Investing $1000 In UnitedHealth Group: 2013 Vs. 2023

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing $1000 in UnitedHealth Group: A Decade of Growth (2013 vs. 2023)

The healthcare industry is a behemoth, and UnitedHealth Group (UNH) has consistently positioned itself as a leader. But how would a $1,000 investment in UNH in 2013 fare compared to holding it until 2023? This analysis dives into the decade-long performance, highlighting the potential rewards and risks of long-term investment in this healthcare giant.

2013: The Starting Line

In early 2013, UnitedHealth Group's stock price hovered around $60 per share. A $1,000 investment would have secured approximately 16 shares, excluding brokerage fees. At the time, the Affordable Care Act (ACA) was still relatively new, presenting both challenges and opportunities for the healthcare sector. The market was cautiously optimistic about UNH's future, with some analysts projecting steady growth fueled by an aging population and increasing demand for healthcare services.

2023: A Decade of Returns

Fast forward ten years, and the picture is significantly different. As of October 26, 2023, UNH's stock price sits considerably higher. While the exact price fluctuates daily, the significant growth is undeniable. A $1,000 investment in 2013 would have likely yielded a substantial return, significantly outpacing many other investments over the same period. This growth is attributable to several factors:

- Strong Financial Performance: UNH has consistently reported strong earnings and revenue growth, demonstrating its ability to navigate market challenges and capitalize on industry trends.

- Diversification: The company's diversified business model, encompassing insurance, healthcare services, and technology, has provided resilience against economic downturns and regulatory changes.

- Innovation and Technology: UNH's investments in technology and data analytics have enhanced operational efficiency and improved patient care, further boosting profitability.

- Aging Population: The increasing number of elderly individuals in the US and globally has fueled demand for healthcare services, directly benefiting UNH's core business.

Analyzing the Growth: More Than Just Numbers

While the precise return on investment (ROI) depends on the exact purchase and sale dates, and brokerage fees, it's clear that a $1,000 investment in UNH in 2013 would have generated a substantial profit in 2023. This showcases the power of long-term investing in a fundamentally strong company operating within a consistently growing sector.

Factors to Consider:

It's crucial to remember that past performance is not indicative of future results. Investing in the stock market always carries inherent risks, including:

- Market Volatility: Stock prices can fluctuate significantly, and unforeseen events can impact a company's performance.

- Regulatory Changes: Healthcare policy is constantly evolving, and regulatory changes could impact UNH's profitability.

- Competition: The healthcare industry is highly competitive, and UNH faces ongoing pressure from other major players.

Conclusion: A Long-Term Perspective

Investing in UnitedHealth Group in 2013 proved to be a rewarding decision for long-term investors. The significant growth over the past decade demonstrates the potential of strategic investment in established companies within robust sectors. However, potential investors should always conduct thorough research, understand the inherent risks, and consider their individual financial goals before making any investment decisions. This analysis serves as an illustrative example and shouldn't be considered financial advice. Consult with a qualified financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing $1000 In UnitedHealth Group: 2013 Vs. 2023. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Netflix Stock Market Volatility Linked To Tariff Uncertainty

Apr 08, 2025

Netflix Stock Market Volatility Linked To Tariff Uncertainty

Apr 08, 2025 -

Jadwal Dan Tim Peserta Esl Mobile Masters 2025 Fase Grup Panduan Lengkap

Apr 08, 2025

Jadwal Dan Tim Peserta Esl Mobile Masters 2025 Fase Grup Panduan Lengkap

Apr 08, 2025 -

Analyzing Space X Starships Potential For Global Cargo And Fuel Efficiency

Apr 08, 2025

Analyzing Space X Starships Potential For Global Cargo And Fuel Efficiency

Apr 08, 2025 -

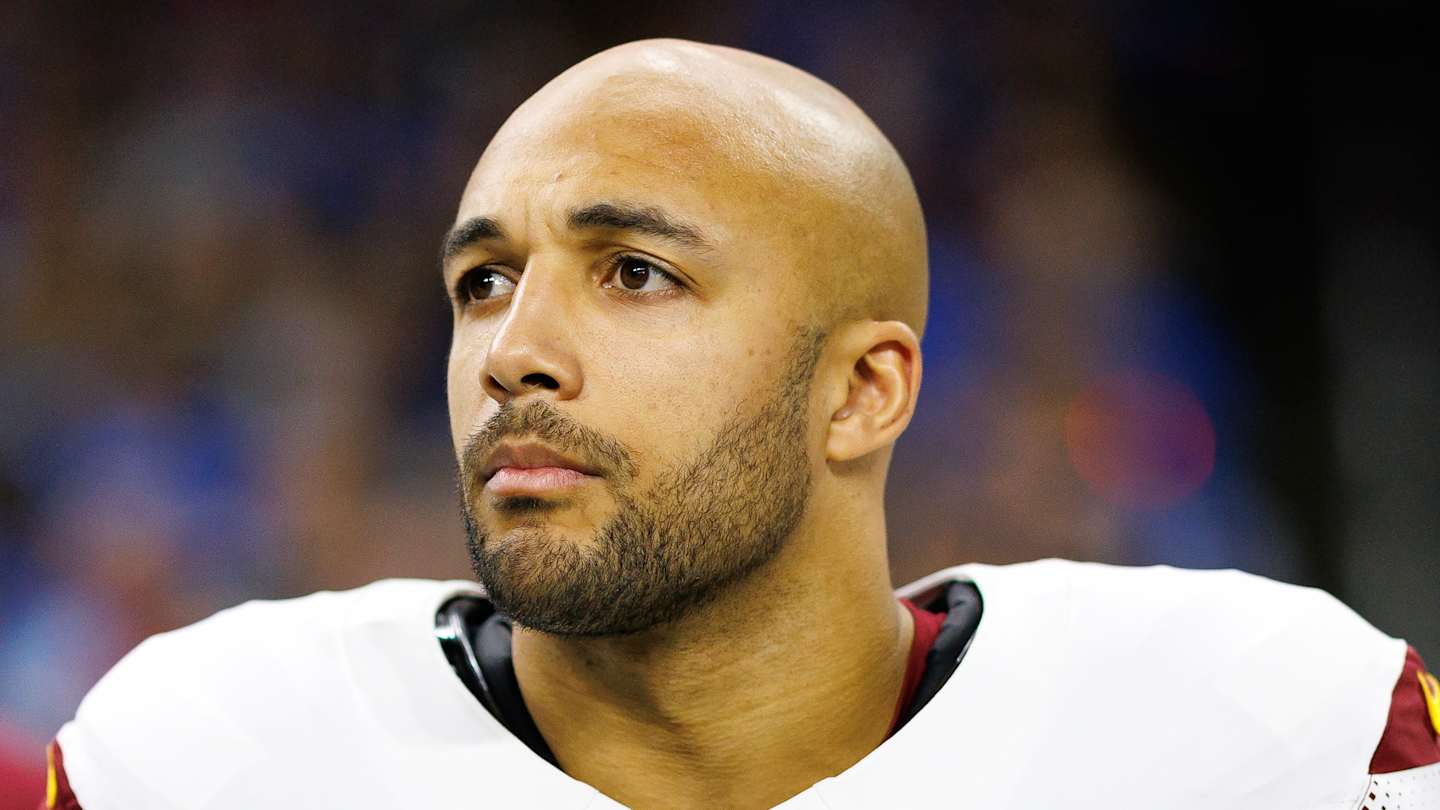

Washington Commanders 7 Veterans Possibly In Their Final Year

Apr 08, 2025

Washington Commanders 7 Veterans Possibly In Their Final Year

Apr 08, 2025 -

Esl Mobile Masters 2025 12 Tim Berebut Gelar Di Fase Grup Simak Jadwalnya

Apr 08, 2025

Esl Mobile Masters 2025 12 Tim Berebut Gelar Di Fase Grup Simak Jadwalnya

Apr 08, 2025