for Customers

Millions of UK customers faced significant disruption last [Insert Date] when Lloyds Banking Group (which includes Halifax) and Nationwide Building Society experienced major online banking outages. This widespread failure left countless individuals and businesses unable to access their accounts, make payments, or manage their finances, sparking widespread concern and anger. This article delves into the details of the outages, explores potential causes, and examines the implications for customers and the future of digital banking security.

The Scale of the Disruption:

The outages weren't isolated incidents. Both Lloyds Banking Group and Nationwide reported significant difficulties accessing online and mobile banking services for several hours. Social media was flooded with complaints from frustrated customers, highlighting the widespread impact of the disruption. The sheer number of affected customers underlines the vulnerability of even the largest financial institutions to major technological failures. This incident served as a stark reminder of the crucial role online banking plays in modern life and the devastating consequences of such widespread service interruptions.

Potential Causes Under Scrutiny:

While neither Lloyds nor Nationwide has officially confirmed the root cause of their outages, speculation points towards several possibilities:

- Cyberattack: The possibility of a sophisticated cyberattack targeting the banking systems cannot be ruled out. While neither bank has explicitly stated this as the cause, the scale and nature of the outages raise concerns. Investigations are underway to determine if malicious activity played a role.

- System Failure: A major software glitch or hardware malfunction within the banks' infrastructure could have triggered the widespread service disruption. This scenario is plausible, given the complex systems involved in managing online banking services. Regular system maintenance and robust disaster recovery plans are crucial to mitigate such risks.

- Third-Party Provider Issues: Many banks rely on third-party providers for various aspects of their technology infrastructure. A failure within a third-party system could have cascading effects, impacting multiple banks simultaneously.

Implications for Customers and the Future of Online Banking:

The outages have raised several crucial questions about the reliability and security of online banking in the UK:

- Compensation for Customers: Customers who experienced financial hardship due to the outages are likely to demand compensation from the affected banks. The banks will need to address these claims fairly and transparently.

- Improved Resilience: The incident highlights the urgent need for banks to invest in more robust and resilient IT infrastructure. This includes enhanced cybersecurity measures, improved disaster recovery plans, and rigorous testing of systems.

- Customer Confidence: The outages could erode customer confidence in online banking, particularly among those already hesitant about the security of digital financial services. Banks must work to reassure their customers and demonstrate their commitment to reliable and secure online services.

What's Next?

The investigation into the Lloyds, Halifax, and Nationwide outages is ongoing. A thorough understanding of the root cause is crucial for preventing similar incidents in the future. The incident underscores the vital need for the banking sector to prioritize robust cybersecurity, reliable infrastructure, and transparent communication with customers during times of disruption. The outcome of this investigation will significantly influence the future of online banking security and customer trust in the UK. Stay tuned for further updates as the investigation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investigating The Recent Lloyds, Halifax, And Nationwide UK Online Banking Outages. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Crypto Holdings Bullish Signals Despite Analyst Concerns

Mar 04, 2025

Trumps Crypto Holdings Bullish Signals Despite Analyst Concerns

Mar 04, 2025 -

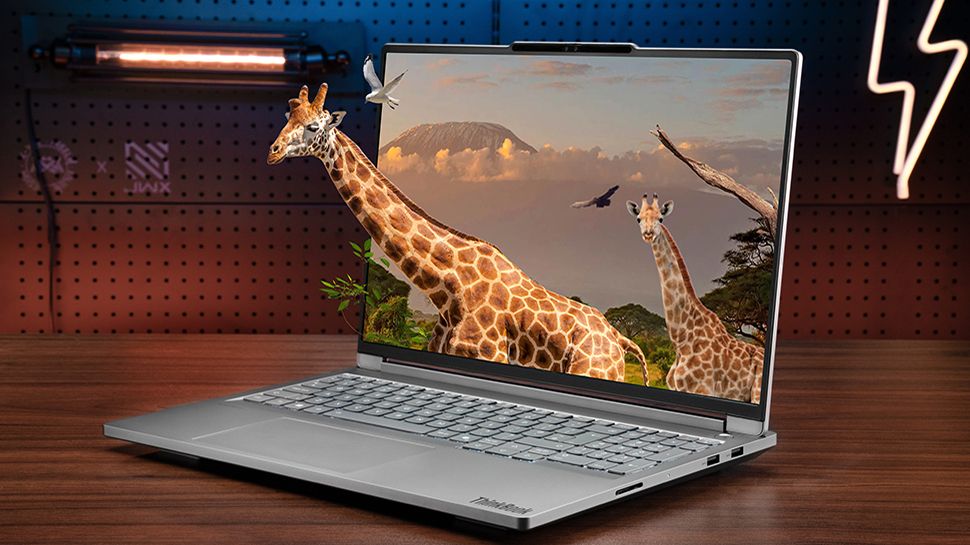

Lenovo Think Book 3 D Review High Quality But A Niche Market

Mar 04, 2025

Lenovo Think Book 3 D Review High Quality But A Niche Market

Mar 04, 2025 -

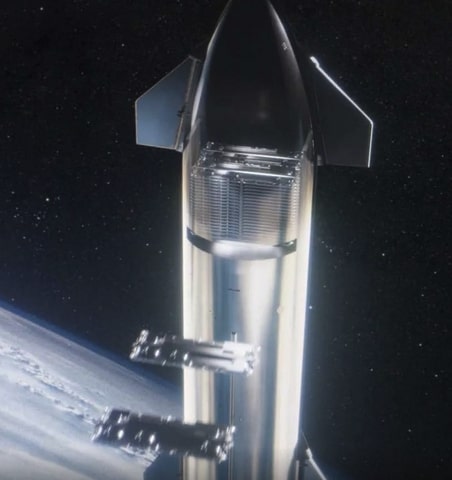

Starlink Reaches 5 Million Users Space Xs V3 Satellite Launch And Starship Reusability Plans

Mar 04, 2025

Starlink Reaches 5 Million Users Space Xs V3 Satellite Launch And Starship Reusability Plans

Mar 04, 2025 -

March 2025 Altcoin Outlook Identifying 3 Potential Breakout Candidates

Mar 04, 2025

March 2025 Altcoin Outlook Identifying 3 Potential Breakout Candidates

Mar 04, 2025 -

Exceptional Performance Mini Pc Undercuts Mac Studio And Nvidia Digits Pricing

Mar 04, 2025

Exceptional Performance Mini Pc Undercuts Mac Studio And Nvidia Digits Pricing

Mar 04, 2025