Investing In Nvidia: Three Reasons To Act Today

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Nvidia: Three Reasons to Act Today

The tech world is buzzing, and Nvidia (NVDA) is at the center of the storm. This isn't just hype; Nvidia's current trajectory presents a compelling investment opportunity, and for savvy investors, the time to act is now. This article explores three key reasons why adding Nvidia to your portfolio today could be a smart move.

H2: 1. The Unstoppable Rise of AI: Nvidia's Core Advantage

Artificial intelligence is no longer a futuristic concept; it's reshaping industries at an unprecedented pace. From self-driving cars to advanced medical imaging, AI is everywhere, and Nvidia is at the forefront, supplying the crucial computing power that fuels this revolution. Their GPUs (Graphics Processing Units), originally designed for gaming, have proven exceptionally well-suited for the complex calculations required by AI and machine learning. This isn't a passing trend; AI adoption is accelerating, and Nvidia is perfectly positioned to capitalize on this explosive growth. This makes Nvidia stock a strong candidate for long-term growth fueled by the expanding AI market.

- High Demand: The demand for Nvidia's high-performance computing chips significantly outpaces supply, resulting in strong pricing power and substantial revenue growth.

- Data Center Dominance: Nvidia's data center business is booming, driven by the increasing need for AI processing in cloud computing and various industries.

- Innovation: Nvidia consistently pushes the boundaries of GPU technology, ensuring it stays ahead of the competition and maintains its market leadership.

H2: 2. Beyond AI: A Diversified Portfolio of Growth Opportunities

While AI is a major driver of Nvidia's success, it's not their only avenue for growth. The company is also making significant strides in other areas, including:

- Gaming: Nvidia remains a dominant player in the gaming industry, providing high-performance GPUs for gamers worldwide. This segment continues to generate significant revenue and provides a solid foundation for the company's overall performance.

- Automotive: Nvidia's automotive platform, DRIVE, is powering the development of autonomous vehicles. As the self-driving car market matures, this segment holds immense potential for future growth.

- Professional Visualization: Nvidia's GPUs are used extensively in professional fields like design, architecture, and filmmaking, providing another reliable source of revenue.

H3: Reduced Risk Through Diversification: Nvidia's diversified business model mitigates the risk associated with relying solely on a single technology. This broad portfolio of growth opportunities makes it a more attractive investment than companies solely focused on the AI sector.

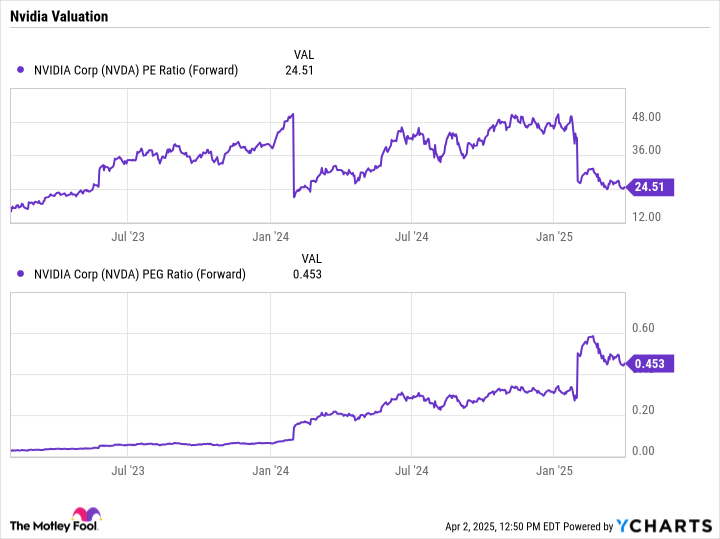

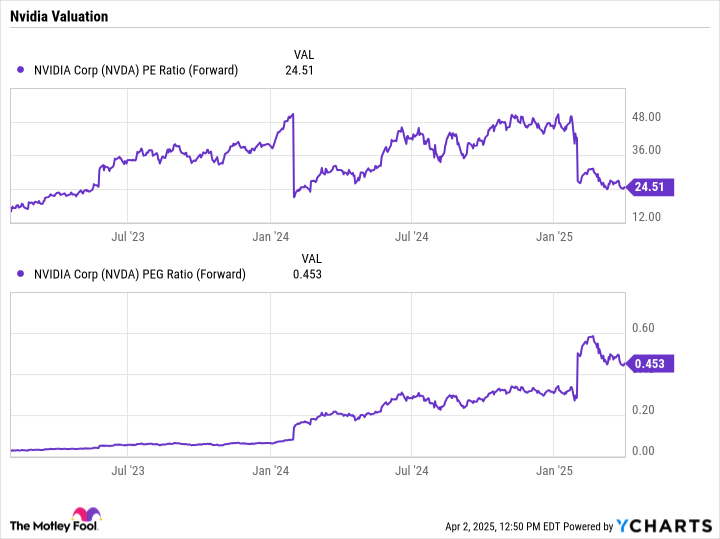

H2: 3. Strong Financial Performance and Future Outlook

Nvidia's financial results consistently exceed expectations, showcasing its strong market position and the effectiveness of its business strategy. Analysts predict continued growth in the coming years, fueled by the ongoing expansion of AI and other key markets. This positive outlook makes Nvidia stock an attractive prospect for investors seeking both short-term gains and long-term growth.

- Consistent Revenue Growth: Nvidia's revenue has shown consistent year-over-year growth, indicating strong demand for its products and services.

- Positive Earnings: The company has consistently delivered positive earnings, demonstrating its profitability and financial strength.

- Analyst Ratings: Many leading financial analysts maintain a positive outlook on Nvidia's stock, further reinforcing its investment potential.

H2: Conclusion: Seizing the Nvidia Opportunity

Investing in Nvidia is not without risk, as with any stock. However, the company's strong financial performance, its position at the heart of the AI revolution, and its diverse portfolio of growth opportunities make it a compelling investment option for those looking to capitalize on the future of technology. The time to consider adding Nvidia to your portfolio may well be today. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Nvidia: Three Reasons To Act Today. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Norfolk Island Business Owners Face Unique Us Tariff Challenge

Apr 08, 2025

Norfolk Island Business Owners Face Unique Us Tariff Challenge

Apr 08, 2025 -

Epic Games Fortnite Update 34 30 Server Outage And Maintenance Schedule

Apr 08, 2025

Epic Games Fortnite Update 34 30 Server Outage And Maintenance Schedule

Apr 08, 2025 -

Rekor Kunjungan Ikn Tembus 14 105 Wisatawan Faktor Penyebab Dan Dampaknya

Apr 08, 2025

Rekor Kunjungan Ikn Tembus 14 105 Wisatawan Faktor Penyebab Dan Dampaknya

Apr 08, 2025 -

Ahl Hockey Rocket Secure Point Thanks To Primeaus Stellar Goaltending

Apr 08, 2025

Ahl Hockey Rocket Secure Point Thanks To Primeaus Stellar Goaltending

Apr 08, 2025 -

Victorian Man Dead On Property Another Hospitalized Under Police Guard

Apr 08, 2025

Victorian Man Dead On Property Another Hospitalized Under Police Guard

Apr 08, 2025