Investing In QUBT: Analyzing Quantum Computing Stock Before Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in QUBT: Analyzing Quantum Computing Stock Before Earnings

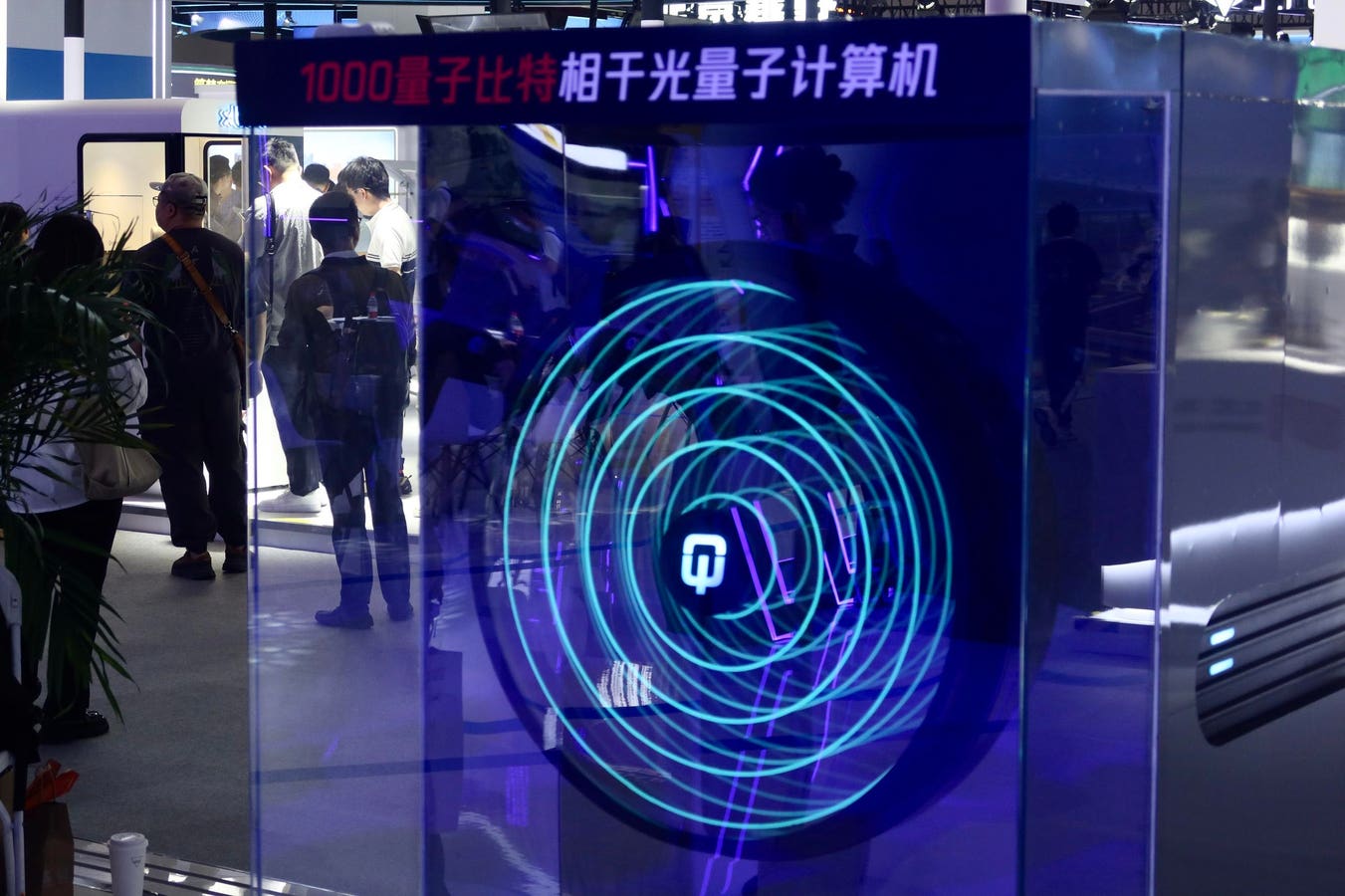

Quantum computing is no longer a futuristic fantasy; it's rapidly becoming a reality, sparking significant interest among investors. One company at the forefront of this technological revolution is Quantum Computing Inc. (QUBT), and with earnings season approaching, now is the crucial time to analyze QUBT stock and determine if it's a worthwhile investment. This article will delve into the key factors to consider before QUBT releases its earnings report.

The Allure of Quantum Computing and QUBT's Position

The potential applications of quantum computing are vast, spanning drug discovery, materials science, financial modeling, and artificial intelligence. This transformative technology promises to solve complex problems currently intractable for even the most powerful classical computers. QUBT, a leader in the field, is developing and commercializing quantum computing solutions, making it a compelling stock for those seeking exposure to this burgeoning market. Their focus on practical applications and strategic partnerships sets them apart from many competitors still in the research phase.

Analyzing QUBT Stock Before Earnings: Key Factors

Several key factors should inform your investment decision before QUBT announces its earnings:

1. Recent Developments and Partnerships: Pay close attention to any recent announcements regarding new partnerships, technological advancements, or successful product deployments. These events often significantly impact stock price. Look for news regarding collaborations with major corporations or research institutions. A strong pipeline of partnerships generally indicates positive future growth.

2. Revenue Growth and Financial Performance: Examine QUBT's historical financial performance, including revenue growth, profitability (or lack thereof), and operating expenses. While many quantum computing companies are still in early stages and may not be profitable, consistent revenue growth is a positive sign indicating market traction. Compare their performance to competitors within the industry to gain perspective.

3. Industry Trends and Competition: The quantum computing sector is evolving rapidly. Understanding broader market trends, such as government investment in quantum research and the competitive landscape, is crucial. Analyze the competitive strengths and weaknesses of QUBT compared to other players in the field. This will help you assess their long-term potential.

4. Management Team and Expertise: A strong management team with proven expertise in quantum computing and business acumen is essential for a company's success. Research the backgrounds and experience of QUBT's leadership to gauge their ability to navigate the challenges and opportunities of this rapidly developing sector.

5. Analyst Ratings and Price Targets: Before making any investment decisions, consult reputable financial analysts' reports and price targets for QUBT stock. These reports can provide valuable insights based on thorough research and analysis. Remember, however, that analyst opinions are not guarantees of future performance.

6. Understanding the Risks: Investing in QUBT, or any early-stage technology company, involves inherent risks. The quantum computing market is still developing, and there's no guarantee of future success. Potential challenges include technological hurdles, intense competition, and the need for substantial capital investment.

Making Informed Investment Decisions

Investing in QUBT requires careful consideration of the factors outlined above. Conduct thorough due diligence, diversify your portfolio, and only invest what you can afford to lose. Remember that past performance is not indicative of future results. While QUBT presents exciting opportunities, it's crucial to approach the investment with a balanced and informed perspective. Keep a close watch on the news surrounding the company and industry leading up to, and after, their earnings announcement. This will help you make the most informed decision for your investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In QUBT: Analyzing Quantum Computing Stock Before Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Lasting Impact Pridham On Goodes Afl Hardships

May 17, 2025

The Lasting Impact Pridham On Goodes Afl Hardships

May 17, 2025 -

Buffett Apontou Seu Sucessor Greg Abel Lidara Com Todos Os Investimentos Da Berkshire

May 17, 2025

Buffett Apontou Seu Sucessor Greg Abel Lidara Com Todos Os Investimentos Da Berkshire

May 17, 2025 -

El Salvadors Bitcoin Gamble Why It Succeeded There And Would Fail In The Us

May 17, 2025

El Salvadors Bitcoin Gamble Why It Succeeded There And Would Fail In The Us

May 17, 2025 -

Cenario Economico Copom Decide Ipca E Dados Da China Afetam A Industria Brasileira

May 17, 2025

Cenario Economico Copom Decide Ipca E Dados Da China Afetam A Industria Brasileira

May 17, 2025 -

The Kleya Cassian Relationship In Andor Gilroy Reveals All In Finale Interview

May 17, 2025

The Kleya Cassian Relationship In Andor Gilroy Reveals All In Finale Interview

May 17, 2025