Investing After The Nasdaq Sell-Off: Palo Alto Networks Or Nvidia?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing After the Nasdaq Sell-Off: Palo Alto Networks or Nvidia?

The recent Nasdaq sell-off has left many investors wondering where to put their money. Two tech giants, Palo Alto Networks (PANW) and Nvidia (NVDA), offer compelling but distinct investment opportunities in the post-sell-off market. Both companies are leaders in their respective sectors, but their growth trajectories and risk profiles differ significantly. This article will delve into the strengths and weaknesses of each, helping you make an informed investment decision.

Understanding the Market Context: The Nasdaq's recent downturn, fueled by concerns about inflation, interest rate hikes, and a potential recession, has created a volatile investment landscape. However, this volatility also presents opportunities for savvy investors to acquire high-quality stocks at potentially discounted prices. Choosing between Palo Alto Networks and Nvidia requires a careful consideration of individual investment goals and risk tolerance.

Palo Alto Networks (PANW): Cybersecurity Stability in a Turbulent Market

Palo Alto Networks is a dominant player in the cybersecurity market. Its robust product portfolio, encompassing next-generation firewalls, cloud security, and threat intelligence, provides a relatively stable revenue stream even during economic uncertainty.

-

Strengths:

- Strong Market Position: PANW enjoys a significant market share in the enterprise cybersecurity sector.

- Recurring Revenue: A substantial portion of its revenue comes from subscription-based services, offering predictable and consistent income.

- Growth Potential: The cybersecurity market continues to expand rapidly, driven by increasing digitalization and evolving cyber threats.

-

Weaknesses:

- Higher Valuation: Compared to Nvidia, PANW trades at a relatively higher price-to-earnings ratio, reflecting its established position but potentially limiting upside potential.

- Competition: The cybersecurity market is increasingly competitive, with new players constantly emerging.

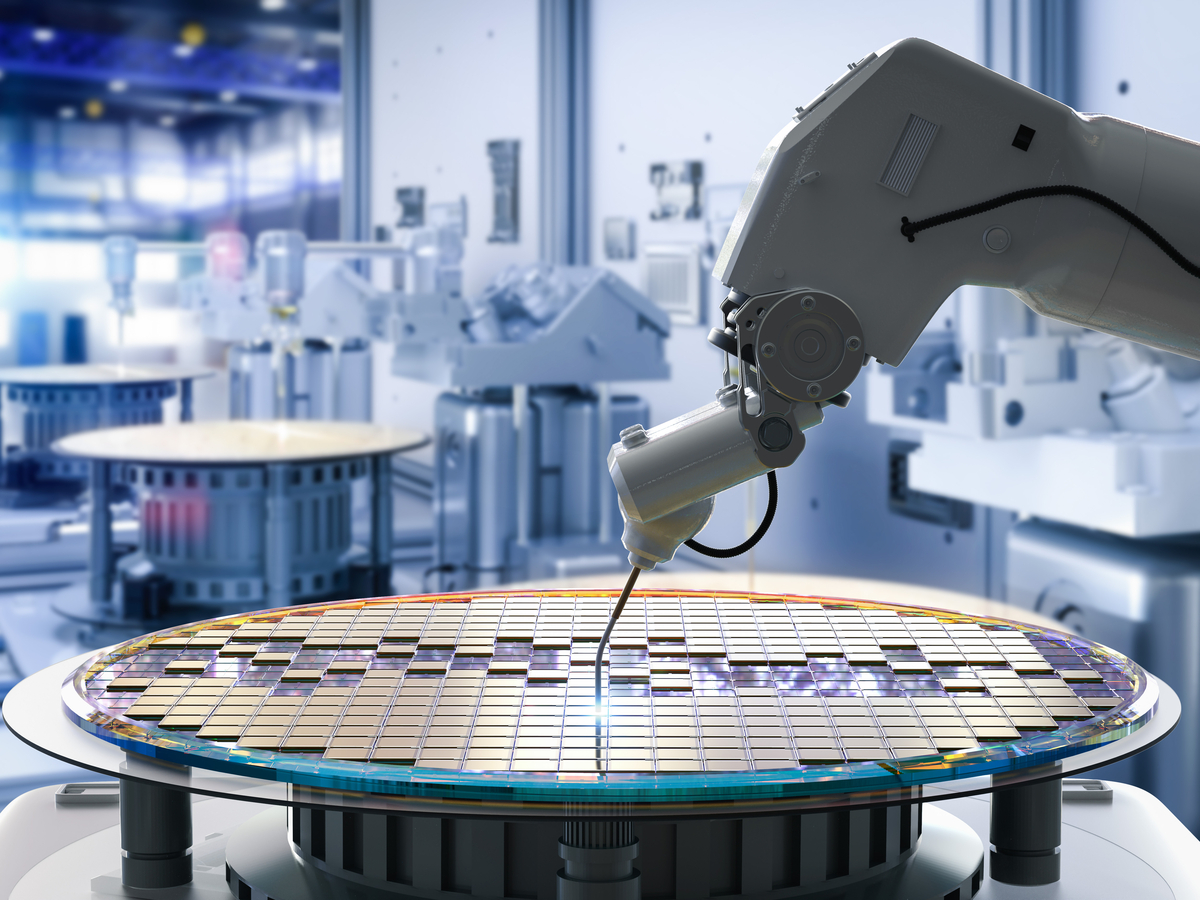

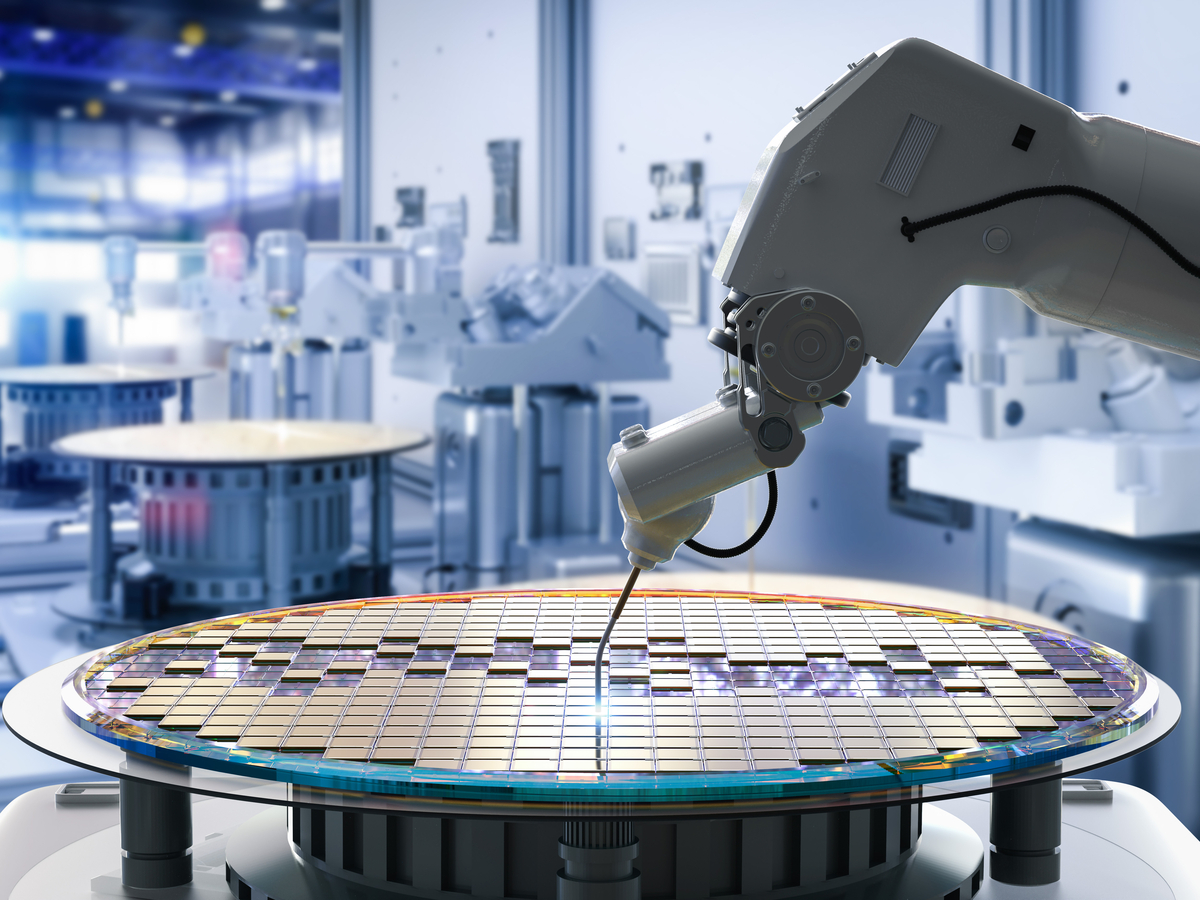

Nvidia (NVDA): Riding the AI Wave

Nvidia, a leading designer of graphics processing units (GPUs), is at the forefront of the artificial intelligence (AI) revolution. Its GPUs are crucial for powering AI and machine learning applications, positioning it for significant growth in this rapidly expanding sector.

-

Strengths:

- AI Dominance: NVDA is the dominant player in the GPU market, particularly for AI applications.

- High Growth Potential: The AI market is expected to experience explosive growth in the coming years, offering substantial potential for NVDA.

- Diversification: While AI is a primary driver, NVDA also operates in other high-growth markets like gaming and data centers.

-

Weaknesses:

- Higher Risk: The AI market is still relatively young and subject to significant volatility. Dependence on a single, rapidly evolving technology increases risk.

- Geopolitical Factors: NVDA's business is susceptible to geopolitical tensions, particularly concerning its reliance on manufacturing in certain regions.

Which Stock is Right for You?

The choice between Palo Alto Networks and Nvidia ultimately depends on your investment strategy and risk tolerance.

-

Conservative Investors: Palo Alto Networks offers a more stable, albeit potentially slower-growth, investment opportunity. Its recurring revenue model and established market position provide a degree of protection against market downturns.

-

Growth-Oriented Investors: Nvidia presents a higher-risk, higher-reward proposition. Its exposure to the booming AI market offers the potential for substantial returns, but also comes with greater volatility.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you should conduct thorough research and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing After The Nasdaq Sell-Off: Palo Alto Networks Or Nvidia?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jumlah Wisatawan Ikn Tembus 14 105 Dalam Sehari Rekor Tertinggi Baru

Apr 08, 2025

Jumlah Wisatawan Ikn Tembus 14 105 Dalam Sehari Rekor Tertinggi Baru

Apr 08, 2025 -

Live Updates Stock Market Collapse As Dow Futures Fall Sharply

Apr 08, 2025

Live Updates Stock Market Collapse As Dow Futures Fall Sharply

Apr 08, 2025 -

Samsung Galaxy S26 Ultra Leaks Suggest Revolutionary Camera Lens Magnet Removal

Apr 08, 2025

Samsung Galaxy S26 Ultra Leaks Suggest Revolutionary Camera Lens Magnet Removal

Apr 08, 2025 -

Avbrutna Planer Malmoe Far Inga Gratis Tagresor Foer Komplicerat

Apr 08, 2025

Avbrutna Planer Malmoe Far Inga Gratis Tagresor Foer Komplicerat

Apr 08, 2025 -

Il Passato Glorioso Della Sampdoria Un Eredita Per Il Presente

Apr 08, 2025

Il Passato Glorioso Della Sampdoria Un Eredita Per Il Presente

Apr 08, 2025