Investment Opportunity: Palo Alto Networks Or Nvidia After The Nasdaq Decline?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investment Opportunity: Palo Alto Networks or Nvidia After the Nasdaq Decline?

The recent Nasdaq decline has left many investors wondering where to put their money. Two tech giants, Palo Alto Networks (PANW) and Nvidia (NVDA), stand out as potential investment opportunities, but which one offers the better bet after this market downturn? This article delves into the strengths and weaknesses of each company, helping you make an informed investment decision.

The Nasdaq Dip: A Buying Opportunity?

The recent volatility in the Nasdaq has created a challenging environment for investors. While fear is understandable, market corrections often present opportunities for savvy investors to acquire strong companies at discounted prices. Both Palo Alto Networks and Nvidia are leaders in their respective sectors, making them compelling candidates for consideration. However, a thorough analysis is crucial before committing capital.

Palo Alto Networks (PANW): Cybersecurity's Steady Hand

Palo Alto Networks dominates the cybersecurity market, offering a comprehensive suite of security solutions for businesses of all sizes. Their strong position in this ever-expanding market makes them a relatively safe investment, even amidst economic uncertainty.

Strengths of Palo Alto Networks:

- Consistent Growth: PANW has demonstrated consistent revenue growth, fueled by increasing demand for robust cybersecurity solutions.

- Strong Market Position: They are a recognized leader in the industry, with a wide customer base and a strong brand reputation.

- Recurring Revenue Model: A significant portion of their revenue comes from subscription-based services, providing a predictable and stable income stream.

- Innovation: PANW continues to innovate, expanding its product offerings and staying ahead of the evolving threat landscape.

Weaknesses of Palo Alto Networks:

- High Valuation: Even after the recent market correction, PANW's stock price remains relatively high compared to some competitors.

- Competition: The cybersecurity market is competitive, with several strong players vying for market share.

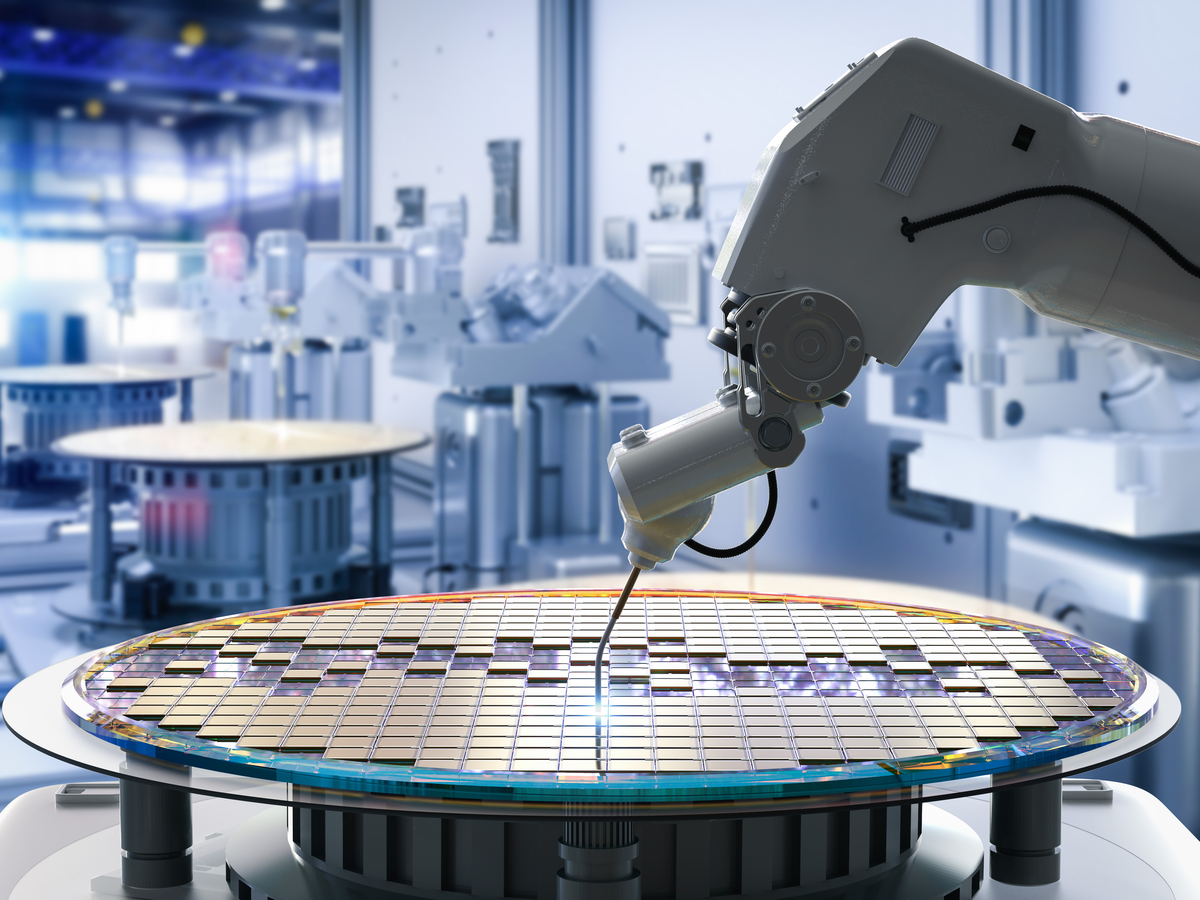

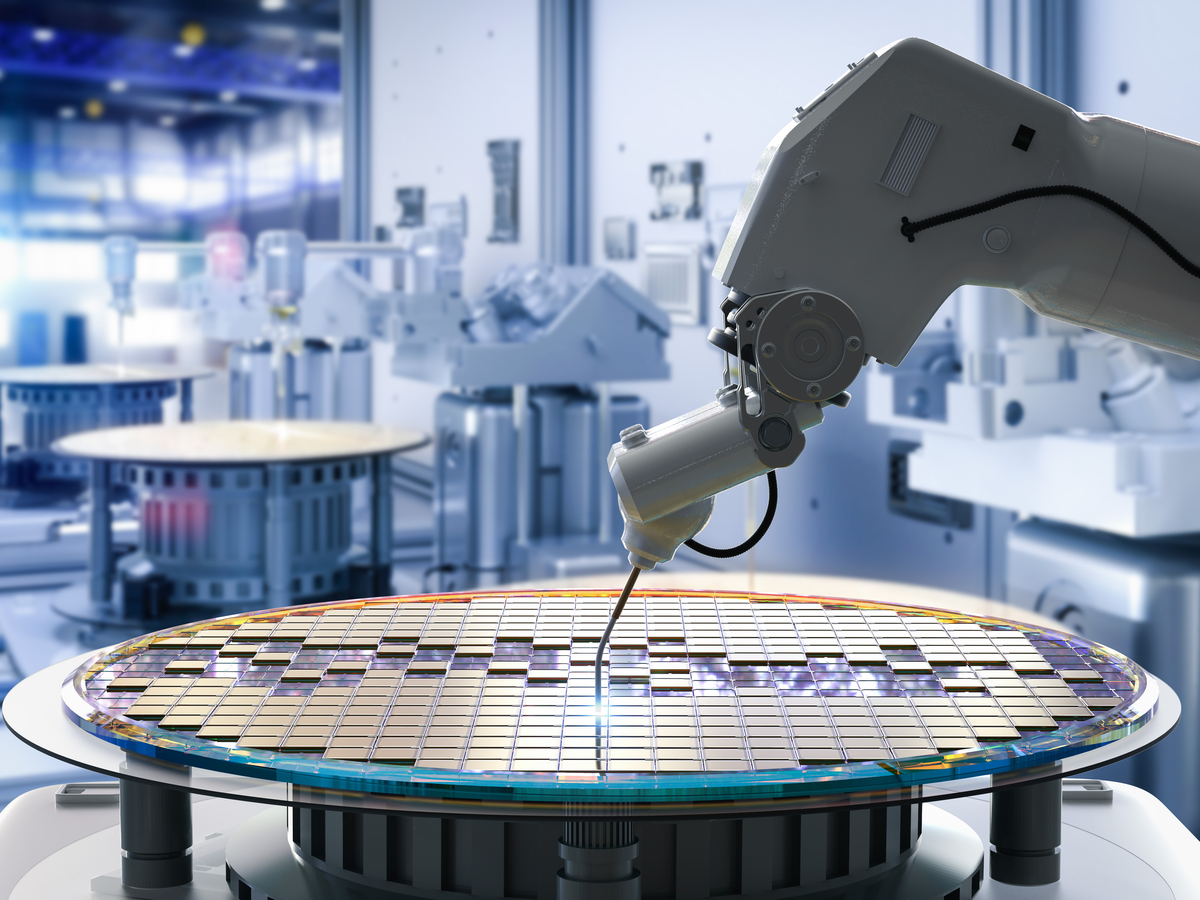

Nvidia (NVDA): Riding the AI Wave

Nvidia, a leading designer of graphics processing units (GPUs), has become synonymous with artificial intelligence (AI). Their GPUs are crucial for powering AI applications, making them a central player in the rapidly expanding AI revolution.

Strengths of Nvidia:

- AI Dominance: NVDA's GPUs are essential for training and running AI models, giving them a significant advantage in the booming AI market.

- High Growth Potential: The AI market is projected to experience explosive growth in the coming years, presenting significant opportunities for NVDA.

- Data Center Growth: Beyond AI, NVDA's GPUs are also vital for data centers, further boosting their revenue streams.

Weaknesses of Nvidia:

- High Volatility: NVDA's stock price is known for its volatility, reflecting the speculative nature of the AI market.

- Dependence on AI: Their success is heavily reliant on the continued growth and adoption of AI technologies.

- Supply Chain Risks: Like many tech companies, NVDA faces potential challenges related to global supply chains.

The Verdict: Which Stock to Choose?

The choice between Palo Alto Networks and Nvidia depends on your risk tolerance and investment horizon.

-

Lower Risk, Steady Growth: Palo Alto Networks offers a more conservative investment with a focus on steady growth and a strong market position. It’s a suitable choice for investors seeking less volatility.

-

Higher Risk, Higher Reward: Nvidia presents a higher-risk, higher-reward opportunity, tied to the explosive potential of the AI market. This is more suitable for investors with a longer time horizon and a greater tolerance for risk.

Ultimately, thorough due diligence, considering your personal financial goals, and potentially consulting with a financial advisor are crucial before making any investment decision. This analysis provides a starting point for your research, but it's not financial advice. Remember to always invest wisely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investment Opportunity: Palo Alto Networks Or Nvidia After The Nasdaq Decline?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fake Ideas Contest Hobart Stadiums Agonocratic Spectacle

Apr 07, 2025

Fake Ideas Contest Hobart Stadiums Agonocratic Spectacle

Apr 07, 2025 -

Will Tesla Deliver On Its Promise Factory Upgrades Target 15 K Evs By 2026

Apr 07, 2025

Will Tesla Deliver On Its Promise Factory Upgrades Target 15 K Evs By 2026

Apr 07, 2025 -

Saldo Dana Gratis Cek Link Dana Kaget Minggu 6 April 2025

Apr 07, 2025

Saldo Dana Gratis Cek Link Dana Kaget Minggu 6 April 2025

Apr 07, 2025 -

Analysis Bitcoin Btc Market Cooling 100 K Milestone In Jeopardy

Apr 07, 2025

Analysis Bitcoin Btc Market Cooling 100 K Milestone In Jeopardy

Apr 07, 2025 -

Efek Kebijakan Perdagangan Trump Studi Kasus Tentang Saham Harga Minyak Dan Inflasi

Apr 07, 2025

Efek Kebijakan Perdagangan Trump Studi Kasus Tentang Saham Harga Minyak Dan Inflasi

Apr 07, 2025