Investing In Crypto IPOs: A Deep Dive Into Circle, Bitkub, And Blockchain.com's Public Offerings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Crypto IPOs: A Deep Dive into Circle, Bitkub, and Blockchain.com's Public Offerings

The cryptocurrency market, once the exclusive domain of tech-savvy early adopters, is rapidly maturing. With the increasing mainstream adoption of digital assets, Initial Public Offerings (IPOs) from prominent crypto companies are becoming a hot topic for investors. This article delves into the recent and anticipated public offerings of three major players: Circle, Bitkub, and Blockchain.com, examining the potential risks and rewards of investing in this burgeoning sector.

Understanding the Crypto IPO Landscape

Investing in crypto IPOs presents a unique opportunity to gain exposure to the rapidly evolving digital asset ecosystem. Unlike traditional IPOs, crypto-related offerings often come with higher volatility and risk due to the inherent instability of the cryptocurrency market. Factors such as regulatory uncertainty, technological advancements, and market sentiment significantly impact the performance of these companies.

Circle: A Stablecoin Giant Takes the Leap

Circle, a leading provider of stablecoins like USDC, has already completed a significant fundraising round, setting the stage for a potential future IPO. Their established position in the market, coupled with their focus on regulatory compliance, makes them an attractive prospect for investors seeking relatively less volatile exposure to the crypto space. However, the success of their potential IPO hinges heavily on the continued growth and adoption of stablecoins and their ability to navigate evolving regulatory landscapes.

Bitkub: Southeast Asia's Crypto Exchange Enters the Public Market

Bitkub, a prominent cryptocurrency exchange in Thailand, has already completed its IPO, marking a significant milestone for the Southeast Asian crypto market. Its success provides valuable insights into the potential of regional crypto exchanges to attract investors. However, the inherent risks associated with exchange-based investments, including security breaches and regulatory challenges specific to the region, should be carefully considered.

Blockchain.com: A Global Platform Eyes Public Listing

Blockchain.com, a well-established cryptocurrency platform offering a range of services including wallets and exchange functionalities, is anticipated to pursue a public listing. Its global reach and diverse product offerings present a compelling investment case. Yet, investors need to assess the competitive landscape, technological innovations, and the company's ability to maintain its market share amidst increasing competition.

Key Considerations for Investing in Crypto IPOs

- Due Diligence is Paramount: Thorough research into the company's financials, management team, technology, and regulatory compliance is crucial.

- Risk Tolerance: Crypto IPOs are inherently high-risk investments. Only invest capital you can afford to lose.

- Market Volatility: The cryptocurrency market is known for its volatility. Be prepared for significant price fluctuations.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving. Stay informed about potential changes.

- Diversification: Diversifying your portfolio across multiple asset classes is vital to mitigate risk.

Conclusion: Navigating the Opportunities and Challenges

Investing in crypto IPOs offers exciting opportunities for investors to participate in the growth of the digital asset sector. However, it's critical to approach these investments with caution, conducting thorough due diligence, understanding the inherent risks, and carefully managing your portfolio. Circle, Bitkub, and Blockchain.com represent just a few examples of the growing number of crypto companies entering the public market; the future of this sector is dynamic, presenting both significant potential rewards and substantial risks. Careful consideration and a well-defined investment strategy are key to navigating this evolving landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Crypto IPOs: A Deep Dive Into Circle, Bitkub, And Blockchain.com's Public Offerings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Galvin Faces 2 Million Dilemma Competing Nrl Offers Revealed

May 23, 2025

Galvin Faces 2 Million Dilemma Competing Nrl Offers Revealed

May 23, 2025 -

Octopus Energys Tenant Power Tariff Save Social Housing Tenants Up To 200 Yearly

May 23, 2025

Octopus Energys Tenant Power Tariff Save Social Housing Tenants Up To 200 Yearly

May 23, 2025 -

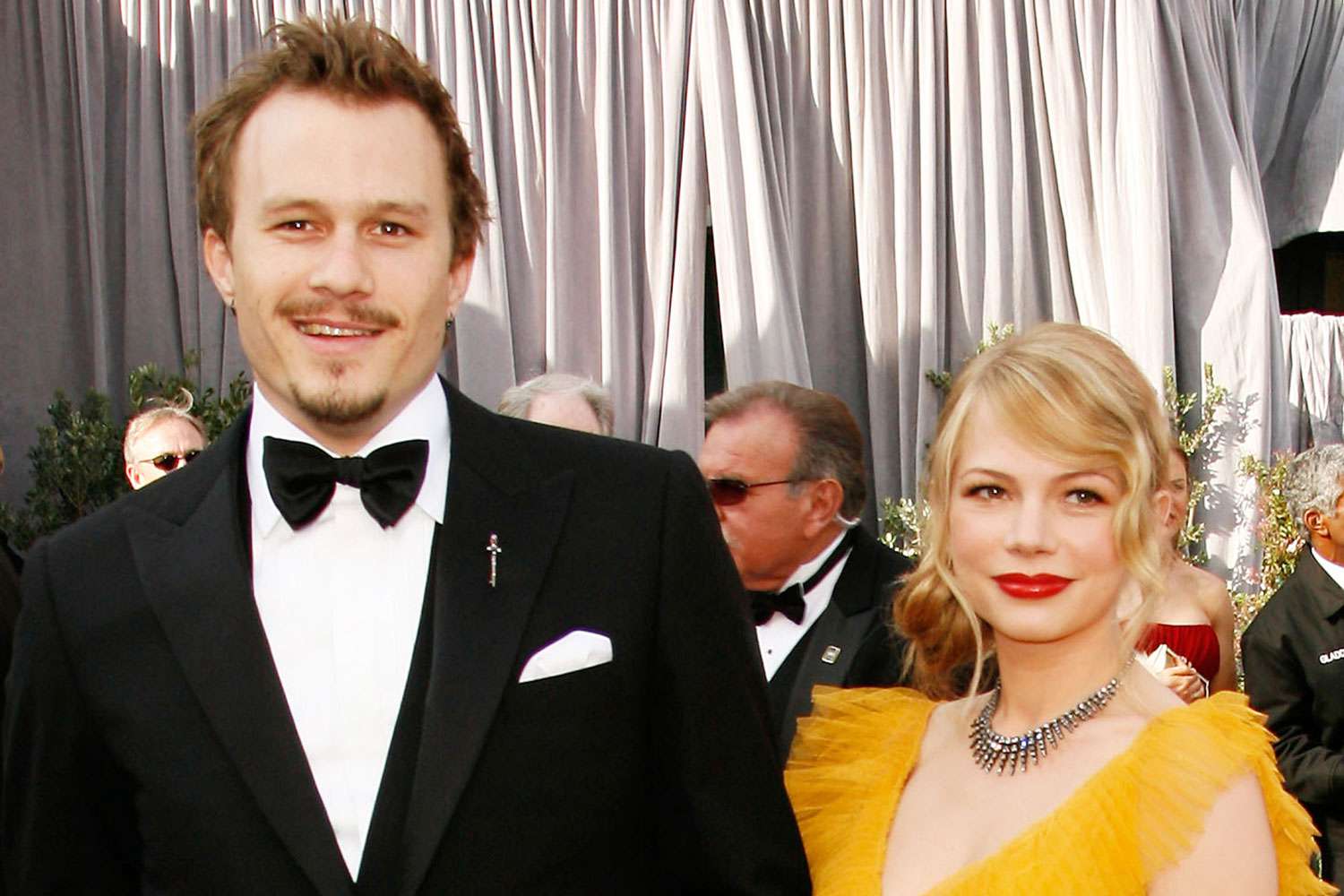

Michelle Williams On Heath Ledger A Daughters Love And A Fathers Legacy

May 23, 2025

Michelle Williams On Heath Ledger A Daughters Love And A Fathers Legacy

May 23, 2025 -

Ana De Armas Attends John Wick Ballerina Premiere Without Rumored Boyfriend Tom Cruise

May 23, 2025

Ana De Armas Attends John Wick Ballerina Premiere Without Rumored Boyfriend Tom Cruise

May 23, 2025 -

Dyson Pencil Vac Thin Design Powerful Suction A Complete Review

May 23, 2025

Dyson Pencil Vac Thin Design Powerful Suction A Complete Review

May 23, 2025

Latest Posts

-

Amy Schumer 45 Million Fortune Fuels Impressive Real Estate Holdings

May 23, 2025

Amy Schumer 45 Million Fortune Fuels Impressive Real Estate Holdings

May 23, 2025 -

Bet On Netflix Is This Manga Adaptation Worth Watching A Critical Review

May 23, 2025

Bet On Netflix Is This Manga Adaptation Worth Watching A Critical Review

May 23, 2025 -

Fountain Of Youth Eiza Gonzalez Habla De Su Experiencia Con El Director Guy Ritchie

May 23, 2025

Fountain Of Youth Eiza Gonzalez Habla De Su Experiencia Con El Director Guy Ritchie

May 23, 2025 -

Planning Your Trip Hay Festival Shuttle Bus From Worcester And Hereford

May 23, 2025

Planning Your Trip Hay Festival Shuttle Bus From Worcester And Hereford

May 23, 2025 -

Venus Aerospace Achieves First Flight With Innovative Rotating Detonation Engine Technology

May 23, 2025

Venus Aerospace Achieves First Flight With Innovative Rotating Detonation Engine Technology

May 23, 2025