Investing In 2025: A Head-to-Head Analysis Of MicroStrategy (MSTR) And Bitcoin (BTC)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Investing in 2025: A Head-to-Head Analysis of MicroStrategy (MSTR) and Bitcoin (BTC)</h1>

The year is 2024, and investors are already looking ahead to 2025, strategizing their portfolios for potential growth. Two prominent players consistently in the conversation are MicroStrategy (MSTR), a business intelligence company with a massive Bitcoin holding, and Bitcoin (BTC) itself. But which is the better investment for 2025? This head-to-head analysis dives deep into both, weighing their respective strengths and risks.

<h2>MicroStrategy (MSTR): More Than Just Bitcoin</h2>

MicroStrategy, led by the outspoken Michael Saylor, has become synonymous with Bitcoin. Their substantial Bitcoin holdings represent a significant portion of their overall assets, making their stock price heavily correlated with BTC's performance. This presents a double-edged sword.

<h3>Advantages of Investing in MSTR:</h3>

- Exposure to Bitcoin without direct cryptocurrency ownership: For investors hesitant about the complexities of directly holding Bitcoin, MSTR offers a more traditional avenue for exposure.

- Potential for growth beyond Bitcoin: While Bitcoin is a major driver, MicroStrategy's core business in business intelligence still holds potential for independent growth and profitability.

- Established company with a track record: Unlike many crypto-centric ventures, MSTR has a long-standing history and established infrastructure.

<h3>Disadvantages of Investing in MSTR:</h3>

- High correlation with Bitcoin: MSTR's fortunes are largely tied to Bitcoin's price volatility, meaning substantial gains can be offset by equally significant losses.

- Dependence on Bitcoin's future performance: The success of MSTR is largely contingent upon Bitcoin's continued growth and adoption.

- Potential for regulatory challenges: The increasing regulatory scrutiny surrounding Bitcoin could negatively impact both Bitcoin and MSTR.

<h2>Bitcoin (BTC): The Original Cryptocurrency</h2>

Bitcoin, the pioneering cryptocurrency, continues to be a significant force in the digital asset landscape. Its decentralized nature, limited supply, and growing acceptance as a store of value attract investors seeking diversification and long-term growth.

<h3>Advantages of Investing in BTC:</h3>

- Decentralization and security: Bitcoin's decentralized nature makes it resistant to censorship and single points of failure.

- Limited supply: The capped supply of 21 million Bitcoin contributes to its potential scarcity value.

- Growing adoption and institutional interest: Increasing adoption by institutions and corporations is bolstering Bitcoin's legitimacy and potential for future growth.

<h3>Disadvantages of Investing in BTC:</h3>

- Extreme volatility: Bitcoin's price is notoriously volatile, subject to significant swings based on market sentiment and regulatory changes.

- Regulatory uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving, creating uncertainty for investors.

- Security risks associated with self-custody: Holding Bitcoin directly requires robust security measures to protect against theft or loss.

<h2>MSTR vs. BTC in 2025: The Verdict</h2>

Choosing between MicroStrategy and Bitcoin for 2025 depends heavily on your risk tolerance and investment strategy.

- For risk-averse investors seeking indirect Bitcoin exposure: MSTR offers a more traditional entry point with some diversification through its core business.

- For risk-tolerant investors seeking potentially higher returns: Direct Bitcoin investment offers greater upside potential but with significantly higher volatility.

Both MSTR and BTC present intriguing investment opportunities in 2025. However, conducting thorough due diligence, understanding the inherent risks, and aligning your investment choice with your personal risk profile is crucial for success in this dynamic market. Remember to consult with a financial advisor before making any investment decisions. The cryptocurrency market is highly speculative, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In 2025: A Head-to-Head Analysis Of MicroStrategy (MSTR) And Bitcoin (BTC). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rise In Covid 19 Infections In Singapore Authorities Confirm No Increased Severity Or Transmissibility

May 18, 2025

Rise In Covid 19 Infections In Singapore Authorities Confirm No Increased Severity Or Transmissibility

May 18, 2025 -

Increased Security At Ottawa City Hall New Visitor Protocols In Place

May 18, 2025

Increased Security At Ottawa City Hall New Visitor Protocols In Place

May 18, 2025 -

Tragedia No Rs 75 Vitimas Fatais 839 Mil Sem Agua E 420 Mil Sem Eletricidade Por Conta Das Chuvas

May 18, 2025

Tragedia No Rs 75 Vitimas Fatais 839 Mil Sem Agua E 420 Mil Sem Eletricidade Por Conta Das Chuvas

May 18, 2025 -

Ceremony In Rawalpindi Pays Respect To Pakistans Armed Forces

May 18, 2025

Ceremony In Rawalpindi Pays Respect To Pakistans Armed Forces

May 18, 2025 -

Cf Montreal Toronto Fc Rivalry Renewed In Conference Play

May 18, 2025

Cf Montreal Toronto Fc Rivalry Renewed In Conference Play

May 18, 2025

Latest Posts

-

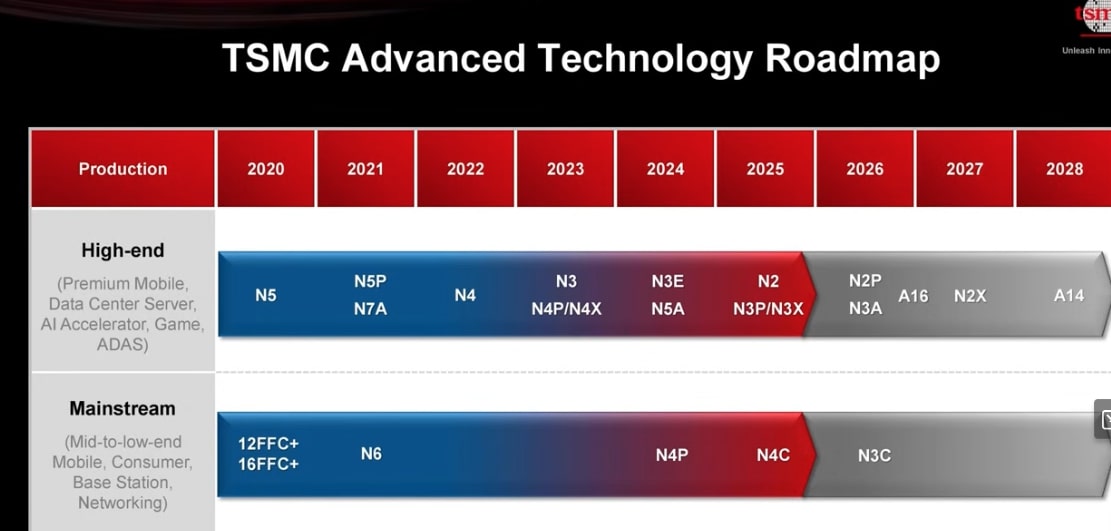

Tsmcs 1 4nm A14 Node And 2028 Roadmap A Deep Dive Into The 2025 Symposium

May 19, 2025

Tsmcs 1 4nm A14 Node And 2028 Roadmap A Deep Dive Into The 2025 Symposium

May 19, 2025 -

Aaron Gordon Injury Update Hamstring Strain And Game 7 Status

May 19, 2025

Aaron Gordon Injury Update Hamstring Strain And Game 7 Status

May 19, 2025 -

Everything We Know About Marvels Ironheart Release Cast And Plot

May 19, 2025

Everything We Know About Marvels Ironheart Release Cast And Plot

May 19, 2025 -

Roma Vs Udinese Tudor Demands All Out Performance

May 19, 2025

Roma Vs Udinese Tudor Demands All Out Performance

May 19, 2025 -

Project Vic Validation Logicubes Falcon Neo 2 Forensic Imager Now Vics Compliant

May 19, 2025

Project Vic Validation Logicubes Falcon Neo 2 Forensic Imager Now Vics Compliant

May 19, 2025