Investing In QUBT: A Pre-Earnings Analysis Of Quantum Computing Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in QUBT: A Pre-Earnings Analysis of Quantum Computing Stock

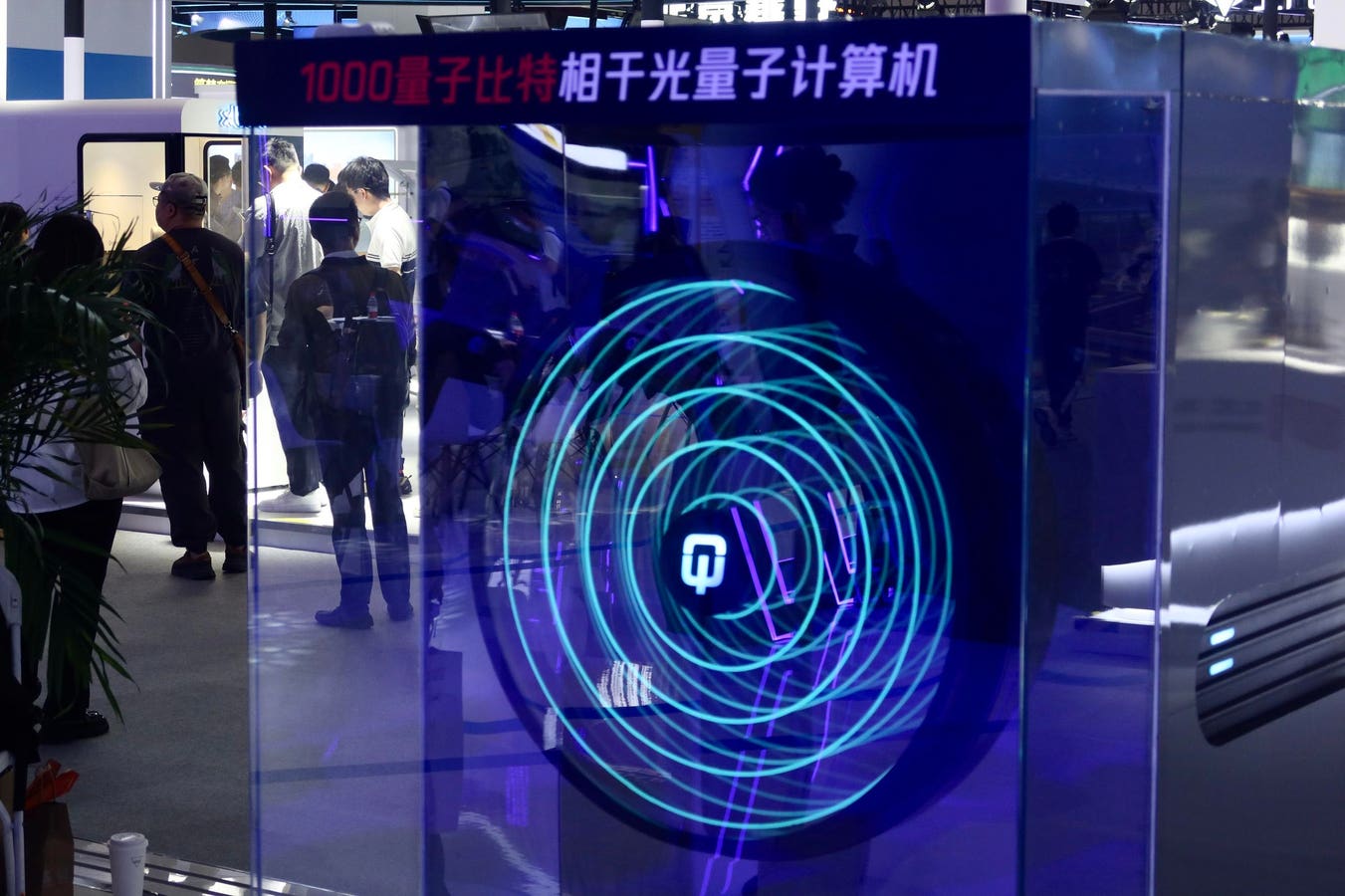

The quantum computing sector is poised for explosive growth, and QUBT (a hypothetical ticker symbol representing a quantum computing company) is at the forefront. As investors eagerly await QUBT's upcoming earnings report, understanding the company's trajectory and potential is crucial for making informed investment decisions. This pre-earnings analysis delves into the key factors that will likely shape QUBT's performance and its implications for investors.

QUBT's Position in the Quantum Computing Landscape

Quantum computing, a field aiming to solve currently intractable problems, is attracting significant investment. Companies like QUBT are leading the charge in developing and commercializing this disruptive technology. Their focus on [mention QUBT's specific area of expertise, e.g., developing advanced quantum algorithms, building cutting-edge quantum hardware, or providing cloud-based quantum computing services] sets them apart in a rapidly evolving market. The company's recent partnerships with [mention key partners, if any] further strengthen its position and indicate a promising future.

Key Factors to Watch in QUBT's Earnings Report:

- Revenue Growth: The rate of revenue growth will be a critical indicator of QUBT's market penetration and the adoption of its quantum computing solutions. Analysts will be closely scrutinizing this metric to gauge the company's overall financial health.

- Research and Development (R&D) Expenditure: Significant investment in R&D is essential for staying competitive in the quantum computing race. Investors should examine QUBT's R&D spending to assess its commitment to innovation and long-term growth potential. A substantial increase in R&D could signal ambitious plans for future breakthroughs.

- Customer Acquisition: Securing new customers, particularly large enterprises and government agencies, is vital for QUBT's success. The earnings report should shed light on the company's progress in expanding its customer base and building strategic partnerships.

- Profitability: While profitability might not be expected in the early stages of a high-growth technology company, the direction of the company's operating margins will offer valuable insight into its financial sustainability.

- Guidance: The management's outlook for future quarters will be a key factor influencing investor sentiment. Positive guidance indicating strong revenue growth and expanding market share would likely boost investor confidence.

Risks to Consider:

Investing in QUBT, like any quantum computing stock, carries inherent risks. These include:

- Technological challenges: The development of quantum computing is complex and faces significant technological hurdles. Setbacks in research and development could negatively impact the company's progress.

- Competition: The quantum computing field is highly competitive, with several major players vying for market dominance. Intense competition could pressure QUBT's pricing and market share.

- Regulatory uncertainty: The regulatory landscape for quantum computing is still evolving, and changes in regulations could impact the company's operations.

Investment Implications:

The upcoming earnings report will offer crucial information for investors considering adding QUBT to their portfolio. A strong performance, showing robust revenue growth, strategic partnerships, and a positive outlook, would likely drive up the stock price. However, a disappointing report could lead to a decline. Investors should carefully weigh the potential rewards against the inherent risks before making any investment decisions. It's advisable to consult with a financial advisor before investing in any stock, particularly in a high-growth sector like quantum computing.

Conclusion:

QUBT presents an exciting investment opportunity in the burgeoning quantum computing sector. While the risks are undeniable, the potential rewards are significant. Thorough analysis of the upcoming earnings report, alongside a comprehensive understanding of the broader quantum computing landscape, will be key to making informed and strategic investment decisions. Keep an eye on the post-earnings market reaction for a clearer picture of investor sentiment. Remember to always conduct your own thorough research before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In QUBT: A Pre-Earnings Analysis Of Quantum Computing Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Western Uniteds Semi Final Squad Ins And Outs Revealed

May 17, 2025

Western Uniteds Semi Final Squad Ins And Outs Revealed

May 17, 2025 -

Major Ice Cream And Frozen Yogurt Recall Over 20 Varieties Contaminated With Plastic

May 17, 2025

Major Ice Cream And Frozen Yogurt Recall Over 20 Varieties Contaminated With Plastic

May 17, 2025 -

Gloom Descends Record Low In Us Consumer Confidence

May 17, 2025

Gloom Descends Record Low In Us Consumer Confidence

May 17, 2025 -

Production Shutdown At Top Us Steel Company After Cyber Breach

May 17, 2025

Production Shutdown At Top Us Steel Company After Cyber Breach

May 17, 2025 -

Tumor Niche Taurine And Glycolysis A New Pathway In Leukemia Development

May 17, 2025

Tumor Niche Taurine And Glycolysis A New Pathway In Leukemia Development

May 17, 2025