Investing In The Nasdaq Decline: Palo Alto Networks Or Nvidia?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in the Nasdaq Decline: Palo Alto Networks vs. Nvidia – Which Tech Titan Offers Better Value?

The Nasdaq's recent dip has presented a compelling opportunity for savvy investors. But with a plethora of tech giants experiencing price corrections, choosing the right stock requires careful consideration. Two prominent contenders, Palo Alto Networks (PANW) and Nvidia (NVDA), both offer compelling investment cases, but cater to different risk tolerances and investment strategies. This analysis will delve into the strengths and weaknesses of each, helping you determine which – if either – aligns with your portfolio goals during this market downturn.

Palo Alto Networks (PANW): A Cybersecurity Safe Haven?

Palo Alto Networks, a leader in cybersecurity solutions, has consistently demonstrated resilience even amidst broader market volatility. Their robust product portfolio, encompassing next-generation firewalls, cloud security, and threat intelligence, caters to a constantly growing market demand. This makes PANW a relatively defensive play in a turbulent tech landscape.

Strengths of Investing in Palo Alto Networks:

- Strong recurring revenue: PANW boasts a significant portion of recurring revenue through subscription-based services, providing predictable income streams and mitigating some of the risks associated with one-time sales.

- Essential services: Cybersecurity is a non-cyclical industry; businesses, regardless of market conditions, require robust security infrastructure. This positions PANW favorably during economic downturns.

- Consistent growth: Despite market fluctuations, Palo Alto Networks has demonstrated a history of consistent revenue and earnings growth, indicating a strong underlying business model.

- Strategic acquisitions: PANW's strategic acquisitions have expanded its product portfolio and market reach, further solidifying its position in the cybersecurity market.

Weaknesses of Investing in Palo Alto Networks:

- Premium valuation: Compared to some other tech stocks, PANW still commands a relatively high valuation, potentially limiting upside potential in the short-term.

- Competition: The cybersecurity market is fiercely competitive, with established players and emerging startups vying for market share.

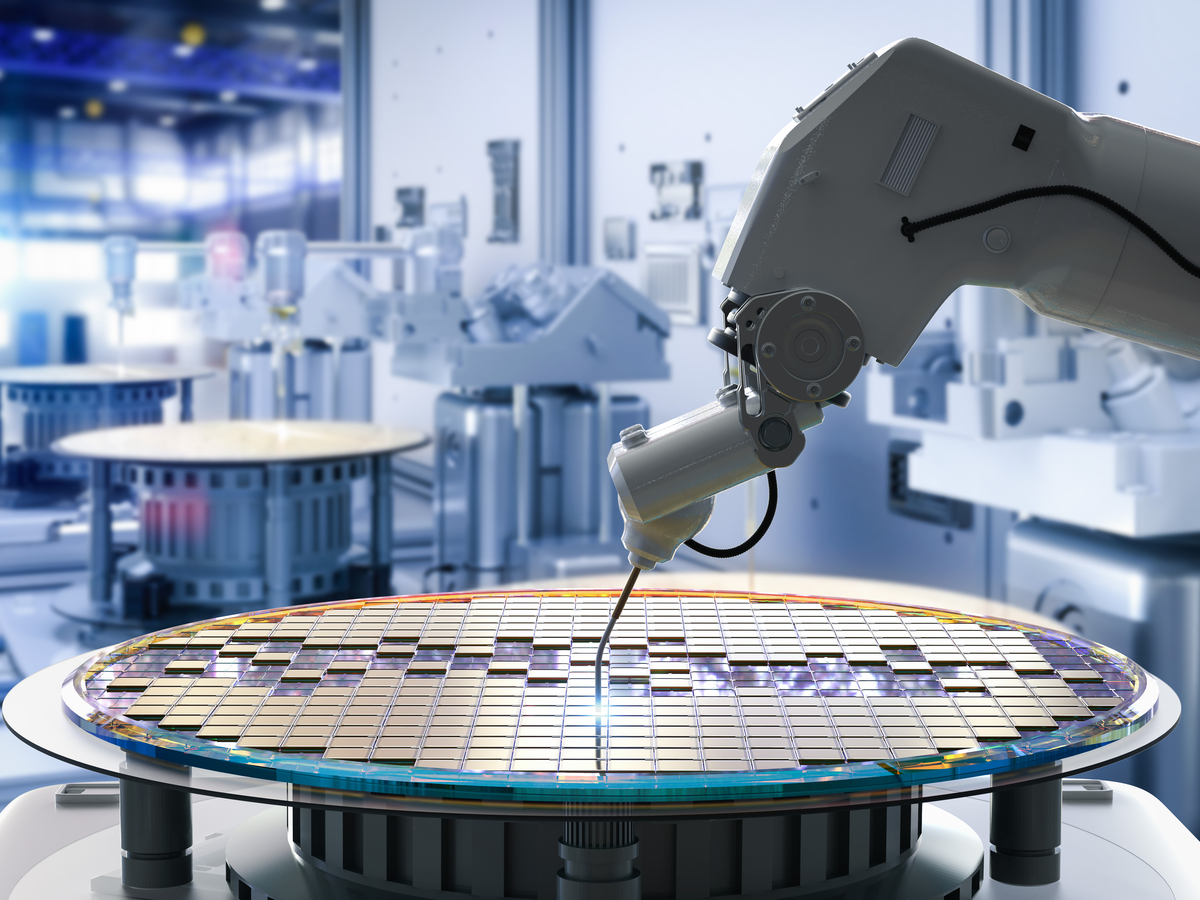

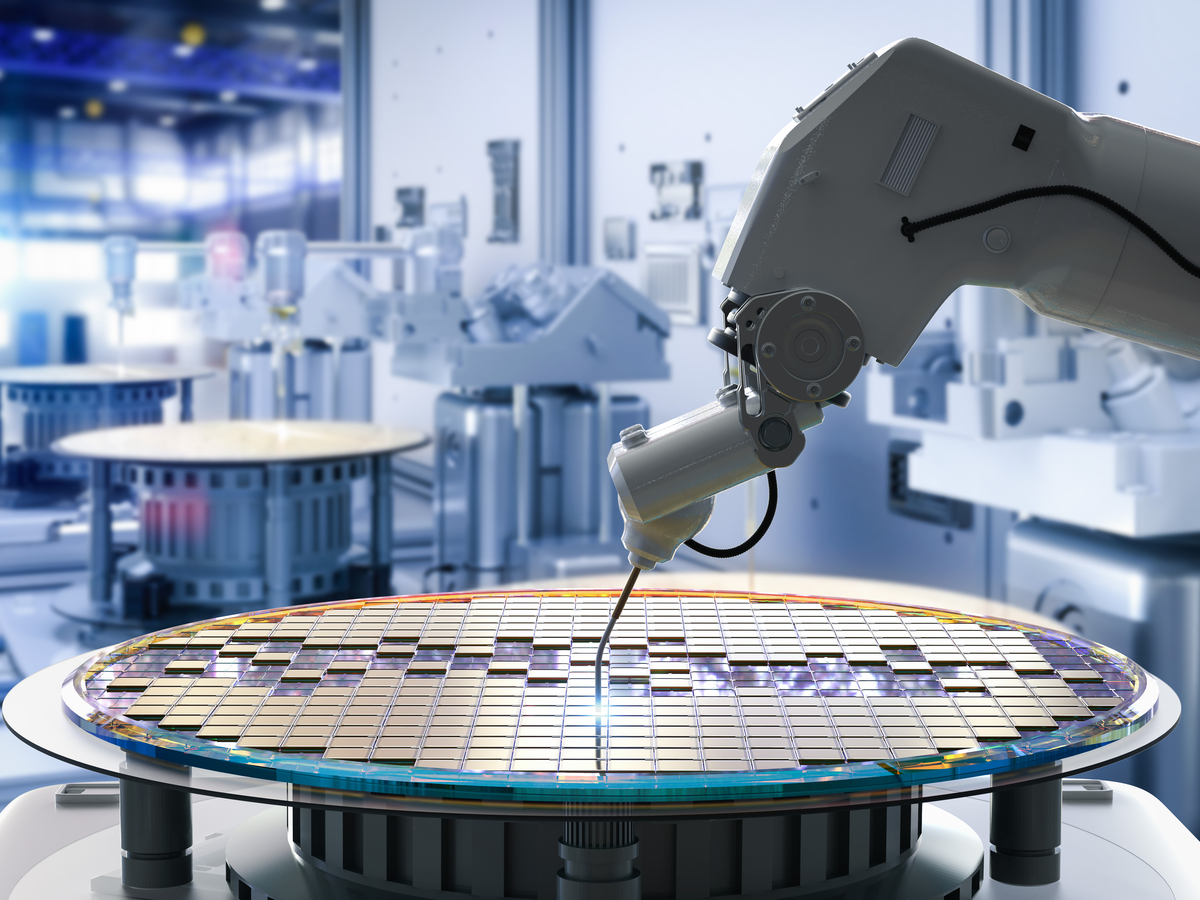

Nvidia (NVDA): Riding the AI Wave?

Nvidia, a dominant player in the GPU market, has experienced explosive growth fueled by the burgeoning AI revolution. Their high-performance GPUs are crucial for AI training and inference, positioning NVDA as a key beneficiary of this technological shift.

Strengths of Investing in Nvidia:

- AI dominance: Nvidia's GPUs are the gold standard for AI development, giving them a significant competitive advantage in this rapidly expanding market.

- Data center growth: The increasing demand for data center infrastructure, driven by AI and cloud computing, is a major growth driver for NVDA.

- High growth potential: The long-term prospects for AI are immense, suggesting substantial growth potential for Nvidia in the years to come.

- Diversified revenue streams: While GPUs are core to their business, Nvidia has diversified into other areas like automotive and professional visualization, reducing reliance on a single market.

Weaknesses of Investing in Nvidia:

- High volatility: NVDA's stock price is notoriously volatile, reflecting the high-growth, high-risk nature of the AI market.

- Dependence on specific sectors: Nvidia's success is heavily tied to the continued growth of the AI and data center markets. Any slowdown in these sectors could significantly impact NVDA's performance.

- Supply chain challenges: Like many tech companies, Nvidia can be impacted by global supply chain disruptions.

The Verdict: Which Stock is Right for You?

The choice between Palo Alto Networks and Nvidia ultimately depends on your individual risk tolerance and investment horizon.

-

Conservative Investors: Palo Alto Networks offers a more stable, defensive investment with a focus on consistent growth and recurring revenue. The lower volatility makes it a suitable choice for risk-averse investors.

-

Growth Investors: Nvidia presents a higher-risk, higher-reward opportunity, capitalizing on the explosive growth of the AI market. However, investors need to be prepared for potentially significant price fluctuations.

Both PANW and NVDA represent strong companies within their respective sectors. Thorough due diligence, including understanding your own risk profile and investment goals, is crucial before making any investment decisions. Consult with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In The Nasdaq Decline: Palo Alto Networks Or Nvidia?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ikn Terdampak Infestasi Tikus Besar Besaran Saat Lebaran Penjelasan Otorita

Apr 07, 2025

Ikn Terdampak Infestasi Tikus Besar Besaran Saat Lebaran Penjelasan Otorita

Apr 07, 2025 -

Dunia Bisnis Berduka Murdaya Poo Pemilik Pondok Indah Mall Meninggal Di Singapura

Apr 07, 2025

Dunia Bisnis Berduka Murdaya Poo Pemilik Pondok Indah Mall Meninggal Di Singapura

Apr 07, 2025 -

Annoying Minecraft Movie Sparks Debate Over Cinema Etiquette

Apr 07, 2025

Annoying Minecraft Movie Sparks Debate Over Cinema Etiquette

Apr 07, 2025 -

Remembering A Legend Raiders Emotional Farewell To Rugby League Trailblazer

Apr 07, 2025

Remembering A Legend Raiders Emotional Farewell To Rugby League Trailblazer

Apr 07, 2025 -

Villeneuve Highlights Aston Martins Strolls Unexpected Positive Change

Apr 07, 2025

Villeneuve Highlights Aston Martins Strolls Unexpected Positive Change

Apr 07, 2025