Investing In META Stock: Weighing The Risks And Rewards After The US-China Trade Agreement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in META Stock: Weighing the Risks and Rewards After the US-China Trade Agreement

The recent US-China trade agreement has sent ripples throughout the global economy, impacting various sectors and prompting investors to re-evaluate their portfolios. Meta Platforms (META), formerly Facebook, is no exception. While the agreement offers potential benefits, it also introduces new complexities for the tech giant, leaving investors to carefully weigh the risks and rewards before investing in META stock.

The Impact of the US-China Trade Agreement on META

The agreement's impact on META is multifaceted. While it reduces immediate trade tensions, the long-term effects remain uncertain. Here's a breakdown:

-

Reduced Uncertainty: The agreement provides a degree of stability, reducing the uncertainty that previously hampered investment decisions. This improved predictability can boost investor confidence.

-

Access to Chinese Markets: While not explicitly addressing META's specific operations, the broader easing of trade restrictions could indirectly benefit the company by facilitating easier access to the vast Chinese market, a significant potential growth area. However, navigating China's regulatory landscape remains a significant challenge.

-

Increased Competition: The agreement may also lead to increased competition from Chinese tech companies, particularly in areas like artificial intelligence and virtual reality, where META is heavily invested. This heightened competition could pressure META's profit margins.

Analyzing the Risks of Investing in META Stock

Despite the potential upsides, several risks remain associated with investing in META:

-

Regulatory Scrutiny: META faces ongoing regulatory scrutiny globally concerning data privacy, antitrust issues, and the spread of misinformation. These challenges could lead to hefty fines, operational restrictions, or even break-ups, negatively impacting the stock price.

-

Advertising Revenue Dependence: META's revenue is heavily reliant on advertising revenue. Any significant downturn in the advertising market, potentially linked to economic slowdowns or changes in digital advertising trends, could severely impact META's profitability.

-

Competition from other Tech Giants: META faces fierce competition from other tech giants like Google (Alphabet), Amazon, and Apple, all vying for market share in various segments, including social media, advertising, and cloud computing.

The Rewards of Investing in META Stock

Despite the risks, META stock also presents several potential rewards:

-

Market Dominance: META remains a dominant player in social media, with billions of users across its platforms (Facebook, Instagram, WhatsApp). This vast user base provides a solid foundation for future growth.

-

Innovation in Metaverse Technologies: META is heavily invested in developing metaverse technologies, a potentially revolutionary area with immense long-term growth potential. Success in this field could significantly boost the company's value.

-

Strong Brand Recognition: The Facebook brand, despite recent controversies, enjoys incredibly high brand recognition globally, giving META a competitive edge.

Conclusion: A Calculated Investment

Investing in META stock after the US-China trade agreement requires a careful assessment of both the potential rewards and risks. While the agreement brings a degree of stability, ongoing regulatory challenges, competition, and reliance on advertising revenue remain significant concerns. Investors should thoroughly research the company's financials, consider their risk tolerance, and diversify their portfolios before making any investment decisions. The potential for significant returns in the metaverse and continued dominance in social media should be weighed against the inherent risks involved. Conducting independent due diligence is crucial before investing in any stock, and seeking professional financial advice is always recommended.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In META Stock: Weighing The Risks And Rewards After The US-China Trade Agreement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Capitals De Washington Humilies Par Les Hurricanes Defaite 5 2

May 13, 2025

Capitals De Washington Humilies Par Les Hurricanes Defaite 5 2

May 13, 2025 -

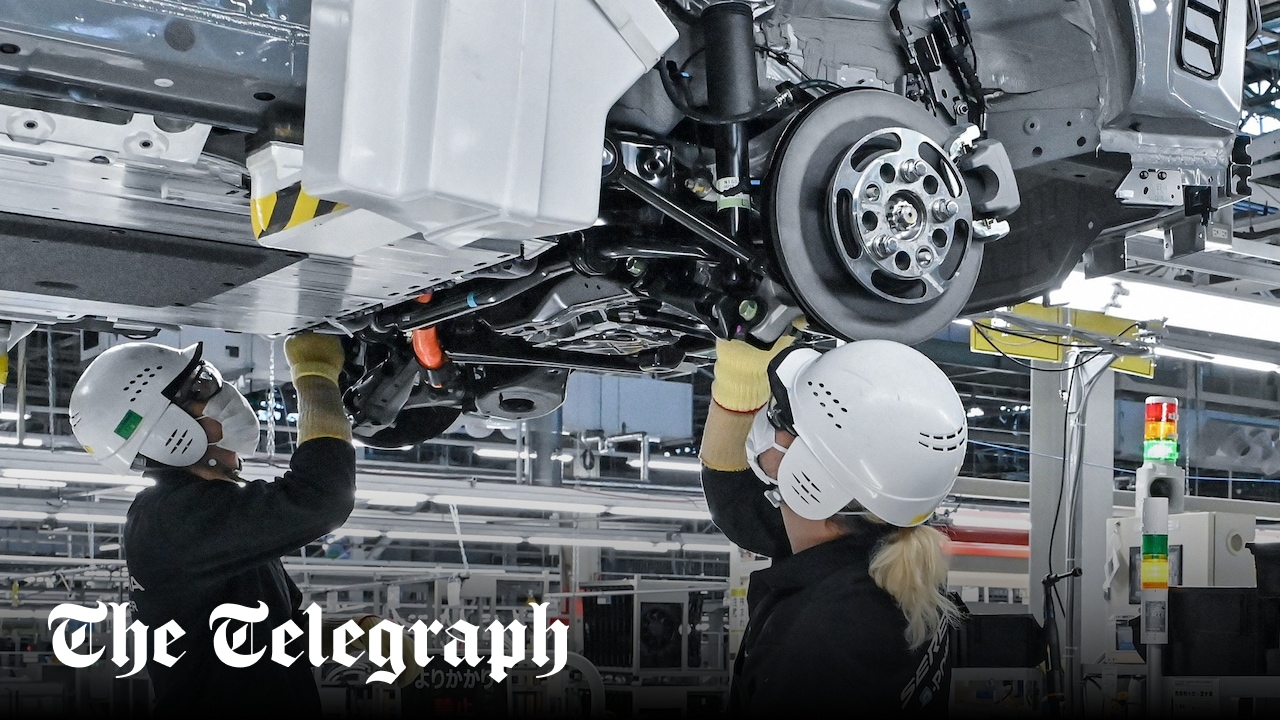

20 000 Job Losses Announced By Nissan Impact On Global Operations

May 13, 2025

20 000 Job Losses Announced By Nissan Impact On Global Operations

May 13, 2025 -

Crypto Debit Cards Spending Made Easy With Stablecoins

May 13, 2025

Crypto Debit Cards Spending Made Easy With Stablecoins

May 13, 2025 -

Invista Em Cotas Praia E Campo Com Baixo Investimento Inicial Em Imoveis

May 13, 2025

Invista Em Cotas Praia E Campo Com Baixo Investimento Inicial Em Imoveis

May 13, 2025 -

Buffett Confirma Greg Abel Lidereara As Decisoes De Investimento Da Berkshire Hathaway

May 13, 2025

Buffett Confirma Greg Abel Lidereara As Decisoes De Investimento Da Berkshire Hathaway

May 13, 2025

Latest Posts

-

Les Hurricanes A Un Match De La Finale De L Est Grace A Un But Decisif De Hall

May 13, 2025

Les Hurricanes A Un Match De La Finale De L Est Grace A Un But Decisif De Hall

May 13, 2025 -

Gerdau Operacoes Suspensas No Rs Apos Fortes Chuvas

May 13, 2025

Gerdau Operacoes Suspensas No Rs Apos Fortes Chuvas

May 13, 2025 -

Investissements Et Echanges Le Maroc Et L Arabie Saoudite Developpent Leur Cooperation Logistique

May 13, 2025

Investissements Et Echanges Le Maroc Et L Arabie Saoudite Developpent Leur Cooperation Logistique

May 13, 2025 -

Walton Goggins Of The White Lotus A Powerful Message About Love Resilience And Family

May 13, 2025

Walton Goggins Of The White Lotus A Powerful Message About Love Resilience And Family

May 13, 2025 -

Russias Victory Day Parade 2024 Weapons Troops And Putins Message

May 13, 2025

Russias Victory Day Parade 2024 Weapons Troops And Putins Message

May 13, 2025